Insolvency and Bankruptcy Board of India (IBBI)

What is the "Insolvency and Bankruptcy Board of India?"

Insolvency and Bankruptcy Board of India (IBBI), established on 1st October, 2016, is a statutory body that regulates and oversees the insolvency and bankruptcy processes in India. Its primary goal is to assist companies and individuals facing financial distress. Its objective is to keep an eye on professionals managing these cases and ensure fair treatment for all stakeholders, including creditors and debtors. It is a key pillar to the ecosystem responsible for implementation of the Code that consolidates and amends the laws relating to reorganization and insolvency resolution of corporate persons, partnership firms and individuals in a time bound manner for maximization of the value of assets of such persons, to promote entrepreneurship, availability of credit and balance the interests of all the stakeholders.[1] The head office of the Board shall be located in the National Capital Region, as specified by the Central Government through a notification.[2]

Official Definition of IBBI

IBBI as defined in legislation(s)

Under the Insolvency and Bankruptcy Code, 2016, "Board" means the Insolvency and Bankruptcy Board of India established under section 3(1)[3] of section 188.[4] It is also defined under the Companies (Registered Valuers and Valuation) Rules, 2017 as “authority” means an authority specified by the Central Government under section 458[5] of the Companies Act, 2013 to perform the functions under these rules. Under Section 188 of IBC, 2016, the IBBI is to be established from the date specified by the Central Government through a notification for the purposes of this Code.[6] The Board shall be a body corporate, having perpetual succession and a common seal, with the authority to acquire, hold, and dispose of both movable and immovable property, and to enter into contracts. The Board, in its corporate name, can also sue or be sued.[7]

Legal provision(s) relating to IBBI

Composition of IBBI

Under Section 189, the IBBI consists of 10 members in total, including:

- A Chairperson.

- Three members from amongst the officers of the Central Government not below the rank of Joint Secretary or equivalent, one each to represent the Ministry of Finance, the Ministry of Corporate Affairs and the Ministry of Law, ex-officio

- One member to be nominated by the Reserve Bank of India, ex-officio

- Five other members to be nominated by the Central Government, of whom at least three shall be the whole-time members.[8]

To Know More: https://www.ibbi.gov.in/uploads/law/IBC%20Part%20IV.pdf

Function of the Board

The functions of the IBBI are stated under Section 196, of the Insolvency and Bankruptcy Code,2016 (IBC), the functions are as follows:

- Registration and Regulation: IBBI is responsible for registration and regulation of Insolvency Professional Agencies (IPAs), Insolvency Professionals (IPs) and Information Utilities (IUs), by following set standards and practices.[9]

- Development and Promotion: It promotes development and regulates work and practices in respect of the working of the insolvency professional agencies, persons as well as Information Utilities to accomplish the objectives set under the IBC.[10]

- Setting Standards: IBBI sets minimum eligibility criteria and standards to operate so that a uniform and professional approach to the entire insolvency ecosystem is provided.[11]

- Curriculum Design: It gives the minimum curriculum for the examination of insolvency professionals so that such professionals are eligible to get enrolled as members of IPAs.[12]

- Monitoring and Inspection: IBBI monitors the performance of IPAs, IPs and IUs, through regular inspections and investigations so as to identify and ensure compliance with the IBC and its regulations.[13]

- Data Management: It collects and maintains records related to insolvency and bankruptcy cases, and disseminates information to the stakeholders as necessary.[14]

- Guideline Issuance: The board issues necessary guidelines to IPAs, IPs, and IUs, promoting transparency and best practices in governance.[15]

- Grievance Redressal: IBBI specifies mechanisms for redressal of grievances against IPs, IPAs, and IUs, ensuring complaints are addressed in compliance with the IBC.[16]

- Research and Development: It periodically carries out studies, researches, and audits into the operations and performance of IPAs, IPs, and IUs with a view to continuous improvement.[17]

Power of the Board

The powers of the IBBI are stated under Section 196 of the IBC, 2016,[18] along with the functions of the board. The powers given to the board is as follows:

- Levying Fees: It can collect fees or other dues for carrying out the objects of the IBC, such as the registration and renewal fee of IPAs, IPs, and IUs.[19]

