Related party

What is a 'Related Party’

A related party is an individual or an entity that has the ability to control or significantly influence another party, often due to existing connections. This can include ownership, management positions, or close family ties.[1]

Official Definition of ‘Related Party’

‘Related Party’ as Defined in Legislation(s)

Section 2(76) of the Companies Act, 2013, defines a “related party” concerning a company as a director; key managerial personnel; a firm, in which a director, manager is a partner; or their relative. A related party can also be a private company in which a director or manager is a member or director; a public company in which a director or manager is a director or holds along with his relatives, more than two per cent. of its paid-up share capital; any body corporate whose Board of Directors, managing director or manager is accustomed to act in accordance with the advice, directions or instructions of a director or manager; any person on whose advice, directions or instructions a director or manager is accustomed to act.

The regulations also, pertain to transactions involving individuals or entities closely associated with the company. These include directors, managers, their relatives, as well as firms or private companies where they hold positions such as partners, shareholders, or directors. Transactions such as sales, purchases, leases, rents, or hirings between the company and these related parties fall under the purview of related party transactions. Clause 49 of the SEBI sets forth procedural conditions for such transactions, aiming to ensure transparency and fairness. Notably, the scope of related party transactions under SEBI's regulations is broader than that stipulated in the Companies Act, 2013, indicating a comprehensive approach to regulating such dealings to safeguard the interests of stakeholders and shareholders in listed companies.

The CA-2013 and SEBI LODR frameworks collectively establish a rigorous regime for Related Party Transactions, balancing commercial flexibility with protective safeguards for minority stakeholders.While both regimes share common ground definitions, arm's-length and ordinary-course exemptions, and abstention of related parties— the LODR regulations introduce a clear materiality threshold (10% of turnover), more prescriptive Audit Committee involvement, and enhanced disclosure mandates.

Recent SEBl amendments further tighten the disclosure regime, reflecting an ongoing commitment to transparency and robust corporate governance.

Listing Obligation & Disclosure Requirements Regulation (LODR), 2015

Regulation 2(zb) of the (Listing Obligation & Disclosure Requirements) Regulation (LODR), 2015 also defines a related party as defined under sub-section (76) of section 2 of the Companies Act, 2013 or under the applicable accounting standards with certain provisos. Section 5(24) of the Insolvency & Bankruptcy Code (IBC) describes a ‘related party’ in relation to a corporate debtor along similar lines. Under LODR, Regulation 2(zc) defines “related party transaction” as a transaction involving a transfer of resources, services or obligations between a listed entity or any of its subsidiaries on one hand, and any other person or entity on the other hand, the purpose and effect of which is to benefit a related party of the listed entity or any of its subsidiaries, with effect from April 1, 2023. This is not present under section 76 of the Companies Act, 2013 and it is an expansive definition that also includes unrelated parties.

'Relative' as defined in the IBC

In the context of related party transactions under the Insolvency and Bankruptcy Code (IBC), 2016), the term "relative" is defined under Section 5(24A) of the IBC.

A "relative" in relation to an individual includes anyone who is related to that individual in any of the following ways:

- Members of the family, including:

- Spouse,

- Parents,

- Children and their spouses,

- Siblings and their spouses.

- Any person who is related to the individual by blood or marriage to such a degree that they may reasonably be expected to influence or be influenced by the individual in relation to the debtor.

Legal Provision(s) Relating to the Term 'Related Party'

Regulation 23 talks about the materiality of the RPT. Under IBC, Sections 43 & 44 deal with related party transactions. Section 43 deals with preferential transactions, and Section 44 outlines the consequences of such transactions. In the context of related parties, Section 43 specifically flags transactions made in favor of related parties within two years before the insolvency commencement date as potentially preferential. These transactions are presumed to give undue advantage to related entities at the expense of other creditors. Section 44 empowers the adjudicating authority to reverse such transactions, restore the property or benefits to the debtor’s estate, and ensure equitable treatment of all stakeholders.

Companies Act, 2013

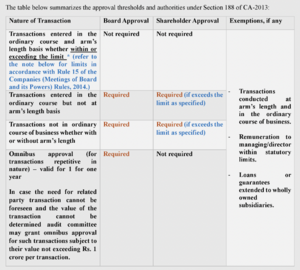

Other provisions relating to ‘Related Party’ are Section 2(77) of the Companies Act, 2013 which defines ‘relative. Section 188 of the Companies Act deals with the procedure for related party transactions.

Material Related Party Transactions

Under CA-2013: The Act does not prescribe a uniform monetary threshold to determine Material Related Party Transaction. Any transaction exceeding the threshold as provided under the Rule 15 of the Companies (Meetings of Board and its Powers) Rules, 2014 shall be considered as Deemed Material Related Party transactions.

• Under SEBI LODR (Regulation 23(1))

The Listed Entity shall formulate a threshold limit duly approved by the Board of Directors to categorize certain transactions as Material Related Party Transactions.

Provided that a transaction with a related party shall be considered material, if:

a) the transaction(s) to be entered into individually or taken together with, previous transactions during a financial year, exceeds rupees one thousand crore or ten per cent of the annual consolidated turnover of the listed entity as per the last audited financial statements of the listed entity, whichever is lower.

b) a transaction involving payments made to a related party with respect to brand usage or royalty to be entered into individually or taken together with previous transactions during a financial year, exceed five percent of the annual consolidated turnover of the listed entity as per the last audited financial statements of the listed entity.

'Related Party' as Defined in Official Document(s)

‘Related party’ has been defined in a number of official documents.

