Company

What is 'Company'

A company is a legal entity formed by one or more individuals for conducting business or other lawful purposes, including profit or charitable objectives. It is an artificial person created by law, having a separate legal identity from its members. It can own property, enter contracts, sue and be sued, and has perpetual succession.

The term “company” is derived from the Latin words com (together) and panis (bread), originally referring to a group of people sharing a meal. Over time, it evolved to signify a formal association organized to conduct business.

The legal nature of a company has been elaborated upon by several jurists. Professor L.H. Haney defines a company as “an artificial person created by law, having a separate entity, with perpetual succession and common seal.” According to Lord Justice Lindley, a company is “an association of many persons who contribute money or money’s worth to a common stock and employ it for a common purpose. The common stock so contributed is denoted in money and is the capital of the company. The persons who contributed it or to whom it belongs are members. The proportion of capital to which each member is entitled is his share.”[1] Chief Justice Marshall of the United States observed that a company is “an artificial person, invisible, intangible, and existing only in contemplation of law."[2] Similarly, Justice James described it as “an association of persons united for a common object.”

From these definitions, it can be concluded that a company is a registered association and an artificial legal person. It possesses an independent legal identity, enjoys perpetual succession, operates with a common capital composed of transferable shares, and provides limited liability to its members. Traditionally, companies also had a common seal for authentication of documents; however, following the enforcement of the Companies (Amendment) Act, 2015, the use of a common seal has been made optional. Together, these characteristics form the foundation of the modern corporate legal structure.

Official Definition of 'Company'

‘Company’ as defined in Legislations

The word “company” is defined in Section 2(20) of Companies Act, 2013 as a company incorporated under this Act or under any previous company law.

A similar definition existed in the Companies Act, 1956, Section 3(1)(i) as a company formed and registered under this Act or an existing company as defined in clause (ii).

However, this statutory definition merely establishes the fact of incorporation without conveying the essential characteristics that define a company as a distinct legal person.

'Company' defined by Case Laws

Salomon v. Salomon & Co. Ltd. (1897)[3]

This case addressed the fundamental principles of corporate personality and the doctrine of limited liability. The House of Lords upheld the doctrine of corporate personality, affirming that a company, once duly incorporated, is a separate legal entity distinct from its shareholders and directors.

Re: The Kondoli Tea Co. Ld. vs Unknown (1886)[4]

It was held by Calcutta High Court that the Company was a separate person; a separate body altogether from the shareholders and the transfer was as much a conveyance, a transfer of the property, as if the shareholders had been totally different persons.

Union Bank of India vs. Khader International Constructions and others (2001)[5]

In this case, the Supreme Court of India held that the term ‘person,’ as mentioned in Order 33, Rule 1 of the Civil Procedure Code, 1908, includes any company. Therefore, a company has the legal capacity to file a suit as an indigent (poor) person, emphasising its status as a legal entity.

Types of 'Company'

There are various kinds of companies that are registered under the Companies Act, 2013. The broad aspect of classification is on the basis of the members, for whom primarily there are two types of companies; private and public. There are also other ways of classifying companies. Incorporated companies are formed by registration under the Companies Act, 2013 or any other law.

Classification on the basis of Number of Members

On the basis of the number of members, there are three kinds of companies:

Private Company

A private company, as defined under Section 2(68) of the Companies Act, 2013, is a company having a minimum paid-up share capital as may be prescribed, and which, through its articles of association, restricts the right to transfer its shares, limits the number of its members to two hundred (excluding employee members and former employees who became members during employment and continued thereafter), and prohibits any public invitation to subscribe to its securities. For the purpose of this limit, joint holders of shares are counted as a single member. While a private company is permitted to issue debentures to any number of persons, it cannot invite the public to subscribe. Every private company is required to add the words “Private Limited” at the end of its name.

Public Company

As per Section 2(71) of the Companies Act, 2013, a public company is defined as:

(a) A company that is not a private company, and

(b) Has a minimum paid-up share capital as may be prescribed.

A company that is a subsidiary of a non-private company is deemed to be a public company for the purposes of the Act.

A public company can be formed by seven or more persons by subscribing their names to the memorandum of association and complying with the registration provisions under the Act. It typically has its shares listed on a stock exchange, making ownership accessible to the general public.

One Person Company

One Person Company (OPC) got its legal recognition for its first time on the implementation of the Companies Act, 2013. The J.J. Irani Committee Report (2005)[6] observed that it is possible for individuals to operate in the economic domain and contribute effectively and therefore recommended that the law should recognize the formation of a single person economic entity in the form of ‘One Person Company’, with a simpler regime to ensure that the entrepreneur is not compelled to fritter away his time, energy and resources on procedural matters. Under Section 2(62), The Companies Act, 2013 “One Person Company” means a company which has only one person as a member. One Person Company will be registered as a private company with one member and one director. It may be formed either as a company limited by shares or a company limited by guarantee or an unlimited liability company.

Classification on the basis of Incorporation

Companies may be Incorporated under the following categories:

Statutory Company

These are constituted by a Special Act of Parliament or State Legislature. The provisions of the Companies Act, 2013 do not apply to them. Examples of these types of companies are Reserve Bank of India, Life Insurance Corporation of India, etc.

Registered Company

The companies which are incorporated under the Companies Act, 2013 or under any previous company law and registered with the Registrar of Companies, fall under this category.

Classification on the basis of Liability

Under this category there are three types of companies: -

Company limited by guarantee

Under the Companies Act, 2013, Section 2(21) “Company limited by guarantee” means a company in which the liability of its members is limited by the memorandum to such amount as the members agree to contribute to the company’s assets in the event of winding up. The members of a guarantee company are, in effect, placed in the position of guarantors of the company’s debts up to the agreed amount. The members are liable to the company and to any other person.