- Access to Information: The board can seek any information and records from the IPAs, IPs, and IUs, which helps in effective supervision.[20]

- Civil Court Powers: IBBI shall have the powers of a civil court under the Code of Civil Procedure, 1908 while discharging its functions for purposes such as summoning persons, enforcing attendance, and inspection of documents, etc.[21]

- Regulation Making: IBBI has the power to make regulations and guidelines on matters related to insolvency and bankruptcy required under the IBC, which includes mechanisms for time-bound disposal of assets.[22]

Regulatory Framework of IBBI

The initial regulatory framework of IBBI was established through IBC, which empowered the Board to frame regulations governing insolvency processes, professionals, information utilities and adjudicatory procedures. In its early phase, IBBI notified core regulations such as those governing the Corporate Insolvency Resolution Process (CIRP), insolvency professionals and information utilities, laying the foundation for a unified and rules-based insolvency regime in India.

Grievance Redressal and Complaints Handling

The Insolvency and Bankruptcy Board of India (IBBI) is empowered under the Insolvency and Bankruptcy Code, 2016, to receive and examine and dispose of grievances and complaints relating to insolvency professionals, agencies, entities and information utilities.

- Section 196(1)(q) authorizes the Board to specify the mechanism for redressal of grievances and to pass orders on complaints.

- Section 217 enables any aggrieved person to file a complaint with the Board.

- Section 218 empowers the Board to order inspections or investigations if there is a prima facie case of misconduct or regulatory violation.

- Section 240(2)(zzy) authorizes the Board to make regulations prescribing the form, manner and time for filing complaints.

In exercise of these powers, the Board has notified the IBBI (Inspection and Investigation) Regulations, 2017 and the IBBI (Grievances and Complaint Handling) Regulations, which provide the framework for the receipt of grievances, examination of complaints, confidentiality requests, escalation for inspection or investigation, timelines for initial review, and disclosure of summary statistics on the IBBI website. Besides this, grievances and complaints are received from the Centralised Public Grievance Redress and Monitoring System (CPGRAMS), Prime Minister’s Office (PMO), MCA, and other authorities. This mechanism aims to address genuine stakeholder grievances without penalising honest conduct, while ensuring accountability and compliance within the insolvency ecosystem.[23]

The receipt and disposal of grievances and complaints till September 30, 2025:

| Year /

Quarter |

Complaints and Grievances Received | Total | |||||||

| Under the Regulations | Through CPGRAM/PMO/

MCA/Other Authorities |

Through Other

Modes |

Recei- ved | Dispo- sed | Under Exami- nation | ||||

| Rece-

ived |

Dispo-

sed |

Rece-

ived |

Dispo-

sed |

Rece-

ived |

Dispo-

sed | ||||

| 2017 – 18 | 18 | 0 | 6 | 0 | 22 | 2 | 46 | 2 | 44 |

| 2018 – 19 | 111 | 51 | 333 | 290 | 713 | 380 | 1157 | 721 | 480 |

| 2019 – 20 | 153 | 177 | 239 | 227 | 1268 | 989 | 1660 | 1393 | 747 |

| 2020 – 21 | 268 | 260 | 358 | 378 | 990 | 1364 | 1616 | 2002 | 361 |

| 2021 – 22 | 276 | 279 | 574 | 570 | 611 | 784 | 1461 | 1633 | 189 |

| 2022 - 23 | 235 | 211 | 399 | 386 | 238 | 272 | 872 | 869 | 192 |

| 2023 – 24 | 209 | 193 | 435 | 452 | 311 | 271 | 955 | 916 | 231 |

| 2024 - 25 | 267 | 239 | 320 | 342 | 316 | 314 | 903 | 895 | 239 |

| Apr-Jun, 2025 | 66 | 85 | 115 | 96 | 57 | 101 | 238 | 282 | 195 |

| July-Sept, 2025 | 79 | 99 | 120 | 127 | 62 | 62 | 261 | 288 | 168 |

| Total | 1682 | 1594 | 2899 | 2868 | 4588 | 4539 | 9169 | 9001 | 168 |

Source: IBBI (Quarterly Newsletter, July - September 2025, Vol. 36)

As defined in Official Government Report

67th Report of Standing Committee on Finance- Action taken by Government on 32nd Report - IBC: Pitfalls and Solutions

The 67th Report of the Standing Committee on Finance (2023-24) acknowledges[24] “the two-tier regulatory structure” or the “regulated self- regulation model” for the development of the Insolvency Professionals as recommended by the Bankruptcy Law Reform Committee (BLRC) Report dated 04th November 2015. This two-tier system combines self-regulation by IPAs with oversight by a central regulator like IBBI. The goal is to create a competitive framework where multiple IPAs set professional standards, enforce discipline, and ensure accountability, while being monitored by the regulator.