Accounting Standards (AS) 18

says that parties are considered to be related if at any time during the reporting period one party has the ability to control the other party or exercise significant influence over the other party in making financial and/or operating decisions. IND-AS 19 describes ‘related party’ in even greater detail[2].

SEBI Circular, June 26, 2025

Under the circular issued by SEBI, related party refers to individuals or entities that have pre-existing relationships with a listed company, such as promoters, subsidiaries, associates, or key managerial personnel, and whose transactions with the company may influence its financial and governance outcomes. The SEBI circular dated June 26, 2025, outlines updated Industry Standards for the minimum information that must be provided to the Audit Committee and shareholders when seeking approval for Related Party Transactions (RPTs). These standards are designed to enhance transparency and ensure consistent disclosures across companies. They were developed by the Industry Standards Forum (ISF), comprising ASSOCHAM, FICCI, and CII, under SEBI’s guidance. The circular mandates that from September 1, 2025, listed entities must comply with these revised standards as part of SEBI’s Listing Obligations and Disclosure Requirements (LODR) regulations. The circular also directs stock exchanges and industry bodies to publish the standards and FAQs to aid compliance and understanding.

'Related Party' as Defined in Case Law(s)

Phoenix ARC (P) Ltd. v. Spade Financial Services Ltd.

Phoenix ARC (P) Ltd. v. Spade Financial Services Ltd. (2021) 3 SCC 475[3] Is the leading and authoritative case law defining ‘related party’:

The definition of the expression “related party” in Section 5(24) is exhaustive, since the expression is defined to “mean” what is set out in sub-clauses (a) to (m). The expression “related party” is defined in Section 5(24) in relation to a corporate debtor. Section 5(24-A) provides a corresponding definition in relation to an individual. The purpose of defining the term separately under different statutes is not to avoid inconsistency but because the purpose of each of them is different. Hence, while understanding the meaning of “related party” in the context of the IBC, it is important to keep in mind that it was defined to ensure that those entities which are related to the corporate debtor can be identified clearly, since their presence can often negatively affect the insolvency process.

International Experience

The U.S. Securities and Exchange Commission (SEC) defines[4] related party as any person who is or was (since the beginning of the last fiscal year for which the Company has filed an Annual Report on Form 10-K and proxy statement, even if such person does not presently serve in that role) an executive officer, director or nominee for director of the Company, any shareholder owning more than 5% of any class of the company's voting securities, or an Immediate Family Member of any such person. Australian Accounting Standard Board’s AASB 124 on Related Party Disclosures defines a related party as a person or entity that is related to the entity that is preparing its financial statements, and sets out a detailed description. In the United Kingdom, related party is defined as per UK adopted international accounting standards[5].

Research that engages with ‘Related Party’

Much if the research on related party is not purely legal (business and accounting research mostly), such as:

An Analysis of Related-Party Transactions in India

This article[6] talks about related-party transactions in the Indian context. It highlights that RPTs have come under close scrutiny in recent years as they have been misused by companies as revealed in various corporate scandals. The study analyses Indian companies for three years between 2009 and 2011 and finds that RPTs were widespread and present in almost all companies during this period. Further, companies with high RPTs related to sales and income were found to report lower performance compared to companies with low RPTs. While ownership structure failed to offer any explanation for the magnitude of RPTs, RPTs were found to be lower in companies where big audit firms were statutory auditors.

Concept of Related Party: Interpretation by Letter or Spirit of the IBC?

This article[7] by Richa Saraf critically analyzes how the term “related party” is interpreted under India’s Insolvency and Bankruptcy Code (IBC), especially in light of the NCLT’s ruling in J.R. Agro Industries v. Swadisht Oils. It argues that although the Code does not explicitly subordinate related party claims, the spirit of the law and international standards, like those in the UNCITRAL Legislative Guide, support such subordination to protect operational creditors. The piece highlights the potential for abuse when related parties, often having insider control, recover debts at the expense of genuine creditors. The NCLT advocated for treating such claims as akin to equity, ranking them lower in the liquidation waterfall. This judicial stance is presented as crucial for ensuring fairness and preventing conflict of interest in insolvency proceedings.

Related terms

Arm’s length- arm's length transaction refers to a deal conducted as if the parties were unrelated, ensuring fairness and objectivity. It implies that the transaction is negotiated freely, without any influence or conflict of interest arising from their relationship. According to Section 188 of the Companies Act, 2013, such transactions must be in the ordinary course of business and at market-determined prices. The standard is whether a similar transaction would have been made with an unrelated party on comparable terms. This ensures that the company does not suffer any unfair loss or disadvantage due to preferential treatment given to a related party[8].

References

- ↑ Richa Saraf, The Concept of Related Party: Interpretation by Letter or Spirit of IBC, VINOD KOTHARI CONSULTANTS (Aug. 2018),https://vinodkothari.com/wp-content/uploads/2019/06/Concept-of-Related-Party.pdf

- ↑ https://www.mca.gov.in/Ministry/notification/pdf/AS_18.pdf

- ↑ https://indiankanoon.org/doc/137461156/

- ↑ https://www.sec.gov/Archives/edgar/data/1437517/000101054917000418/ex142.htm

- ↑ https://www.handbook.fca.org.uk/handbook/DTR/7/3.html

- ↑ https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2352791

- ↑ https://indiacorplaw.in/2018/08/11/concept-related-party-interpretation-letter-spirit-ibc/

- ↑ https://ca2013.com/188-related-party-transactions/#:~:text=(b)%20the%20expression%20%E2%80%9Carm's,any%20loss%20incurred%20by%20it.