Serious Fraud Investigation Office (SFIO)

What is ‘Serious Fraud Investigation Office (SFIO)’?

The Serious Fraud Investigation Office (SFIO) is a specialized government agency under the Ministry of Corporate Affairs (MCA) responsible for investigating and prosecuting serious cases of corporate fraud and white-collar crimes. It was established in 2003, following the recommendations given by the Naresh Chandra Committee and the 2002 stock market scams, essentially to combat financial fraud more effectively.

Evolution of the SFIO

Establishment of SFIO

Before the establishment of the SFIO, corporate frauds in India were investigated by multiple agencies such as the Central Bureau of Investigation (CBI), Enforcement Directorate (ED), Securities and Exchange Board of India (SEBI), and the Income Tax Department. However, these agencies lacked cohesion; none of these agencies were dedicated to investigating serious corporate fraud in an integrated manner.

Several high-profile frauds, such as the stock market scams of 1992 (Harshad Mehta) and 2001 (Ketan Parekh), exposed regulatory loopholes in India’s corporate sector. As a result, this specialized body came into existence upon the recommendations given by the Naresh Chandra Committee (2002) to investigate corporate fraud.

Based on these recommendations, the Government of India established SFIO on July 2, 2003, through a Government Resolution No. 45011/16/2003-ADM-I under the Ministry of Corporate Affairs. However, SFIO did not have statutory powers and functioned as an advisory and investigative body, with its authority derived from government directives rather than legal backing; it relies on other agencies for prosecution and enforcement actions.

Post-Companies Act, 2013

The Companies Act, 2013, formally granted statutory status to SFIO, making it the primary investigative agency for serious corporate fraud. It could now summon individuals, demand documents, conduct forensic audits, and prosecute offenders. With the enactment of the Companies Act, 2013, the Computer Forensic and Data Mining Laboratory (CFDML) was also set up to strengthen its ability to investigate complex digital fraud. CFDML provides forensic analysis, cybercrime investigation, and advanced data mining.

Composition of SFIO

SFIO is headed by a Director as Head of the Department not below the rank of Joint Secretary to the Government of India. The Director is assisted by Additional Directors, Joint Directors, Deputy Directors, Senior Assistant Directors, Assistant Directors, Senior Prosecutors, Prosecutors and other secretarial staff. It consists of multidisciplinary experts in accountancy, law, forensic auditing, IT, investigation, taxation, and financial markets. The Headquarter of Serious Fraud Investigation Office (SFIO) is at New Delhi, and it has five Regional Offices at Mumbai, New Delhi, Chennai, Hyderabad, and Kolkata.

Official Definition of the SFIO by the Ministry of Corporate Affairs

The Government of India decided to establish the Serious Fraud Investigation Office (SFIO) in response to major financial failures and corporate fraud that have affected the country. The key factors that led to its creation are, failure of non-banking financial institutions (NBFCs), vanishing companies, fraudulent plantation companies, and stock market scams.[1]

To tackle such large-scale corporate frauds, the government decided to establish the SFIO as a multidisciplinary organization. The SFIO was constituted in July 2003 following the recommendations of the Naresh Chandra Committee. It was granted statutory force for the first time through the Companies Act, 2013.

SFIO as defined in the Companies Act, 2013

The Serious Fraud Investigation Office (SFIO), as defined under Section 2(83) of the Companies Act, 2013, is the office referred to in Section 211 of the Companies Act, 2013. As per Section 211(1), the Central Government established SFIO through a notification to investigate fraud related to companies. Until such establishment, the SFIO set up through an earlier executive order will continue to function as SFIO.

Legal Provisions relating to ‘SFIO’

Investigation

The provisions that deal with investigations into the affairs of a company by the Serious Fraud Investigation Office (SFIO) are Sections 212 (1), (2), (3), (4), (8) and 213, which are explained as follows:

Section 212(1) - Initiation of SFIO Investigation

The Central Government may direct an SFIO investigation if:

- If the Registrar of Companies (RoC) or an inspector submits a report indicating fraudulent or suspicious activities, the Central Government can order an SFIO investigation under section 208.

- A company itself may pass a special resolution requesting an investigation into its affairs.

- If the central government believes that investigating a company is in the public interest.

- If any department of the central government or a state government requests an investigation.

Section 212(2) - Exclusive Authority of SFIO

- If a case is assigned to SFIO, no other agency (Central Government or any other investigative authority) is allowed to conduct or continue an investigation under the Companies Act for the same matter.