The BLRC believes competition among IPAs will drive better standards, rules, and enforcement. This approach avoids inefficiencies and stagnation that can come with a monopoly, ensuring the IP profession stays efficient and progressive over time.

Learning from mixed experiences of this country with some self-regulatory bodies like ICAI and ICSI as well as experiences of success achieved by financial sector regulators like SEBI, a two-tier system is designed as a balance of independence and responsibility, which goes well with an insolvency system under the IBC.

International Experiences

United Kingdom

Insolvency Service is an executive agency of the Department for Business which regulates insolvency practitioners, oversees corporate and personal insolvency systems. It investigates director misconduct, maintains insolvency register and drafts insolvency rules and guidance.

United States

U.S. Trustee program, Department of Justice is the federal watchdog supervising bankruptcy cases and private trustees. It enforces compliance in bankruptcy cases and oversees Chapter 11 and Chapter 7 processes, issues guidelines and monitors professionals.

Australia

It has two bodies with IBBI-like powers: Australian Securities and Investments Commission (ASIC) and Australian Financial Security Authority (AFSA). ASIC regulates corporate insolvency practitioners and enforces standards. AFSA oversees personal insolvency, bankruptcy trustees, controls insolvency register.

Singapore

Insolvency functions is dealt primarily by the Ministry of Law's Insolvency Office and the Official Assignee/Official Receiver which supervise insolvency practitioners and administer cases. It regulates insolvency practitioners under the Insolvency, Restructuring and Dissolution Act (IRDA, 2018). It oversees licensing, discipline, and supervision and manages public insolvency cases.

Canada

Office of the Superintendent of Bankruptcy handles licensing and regulating insolvency trustees, monitoring insolvency estates, investigating offences and misconduct and controlling insolvency data registry.

Technological Transformation and Initiatives

- Mandatory use of a centralized e-auction platform BAANKNET (formerly “eBKray”) for liquidation asset sales

On 10 January 2025, IBBI issued a circular mandating that all insolvency professionals (IPs) must use BAANKNET for liquidation auctions starting 1 April 2025. On 28 March 2025, a follow-up circular reiterated the exclusive use of BAANKNET for auction and listing of all unsold assets, introducing standardized processes for listing and bidding, submission of Earnest Money Deposit (EMD), and bidder eligibility checks under Section 29A of the Code. This step replaces fragmented, often offline asset sales and aims to bring transparency, broader participation, and better realisation value for creditors.[25]

- Revision and digitization of CIRP/liquidation forms and standard documentation

On 27 May 2025, IBBI launched revised forms for the Corporate Insolvency Resolution Process (CIRP), aiming to simplify compliance, standardize filings, and support digital processing of applications and submissions via its online portal. The shift to digitize, uniform forms help reduce paperwork, potential errors, and administrative delays — a foundational step towards a more digital, efficient insolvency ecosystem.[26]

- Regulatory updates to align liquidation & insolvency process rules with digital/streamlined mechanisms

In 2025, IBBI notified amendments to its regulations — including the Insolvency Resolution Process for Corporate Persons Regulations and the Liquidation Process Regulations — reflecting contemporary requirements such as digital auctioning and standardized procedures for liquidation and resolution. The regulatory revisions help embed the new technological platforms (like BAANKNET) into the legal-regulatory framework, increasing compliance and enforceability.[27]

Appearances in Official Database

IBBI’s Annual Report

The Annual Report 2023 - 2024,[28] IBBI outlines the important developments in insolvency processes, regulatory actions, and capacity-building initiatives. The report provides details about the performance of the Board, service providers, legal actions, and the progress of insolvency and liquidation cases. In addition, the report has included advocacy programs, research publications, and financial performance of the Board.

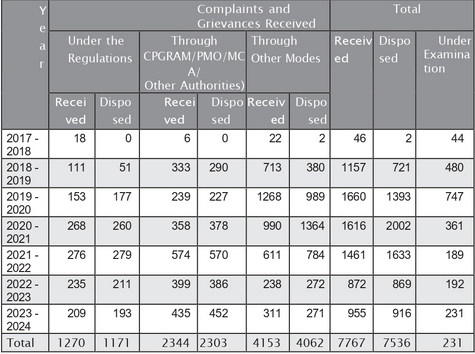

Data on the receipt and disposal of grievances and complaints received

The attached data presents the receipt and disposal of grievances and complaints till March 31, 2024. There are separate columns presenting the total number of complaints received and disposed throughout the years till March 31, 2024 under various modes such as Under the regulations, through CPGRAM/ PMO/MCA/ other authorities and through other modes.

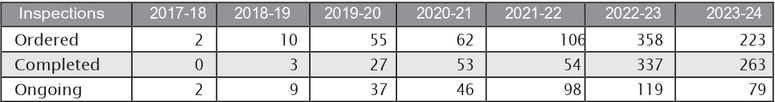

Data of the Inspections of IPs conducted by IBBI

The data indicates a steady and substantial rise in the number of inspections of Insolvency Professionals (IPs) conducted by the IBBI between 2017- 2018 and 2023- 2024. In the initial years (2017-18 and 2018- 2019), only a handful of inspections were ordered and completed, reflecting the early phase of the Board's regulatory monitoring framework. However, from 2020- 2021 onwards, there is a sharp increase, particularly visible in 2022- 2023, when 358 inspections were ordered and 119 were ongoing, showing the Board's growing focus on compliance and accountability within in insolvency ecosystem. Although the number of inspections ordered slightly decreased to 223 in 2023- 2024, the overall trend demonstrates that IBBI has institutionalised a robust inspection mechanism, emphasizing continuous supervision and adherence to professional standards by insolvency practitioners.

Quasi- Judicial Functions

Disciplinary Actions

Disciplinary actions against IPs are steps taken by regulatory authorities, such as the IBBI, to ensure accountability and uphold professional standards.[28] The actions are taken when there is a failure to comply with the IBC, regulations, or the prescribed code of conduct. Common actions include issuing SCNs to seek explanations for misconduct, formal warnings or reprimands, monetary penalties, and in severe cases, suspension or cancellation of registration.[29] IPs may also face debarment from taking new assignments or be required to undergo additional training or compliance measures. These actions ensure the integrity and efficiency of the insolvency resolution process.

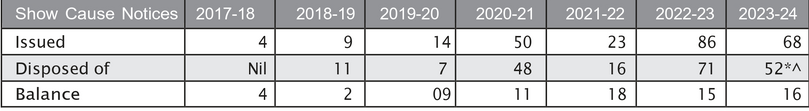

Show Cause Notice against the IP’s

* There are three orders where two SCNs of same IP were disposed by single order.

^Two orders were passed after SCN was remanded back for fresh hearing and disposal.

The IBBI and the IPAs initiate disciplinary actions against recalcitrant service providers. The details of disciplinary actions by IBBI against IPs during 2023-24 are presented in the table. The table above displays the number of show cause notices issued to Insolvency Professionals (IPs) and the corresponding disposals over the years up to March 2024. The balance for each year is calculated by subtracting the number of notices disposed of from those issued.

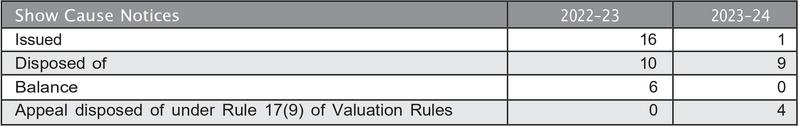

Show Cause Notice against RV/ RVE/ RVO

The table highlights IBBI's continuing oversight of Registered Valuers (RVs), Valuer Entities (RVEs), and Valuer Organisations (RVOs) under the Valuation Rules. In 2022-2023, a total of 16 show cause notices were issued, of which 10 were disposed, leaving 6 pending. By contrast, in 2023-2024, only 1 notice was issued but 9 cases were disposed of, indicating that the Board focused on clearing pending matters rather than initiating new proceedings. Additionally, 4 appeals were resolved under Rule 17(9) of the Valuation Rules during 2023-24. Overall, the data suggests that while the number of new show cause notices declined sharply, IBBI maintained its emphasis on closure of past cases and procedural efficiency in disciplinary oversight of the valuation ecosystem.