- If an investigation by another agency is already underway, it must cease immediately, and all relevant records and documents must be transferred to SFIO.

Section 212(3) - Procedure for Investigation

- SFIO must conduct the investigation in accordance with the procedures specified in the Companies Act.

- The investigation report must be submitted to the central government within a prescribed time.

Section 212(4) - Role of the Investigating Officer

- The Director of SFIO appoints an investigating officer to handle the case.

- The investigating officer has the same powers as an inspector under Section 217 of the Act, which includes:

- Summoning individuals for examination.

- Inspecting documents and books of accounts.

- Seizing relevant records, if necessary.

Section 212(8) - Power to Arrest

Section 212(8) read with the Companies (Arrests in Connection with Investigation by Serious Fraud Investigation Office) Rules, 2017 confers any officer not below the rank of Assistant Director of Serious Fraud Investigation Office with the power to arrest if it has a ‘reason to believe’(backed by recorded reasons) that any person has been guilty of any offence punishable under the sections referred to in Section 212(6).

Section 212(14) - Action Based on Investigation Report

After examining the investigation report (and seeking legal advice if required), the Central Government may direct SFIO to initiate prosecution against the company, its officers and employees (current or former), and any other person involved in the frauds (directly or indirectly).

Section 212(15) - Legal Recognition of SFIO Report

The investigation report submitted by SFIO is legally treated as equivalent to a police report under Section 173 of CrPC (Now, Section 193 of BNSS). This allows the Special Court to proceed with framing charges without requiring additional police investigation.

Section 212(16) - Continuation of Previous SFO Investigations

If SFIO had initiated an investigation under the Companies Act, 1956, such cases will continue under the Act even though the Companies Act, 2013, has come into force.

Section 212(17) - Information Sharing Between Agencies

If the SFIO is investigating a company, other investigative agencies (such as state government, police, or income tax authorities) must share any relevant information or documents they have. SFIO must also share its information with these agencies if it is relevant to their own investigations under other laws.

Case Laws dealing with Investigation

The case of Serious Fraud Investigation Office v. Rahul Modi[2], reinforces the idea that SFIO retains full and exclusive jurisdiction until it completes the investigation even if the prescribed time limit ends. The investigative authority is exclusive and indefinite until completion. Unlike the NIA Act, which provides structured mechanisms for re-transfer, the Companies Act does not provide such flexibility, strengthening the autonomous investigative role of SFIO.

The Madras High Court’s judgement in Church of South India v. Union of India,[3] states that the Central Government can assign the investigation of a company’s affairs to the SFIO if it deems it necessary. However, before making this decision, the central government must be of the opinion that an investigation is necessary. This means the government cannot arbitrarily or mechanically assign an investigation to the SFIO; it must form an opinion grounded in the specific grounds laid out in Section 212(1). The SFIO would not have jurisdiction to investigate a case assigned by the Central Government without forming necessary opinions.

Powers of Investigation Authorities

The provision that deals with the procedure and power of authorities is Section 217, which is explained as follows:

- The inspector, as an officer of the Central Government, has powers similar to those of a civil court under the Code of Civil Procedure, 1908. These powers include:

- The authority to demand the production of books and documents at a specified time and place.

- The power to summon individuals and require them to appear and testify under oath.

- The ability to inspect any books, registers, or documents related to the company.

Case Laws dealing with Section 217(5)

In the case of Vivek Harivyasi v. Serious Fraud Investigation Office[4], the Delhi High Court stated under Sections 217(4) and 217(5) of the Companies Act, the investigating officer has the power to record statements on oath and summon individuals, similar to the power of a civil court. This is significant because it means that the statements made by individuals during an investigation are taken seriously and can be used as evidence in the case.

Appointment of Inspectors for Investigation

Once an investigation is ordered, the central government can appoint one or more inspectors to conduct the inquiry. These inspectors will:

- Examine company records, financial statements, transactions, and other relevant documents.

- Question company directors, officers, or employees.

- Submit a detailed report on their findings to the Central Government.

The scope and manner of the investigation will be decided by the Central Government based on the nature of the allegations.

Cooperation With Other Authorities

If the Court or the National Company Law Tribunal (NCLT), in any legal proceeding, orders an investigation into a company’s affairs, the Central Government must act on the order and initiate an investigation. Unlike Clause (1) of Section 210, where the government has discretionary power, this provision makes the investigation mandatory if a judicial body directs it.

Fraud

Fraud encompasses both active deception, such as misleading actions, and passive deception, like concealing important facts. A mere intent to deceive or gain an undue advantage is sufficient for conviction, even if no actual financial loss occurs.

Under Section 447, any person found guilty of fraud involving ten lakh rupees or one per cent. of the company’s turnover, whichever is lower, shall be punished with imprisonment for a minimum of six months, which may extend up to ten years and a fine of at least the amount involved in the fraud, which may extend up to three times that amount.

If the fraud involves public interest, the minimum term of imprisonment shall be three years. If the fraud involves an amount less than ten lakh rupees or one per cent. of the turnover of the company, whichever is lower, and does not involve public interest, the punishment is lighter. In such cases, the guilty person may face imprisonment for up to five years, or with fine which may extend to fifty lakh rupees, or both.

These punishments are in addition to any liability to repay the money or face other legal consequences under this Act or any other law in force. These stringent provisions ensure that corporate fraud is effectively deterred and punished, safeguarding companies, investors, and the public.

SC Judgment involving fraud

In the case of Vikas Agarwal v. Serious Fraud Investigation [5], the Supreme Court held that the definition of fraud under Section 477 includes any act, omission, concealment, or abuse of position, done with intent to deceive or gain undue advantage. It includes not just company officials but also third parties who collude with them. Thus, because of this broad scope, the trial court has jurisdiction to summon not only company officials but also external individuals who facilitated or benefitted from the fraud.

Recommendation of SFIO by Naresh Chandra Committee

The existence of multiple investigation agencies, each with its own mandate and jurisdiction, often leads to delays in the judicial process and possible misinterpretation of information. Regulatory authorities under company law, securities laws, and the Serious Fraud Investigation Office (SFIO) frequently deal with overlapping issues, necessitating inter-agency coordination to ensure a streamlined and efficient investigation process.

The Naresh Chandra Committee on Corporate Audit and Governance (2002) identified these challenges and proposed solutions:

- A designated task force with a team leader should be appointed to lead investigations, ensuring clarity in responsibilities and reducing duplication of efforts.

- A committee headed by the cabinet secretary should oversee SFIO appointments and operations, coordinating between various agencies to prevent jurisdictional conflicts.

- The duties, scope, and responsibilities of different regulators should be outlined at the start of an investigation to avoid conflicting reports and delays.

- A specialized committee should be formed to initiate both criminal and civil recovery actions, supported by highly trained professionals for effective fraud deterrence.

The Naresh Chandra Committee further emphasizes the need for joint and coordinated investigations by multiple regulatory agencies such as the Serious Fraud Investigation Office (SFIO) and the Central Bureau of Investigation (CBI). This approach ensures a streamlined process, avoids duplication of efforts and enhances efficiency in dealing with complex corporate fraud cases.

To improve governance and investigative efficiency, the Task Force recommends:

- A designated team leader should head the task force for every case. This will ensure accountability, focus, and proper direction for investigations.

- A high-level committee, chaired by the Cabinet Secretary, should directly oversee:

- Appointments and functioning of the investigating office.

- Coordination among various government departments and agencies.

- Investigations and subsequent legal proceedings must be completed within 6 months to ensure swift justice. The Committee emphasizes that no conflicting reports or opinions should arise due to lack of coordination between agencies.

Difference Between SFIO and Other National Investigative Agencies

| Feature | SFIO | CBI | ED | SEBI |

| Jurisdiction | Corporate Fraud | General Crimes | Money Laundering | Stock Market Fraud |

| Legal Basis | Companies Act, 2013 | Bharatiya Nyaya Sanhita 2023 and Bharatiya Nagarik Suraksha Sanhita 2023 | PMLA, FEMA | SEBI Act |

| Arrest Powers | Yes (in fraud cases) | Yes | Yes | No |

| Focus Area | White Collar Crimes | All Crimes | Financial Crimes | Securities Market |

Agencies Similar to SFIO and other International Agencies

United Kingdom: Serious Fraud Office (SFO)

Mandate:

The Serious Fraud Office (SFO) is a non-ministerial government department in the United Kingdom responsible for investigating and prosecuting corporate fraud, financial misconduct, and white collar crime cases in England, Wales, and Northern Ireland. It is the principal enforcer of the Bribery Act 2010, which promotes ethical business practices and good corporate governance.