Disciplinary Proceeding

The table only shows the representation of how the table looks, as it lists the names of 71 Insolvency Professionals (IPs) along with the penalties imposed on them. It highlights different penalties assigned to each individual. The data showcases the regulatory actions taken against these professionals. The variations reflect the nature and severity of the violation.

Disposal of Show Cause Notice (SCNs)

The information is about the resolution of Show Cause Notices (SCNs) issued to entities such as Registered Valuer Organizations (RVOs), Registered Valuation Entities (RVEs), or Registered Valuers (RVs) during the financial year 2022-23. It indicates the actions taken or outcomes of these notices, such as penalties, warnings, or dismissals, for compliance or misconduct issues in that period.

IBBI’s Quarterly Newsletter

The IBBI's Quarterly Newsletter (April 2025 - June 2025) captures quarterly reforms and outcomes under the IBC. It records major regulatory changes and most notably the shift from nine CIRP e-forms to five consolidated CP-1 to CP-5 with monthly reporting, plus Fourth-Amendment measures such as concurrent invitations for whole company plans and asset-sale plans, staged-payment priority for dissenting financial creditors, observer access for interim financiers, and mandatory tabling of all plans before the CoC. It also notes a longer window (24 months) for IP enrolment and a revamped Form-H for plan compliance. By 30 June 2025, 8,492 CIRPs had been admitted; closures included1,258 approved plans and 2,824 liquidations, with creditor realisations averaging 32.75% of admitted claims and 170.84% of liquidation value; 1,191 cases were withdrawn under section 12A. The newsletter further tracks ecosystem activity (IP conclaves, trainings) and decision across courts and tribunals, presenting a data-driven picture of a system aiming for faster, more transparent, value-maximizing resolutions.[30]

To know More: IBBI (Quarterly Newsletter, July - September 2025, Vol. 36)

Recent Orders

The Insolvency and Bankruptcy Board of India (IBBI) regularly publishes orders and directions on its website as part of its regulatory and supervisory mandate under the Insolvency and Bankruptcy Code (IBC), 2016. These orders reflect the Board's role in overseeing insolvency professionals, resolving procedural matters, approving or rejecting resolution plans and ensuring compliance with statutory requirements. They illustrate IBBI's continuous efforts to strengthen Professional accountability, enhance transparency and ensure the proper application of the Code.

Research that engages with IBBI

Insolvency and Bankruptcy Board of India: A Regulator Like No Other, M.S. Sahoo

This article argues that the IBBI is uniquely designed in India's regulatory landscape because it simultaneously regulates professionals, markets, and utilities, all within a newly created insolvency architecture under the IBC. It explains how IBBI had to build an ecosystem from scratch- setting standards, registering and supervising entities, issuing regulations, and developing capacities- while balancing competing objectives such as speed, value maximisation, procedural fairness, and creditor2 confidence.[31]

Information Utilities and Blockchain: An Unlikely but Holy Partnership, Ankeeta Gupta

This research paper (March 2022), aims at studying the implications of incorporating blockchain technology as a functional and foundational technological mechanism for working of Information Utilities in India. A national network creating a financial database allowing for greater symmetry in financial information availability and circulation amongst all the stakeholders within the credit economy has been heralded as the institution which is the need of the hour. The complex financial transactions having tentacles embedded deep into the multitude of financial institutions, corporate entities forming a web over the corporate economy is in dire need of a simplification algorithm which can help study, analyse and disseminate the data in a manner that helps the stakeholders to take efficient and effective decisions.[32]

Challenges

Despite IBBI’s central role as the regulator of India’s insolvency framework, several institutional, structural and regulatory challenges continue to constrain its effectiveness in 2025.