The SFO operates under the Criminal Justice Act 1987. It reports to the Attorney General for England and Wales. It does not have jurisdiction in Scotland, where fraud cases are handled by Police Scotland’s Specialist Crime Division and prosecuted by the Economic Crime Unit of the Crown Office and Procurator Fiscal Service.

Key Similarities:

- Both investigate and prosecute white-collar crimes, including fraudulent trading, financial scams, and misrepresentation in businesses.

- Both agencies have legal powers to summon individuals, demand documents, and conduct inspections.

Key Differences:

- The UK SFO enforces the Bribery Act, 2010, targeting corruption in corporations. Whereas the Indian SFIO does not directly prosecute bribery, because corruption cases are handled by agencies like the Central Bureau of Investigation (CBI) and Enforcement Directorate (ED).

- UK SFIO is government funded but received additional funding for high-profile cases. The Indian SFIO is part of the Ministry of Corporate Affairs and is funded as a government department.

- The UK SFO directly prosecutes cases in courts. But the India SFIO submits investigation reports to government authorities for prosecution.

- While the UK SFO investigated fraud involving corporate entities and public institutions, the India SFIO investigated fraud only in corporate entities registered under the Companies Act.

New Zealand: Serious Fraud Office (SFO)

Mandate:

The New Zealand Serious Fraud Office (SFO) is the country’s primary law enforcement agency responsible for investigating and prosecuting serious and complex financial crimes, including bribery and corruption. It was established under the Serious Fraud Office Act 1990.[6] The SFO operates independently of political influence, with no ministerial direction in its operational decisions.

Key Similarities:

- Both agencies investigate white-collar crimes, including bribery, financial misrepresentation, investment fraud, and corporate misconduct.

- Both agencies have legal authority to compel individuals and businesses to provide documents, answer questions, and assist in investigations.

- Both agencies are statutory bodies established by their respective national laws. Even though they function under the oversight of government ministries, they operate with a degree of independence in their investigations.

Key Differences:

- Indian SFIO is limited to corporate fraud and violations under the Companies Act, 2013. But the New Zealand SFO covers all types of serious fraud, including corporate fraud, bribery, corruption, and public sector misconduct.

- The Indian SFIO functions under the Ministry of Corporate Affairs (MCA), making it more of an investigative body than an independent law enforcement agency. On the other hand, the New Zealand SFO is independent and operates without ministerial interference in operational decisions.

- While the Indian SFIO investigates corporate fraud and submits a report to the Ministry of Corporate Affairs, which then decides on prosecution. The New Zealand SFO has the authority to investigate and prosecute financial crimes directly.

- The Indian SFIO can only investigate cases assigned by the Central Government (not self-initiated). But the New Zealand SFIO can self-initiate investigations based on complaints or intelligence.

Appearance of ‘SFIO’ in Recent Annual Report

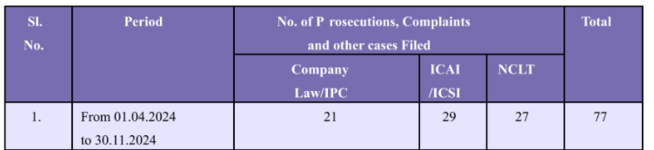

The details of prosecutions, complaints and other cases filed in various designated courts, Statutory Bodies and Tribunal by SFIO.

Representation of ‘SFIO’ in its Official Website

The Serious Fraud Investigation Office (SFIO) official website serves as a primary database for tracking corporate fraud investigations in India.[7] The SFIO website organizes information into different sections, providing insights into its functioning, case handling, and legal framework.

Data on Number of Investigations Completed in 2022-2023

| Financial Year | 2022-2023 |

| Investigation Completed | 29* |

| Financial Year | 2021-2022 |

| Investigation Completed | 13 |

| Financial Year | 2020-2021 |

| Investigation Completed | 7 |

| Financial Year | 2019-2020 |

| Investigation Completed | 12 |

| Financial Year | 2018-2019 |

| Investigation Completed | 12 |

*Note: The figure for the financial year 2022-2023 includes 19 main cases and 10 supplementary/other cases.

Source: Government of India, SERIOUS FRAUD INVESTIGATION OFFICE, Available at: https://sfio.gov.in/en/investigation-completed/

The data represents the number of investigations completed by the Serious Fraud Investigation Office (SFIO) in India for each financial year from 2018-2019 to 2022-2023. The data serves as a performance indicator, showing how many fraud cases SFIO has successfully investigated and closed each year. The number of completed investigations has increased significantly over the years, from 7 cases in 2020-21 to 29 cases in 2022-23. This suggests greater efficiency, improved resources, or a rise in financial fraud cases requiring SFIO intervention.

Year-wise Data on the Total Number of Cases Investigated by Serious Fraud Investigation Office (SFIO)

The Annual Investigative and Prosecutorial performance of SFIO in India (2017-18 to 2021-22)

Research that engages with ‘SFIO’

Role of Serious Fraud Investigation Office (SFIO) in Protection of Investors' Interest: An Overview

This research document examines the role of the Serious Fraud Investigation Office (SFIO) in protecting investors' interests and maintaining corporate governance, going beyond its official definition under the Companies Act, 2013[8]. While the Companies Act grants the government investigative powers in cases of fraud, this study contextualizes SFIO’s role within the broader corporate regulatory framework.

While official documents describe SFIO as a specialized, multi-disciplinary agency, this research critically analyzes its effectiveness in dealing with corporate fraud and compares its role to global investigative bodies.

Challenges

71st Report by Standing Committee on Finance: Demands for Grants (2013-14)

Challenges in SFIO Staffing and Government Response (2013-14)

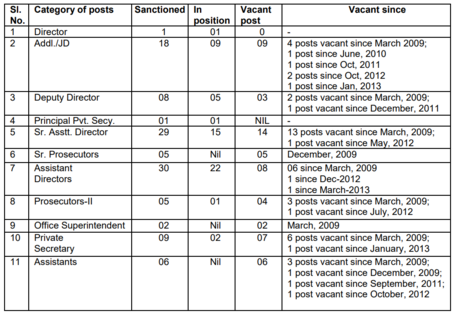

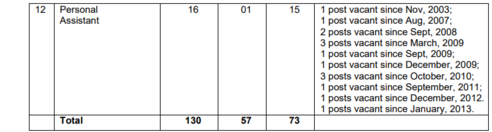

The Serious Fraud Investigation Office (SFIO) has been facing severe manpower shortages, particularly in legal, operational, and support staff roles. The data presented highlights a high vacancy rate, which has significantly impacted its ability to investigate complex corporate fraud cases effectively.[9]

During the 2013-14 budget examination, it was found that:

- 40% of the operational-level posts were vacant.

- 90% of legal staff positions remain unfilled.

- 79% of support staff roles were also unoccupied.

These numbers indicate a serious staffing crisis, particularly in the legal department, which plays a critical role in prosecuting financial crimes.

The reason for the shortage is because all positions were to be filled on a deputation basis, meaning officers from other government departments had to be assigned. This made recruitment slow and unpredictable, as it depended on the willingness of officers to transfer. The Ministry of Corporate Affairs (MCA) had approved a proposal to create a permanent cadre, but it was still pending approval with the Department of Personnel and Training (DoPT).

The SFIO plays a crucial role in investigating serious corporate fraud, but it faces several challenges that hinder its effectiveness. Corporate frauds often involve sophisticated techniques such as accounting manipulation, shell companies, insider trading, and money laundering, making it difficult to detect and prosecute offenders. A former MCA (Ministry of Corporate Affairs) Secretary pointed out that SFIO lacks adequately trained personnel capable of handling complex fraud investigations. As the agency operates within limited financial resources, it affects its ability to upgrade technology, hire experts, and conduct thorough investigations. [10]

Way Forward

70th Report Standing Committee on Finance (2018-19) Sixteenth Lok Sabha: The Banning of Unregulated Deposit Schemes Bill, 2018

The Committee recommends expanding the investigative jurisdiction beyond the Central Bureau of Investigation (CBI) to include agencies such as the Serious Fraud Investigation Office (SFIO).[11] This recommendation is based on the following concerns:

- The Committee suggests that economic offences often involve violations of various financial laws, which may fall under the jurisdiction of other specialized agencies like the SFIO.

- Given the CBI’s heavy workload, granting exclusive jurisdiction to a single agency could lead to inefficiencies. To address this, the Committee recommends expanding Clause 30 to explicitly mention that matters may be referred to SFIO or other agencies or other agencies, depending on the subject matter.

The Committee identifies gaps in the Bill related to regulatory oversight and coordination between agencies:

- The Bill assigns state governments as the primary implementing authorities. However, economic frauds often have national implications, requiring coordination at the central level. However, economic frauds often have national implications, requiring coordination at the central level. The Bill proposes an online database for tracking deposit takers, but no single regulatory body is designated to oversee the entire framework.