- Regulatory Overload and Frequent Amendments

Since the introduction of the IBC, the insolvency framework has undergone repeated amendments through regulations, circulars and subordinate legislation. The IBC (Amendment), 2025 further expands IBBI’s regulatory scope by introducing CIIRP, new disclosure obligations and stricter compliance norms. While these reforms aim at strengthening the ecosystem, they also significantly increase the regulatory burden on IBBI in terms of rulemaking, monitoring and enforcement. This creates challenges of regulatory stability, compliance fatigue among stakeholders and uneven quality of implementation across jurisdictions.[33]

- Persistent Delays in CIRP Despite Regulatory Tightening

Although IBBI has continuously tightened timelines through regulations, system-wide delays persist due to overburdened adjudicating authorities. The Economic Survey 2024–25 notes that prolonged insolvency timelines and value erosion remain key structural weaknesses of India’s insolvency regime. This indirectly limits IBBI’s ability to achieve its statutory objective of time-bound resolution, as regulatory discipline cannot compensate for judicial and institutional delays.[34]

- Quality and Reliability of Market Information

IBBI’s regulatory supervision depends heavily on data supplied by resolution professionals and corporate debtors. However, information asymmetry, under-reporting of assets and valuation disputes continue to compromise the reliability of insolvency data. This has compelled IBBI to issue multiple discussion papers in 2025 on valuation standards, information memoranda and liquidation disclosures. The continuing need for post-facto regulatory correction highlights a systemic challenge in ensuring upfront data integrity.[35]

- Need for Evidence-Based Regulation

A major governance challenge highlighted in 2025 is the absence of a formal Regulatory Impact Assessment (RIA) in insolvency regulation. A Reuters report of January 2025, based on the Economic Survey, explicitly recommended that Indian financial regulators, including the IBBI, institutionalise RIA to measure the economic and social impact of regulatory changes. Without this, insolvency regulations risk being reactive rather than evidence-driven.[36]

- Technological Transition and Cyber-Readiness

With the mandatory rollout of platforms such as BAANKNET for liquidation auctions and digitized CIRP filings in 2025, IBBI now faces the challenge of ensuring cybersecurity, platform integrity, bidder authentication and data protection. As insolvency processes become increasingly digital, regulatory failure in tech governance could directly affect asset realisations and market confidence.[37]

Way Ahead

- IBBI must institutionalise structured coordination with NCLT and NCLAT through shared data systems, regular performance audits and digital case management integration.

- The board should actively promote early-stage resolution tools for MSMEs and start-ups, such as PPIRP, CIIRP, and Fast Track CIRP, supported by simplified compliance, reduced cost structures and capacity-building programmes.

- It should continue refining sector-specific insolvency frameworks that protect workers and homebuyers without weakening creditor discipline.

- IBBI needs to expand its investigation, inspection and disciplinary infrastructure, introduce faster adjudication of professional misconduct and deploy data analytics tools to detect early warning signs of process abuse in CIRP and liquidation.

- The Board should focus on cyber-security frameworks, bidder authentication protocols, audit trails and data-protection standards, so that digital efficiency does not get compromised.

References

- ↑ IBBI, https://ibbi.gov.in/about.

- ↑ Id., § 188(3).

- ↑ The Insolvency and Bankruptcy Code, 2016, § 3(1).

- ↑ The Insolvency and Bankruptcy Code, 2016, Part IV, Chapter I, s. 188, available at: https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273&orderno=212&orgactid=undefined

- ↑ The Companies Act,2013, Chapter XXIX, s. 458, available at: https://www.indiacode.nic.in/bitstream/123456789/2114/5/A2013-18.pdf

- ↑ Id., § 188(1).

- ↑ Id., § 188(2).

- ↑ Id., § 189.

- ↑ Id., § 196(1)(a).

- ↑ Id., § 196(1)(aa).

- ↑ Id., § 196(1)(b), § 196(1)(d).

- ↑ Id., § 196(1)(e).

- ↑ Id., § 196(1)(f).

- ↑ Id., § 196(1)(h)-(n)

- ↑ Id., § 196(1)(m),(p).

- ↑ Id., § 196(1)(q).

- ↑ Id., § 196(r).

- ↑ Id., § 196.

- ↑ § 196(1)(c)

- ↑ § 196(1)(h)

- ↑ § 196(3).

- ↑ § 196(1)(t).

- ↑ IBBI (Quarterly Newsletter, July - September 2025, Vol. 36), E.7, Pg. No. 21, available at: https://ibbi.gov.in/uploads/publication/452d899ae03283f1eb40b1bf7ee5f187.pdf

- ↑ 67th Report of the Standing Committee on Finance: Action Taken by Government on 32nd Report - IBC: Pitfalls and Solutions, https://ibbi.gov.in/uploads/resources/6ea3289fe2832f553b9022115479ff54.pdf

- ↑ IBBI, ‘Circular — Mandatory Use of BAANKNET (formerly eBKray) Auction Platform for Liquidation’ (28 March 2025), available at: https://ibbi.gov.in//uploads/legalframwork/2025-03-28-235256-5phy7-b74b8337a8b16af1af694dc969a6d1f3.pdf (last visited on 2 December 2025)

- ↑ IBBI, "simplified and streamlined forms framework", (Circular No. IBBI/CIRP/85/2025), available at: https://ibbi.gov.in//uploads/legalframwork/ea852c0453195ee2f8bb55f70163149e.pdf (last visited on 2 December 2025)

- ↑ Press Information Bureau, ‘Government Launches BAANKNET e-auction portal’ (24 March 2025), available at: https://www.pib.gov.in/PressReleaseIframePage.aspx?PRID=2114503®=3&lang=2 (last visited on 2 December 2025)

- ↑ 28.0 28.1 IBBI Annual Report, 2023 - 2024, https://ibbi.gov.in/uploads/publication/7d662619a481a37f1e9d19d3a0b6e8fb.pdf

- ↑ Gireesh Chandra Prasad, "IBBI cracks the whip on a dozen insolvency professionals", Livemint, 17 April 2024, available at: https://www.livemint.com/economy/ibbi-takes-action-against-12-insolvency-professionals-so-far-this-year-11713366209088.html (last visited on 27 November 2025)

- ↑ IBBI's Quarterly Newsletter (April - June 2025), available at: https://ibbi.gov.in/uploads/publication/edc044b410d37f0fd22cbe07a74665f3.pdf

- ↑ M. S. Sahoo, "Insolvency and Bankruptcy Board of India: A Regulator Like No Other" (2021) Quinquennial of Insolvency and Bankruptcy Code, 2016, Pg. No.1-24. available at: https://sahooregulatorychambers.in/wp-content/uploads/2024/11/Insolvency-and-Bankruptcy-Board-of-India-A-Regulator-Like-No-Other.pdf

- ↑ Ankeeta Gupta,"Information Utilities and Blockchain: An Unlikely but Holy Partnership", (IBBI Research Initiative RP-01/2022), available at: https://ibbi.gov.in/uploads/publication/6b683482bf24ca7023aa99c8ef198bd8.pdf

- ↑ PRS Legislative Research, The Insolvency and Bankruptcy Code (Amendment) Bill, 2025 – Bill Summary (PRS India 2025), availabe at: https://prsindia.org/billtrack/the-insolvency-and-bankruptcy-code-amendment-bill-2025 (last visited on 2 December 2025)

- ↑ Ministry of Finance, Economic Survey 2024–25 (Government of India 2025), Ch. 3, available at:https://www.indiabudget.gov.in/economicsurvey/doc/echapter.pdf

- ↑ Insolvency and Bankruptcy Board of India, "Discussion Paper on Proposed Guidelines for Conducting Valuation under the Insolvency and Bankruptcy Code, 2016 (IBBI 2025)", available at: https://ibbi.gov.in/uploads/public_comments/Proposed%20draft%20of%20the%20Guidelines%20for%20Conducting%20Valuation%20under%20the%20Insolvency%20and%20Bankruptcy%20Code,%202016.pdf

- ↑ Swati Bhat, ‘India financial regulators need formal impact assessment rules, government report says’ Reuters (31 January 2025), available at: https://www.reuters.com/world/india/india-financial-regulators-need-formal-impact-assessment-rules-government-report-2025-01-31/

- ↑ Press Information Bureau, ‘Government Mandates BAANKNET Platform for Insolvency Liquidation Auctions’ (PIB, March 2025), available at: https://www.pib.gov.in/PressReleasePage.aspx?PRID=2114503®=3&lang=2