- Currently, State-level Coordination Committees (SLCCs) exist under the Reserve Bank of India (RBI), including representatives from SEBI, State Police, and other agencies. These SLCCs function in an ad-hoc manner, which limits their effectiveness in tackling economic offences.

The Committee’s Recommendations:

- Institutionalize the SLCC mechanism at the national level under the nodal department designated in Clause 9.

- The nodal department should go beyond maintaining the database and should have the authority to regulate and monitor the implementation of the bill.

- The Committee suggests that this central authority should have regulatory and enforcement powers, ensuring better coordination between agencies like SFIO, RBI, SEBI, and state governments.

71st Report Standing Committee on Finance (2012- 2013) Fifteenth Lok Sabha: Demands for Grants (2013-14)

Revision of Goodwill Accounting Standards:

During the investigations, SFIO found out that goodwill accounting standards in India lacked clarity, leading to potential misuse in financial reporting. Thus, SFIO recommended a review of existing goodwill accounting standards to prevent manipulation. The issue was referred to the Accounting Standards Board (ASB) for further examination. This helps in preventing financial misrepresentation by ensuring a standardized approach to goodwill valuation.[12]

Proposal for a Central Regulatory Body for Multi-Level Marketing (MLM) Companies:

SFIO observed growing fraud in multi-level marketing (MLM) companies, where Ponzi and pyramid schemes were misleading investors. For this the SFIO recommended the creation of a central regulatory authority for MLM companies to ensure better oversight. This matter was referred to the Central Economic Intelligence Bureau (CEIB) for evaluation and policy consideration. This will help in protecting investors from fraudulent MLM schemes.

Development of a Fraud Prediction Model:

Corporate frauds are often detected only after substantial financial losses have occurred. This indicates a lack of predictive mechanisms to identify fraud early. To combat this, the SFIO initiated a proposal to develop a fraud prediction model for early detection and prevention. Following which, an expert committee was established to prepare a comprehensive framework. This will strengthen proactive fraud detection instead of relying solely on reactive investigations.

References

- ↑ Ministry of Corporate Affairs, “About MCA: Serious Fraud Investigation Office”, available at: https://www.mca.gov.in/mca/html/mcav2_en/home/aboutmca/affiliatedoffices/seriousfraudinvestigationoffice/sfio.html.

- ↑ (2019) 5 SCC 266.

- ↑ Writ Petition Nos. 25236 and 25419 of 2018 & 32587 of 2019, High Court of Madras. https://indiankanoon.org/doc/149897514/.

- ↑ CRM-M No. 35664 of 2019 https://indiankanoon.org/doc/184135932/.

- ↑ CRL.M.C. 647/2019 & CRL. M.A. 2713/2019

- ↑ “Briefing to the Incoming Minister,” Serious Fraud Office, 2020, p.2. Available at: https://sfo.govt.nz/assets/Uploads/BIM-web.pdf.

- ↑ ‘Investigation Completed’ (Serious Fraud Investigation Office) Available at: https://sfio.gov.in/en/investigation-completed/#

- ↑ Radheshyam Prasad and Tabrez Ahmad, ‘Role of Serious Fraud Investigation Office (SFIO) in Protection of Investors Interest: An Overview’ (2014) Volume 1 Issue 3 Ad Valorem 69, 70. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2561827.

- ↑ Standing Committee on Finance, Demands for Grants (Standing Committee Report 71, 2013-14) 3.5. https://eparlib.nic.in/bitstream/123456789/64175/1/15_Finance_71.pdf.

- ↑ Missba Farook Zariwala, ‘Role of Serious Fraud Investigation Office in Corporate Fraud’ Volume 2 Issue 2 Journal of Legal Research and Juridical Sciences 429, 438. https://jlrjs.com/wp-content/uploads/2023/03/48.-Missba-Zariwala-1.pdf.

- ↑ Standing Committee on Finance, The Banning of Unregulated Deposit Schemes Bill, 2018 ( Standing Committee Report 70, 2018-19) Part 2 Clause 8. https://prsindia.org/files/bills_acts/bills_parliament/2018/SCR-The%20Banning%20of%20Unregulated%20Deposit%20Schemes%20Bill,%202018.pdf.

- ↑ Standing Committee on Finance, Demands for Grants (Standing Committee Report 71, 2013-14) 3.4. https://eparlib.nic.in/bitstream/123456789/64175/1/15_Finance_71.pdf.