As per Section 2(22) of the Companies Act, 2013, a “company limited by shares” is one where the liability of members is limited to the amount unpaid (if any) on the shares held by them, as stated in the memorandum of association. Members are not personally liable beyond the unpaid amount on their shares. Companies limited by shares are by far the most common and it may be either public or private.

Unlimited Company

As per Section 2(92) of the Companies Act, 2013, an “unlimited company” is a company not having any limit on the liability of its members. In this type of company, the members are personally liable for all debts and liabilities of the company, without any limit, in case the company’s assets are insufficient. Such companies may or may not have share capital and may be incorporated as either private or public companies. The members are liable to the company and to any other person.

Classification on the basis of Control

A company can be classified either as a holding company or a subsidiary company on the basis of control exercised upon it. A holding company and a subsidiary company are related to one another. If one company exercises control over the other, the former is called a holding company whereas the latter is called a subsidiary company.

Subsidiary Company

“Subsidiary company” or “subsidiary,” Section 2(87), Companies Act, 2013 in relation to the holding company which means-

- A company in which the composition of the Board of Directors are controlled by the holding company.

- A company in which the holding company exercises power at its discretion and appoints or removes all or majority of the directors or more than one-half of the nominal value of equity share capital is held by another company.

Holding Company

Section 2(46), Companies Act, 2013 states that “in relation to one or more other companies, means a company of which such companies are subsidiary companies.” Therefore a company shall be presumed to be a holding company in place of another if it controls the composition of the Board of Directors or holds more than one half of the total voting power of the latter.

Body Corporate

For the purposes of determining holding and subsidiary relationships, Section 2(11) of Companies Act, 2013 the expression “company” includes any body corporate, whether incorporated in India or outside, except where expressly excluded by the Act. It excludes co-operative societies and such other entities as may be specifically excluded by government notification.

Classification on the basis of Ownership

Government company and foreign company are the two categorised on the basis of ownership.

Foreign Company

According to Companies Act, 2013, Section 2(42) “foreign company” means any company or body corporate incorporated outside India which:

(i) has a place of business in India whether by itself or through an agent, physically or through electronic mode; and

(ii) conducts any business activity in India in any other manner.

This definition ensures that entities not incorporated in India but conducting business within its jurisdiction are brought under the compliance framework of Indian company law.

Government Company

As per Section 2(45), Companies Act, 2013, a government company is one in which not less than 51% of the paid-up share capital is held by the Central Government, or any State Government, or a combination of both. The definition also includes any subsidiary company of such a government company.

Other Forms of Companies

Section 8 Company

A Section 8 company, under the Companies Act, 2013, refers to a person or association of persons registered with the object of promoting fields such as commerce, art, science, education, research, social welfare, sports, environment protection, charity, or religion. Such companies are required to apply their income or profits solely towards the promotion of their objectives and are prohibited from distributing dividends to members.

On satisfaction of these conditions, the Central Government may grant a license allowing registration as a limited company without the use of the words “Limited” or “Private Limited” in its name. A Section 8 company cannot be registered as an unlimited company but may take the form of a company limited by shares or by guarantee.

Associate Company/Joint Venture Company

According to Section 2(6) of the Companies Act, 2013, an Associate Company is a company in which another company has significant influence, but which is not a subsidiary of the company having such influence. This relationship is broader than the traditional holding subsidiary model and is based on influence rather than control. The Act clarifies that significant influence means holding at least 20% of the total voting power, or having control or participation in business decisions under an agreement. The definition also includes a joint venture company, which refers to a joint arrangement where two or more parties share joint control and have rights to the net assets of the venture. Associate companies typically arise through strategic partnerships, shareholding arrangements, or contractual rights, and form an integral part of group corporate structures, even though they are not under direct control of the investing entity.

Investment Company

According to Explanation (a) to Section 186 of the Companies Act, 2013, an investment company is one whose principal business activity is the acquisition of shares, debentures, or other securities. A company is deemed to be primarily engaged in the business of investment if at least 50% of its total assets consist of such investments, or if at least 50% of its gross income is derived from the investment business.

Producer Company

A Producer Company is a body corporate formed and registered under the Companies Act, 2013, or earlier under the Companies Act, 1956, for carrying out the activities specified under Section 378B. These companies are typically established by producers, such as farmers, artisans, or others engaged in primary production, to facilitate a wide range of activities including production, harvesting, processing, marketing, selling, or exporting their products. The Companies (Amendment) Act, 2020 introduced a new Chapter (Sections 378A to 378ZU) into the Companies Act, 2013, exclusively governing Producer Companies. This amendment came into effect on 11 February 2021. As per Section 378A(l), a Producer Company is defined as a body corporate having one or more objects related to production, procurement, or processing of primary produce of its members, and registered as such under the Act.

Nidhi Company

A “Nidhi”, as defined under Rule 3(1)(d) of the Nidhi Rules, 2014, is a company incorporated with the object of cultivating the habit of thrift and savings among its members. It functions by accepting deposits from and lending to its members only, strictly for their mutual benefit. A Nidhi must be incorporated as such and must comply with the rules prescribed by the Central Government for its regulation. Though classified as a non-banking financial company (NBFC), a Nidhi is exempted from RBI’s core licensing requirements and is regulated by the Ministry of Corporate Affairs under Section 406 of the Companies Act, 2013. They are also known as Permanent Fund, Benefit Funds, Mutual Benefit Funds and Mutual Benefit Company.

Dormant Company

As per Section 455 of the Companies Act, 2013, a dormant company is one that has been formed and registered under the Companies Act for a future project, or to hold an asset or intellectual property, but is not actively carrying on any business or commercial operations. A company may also be considered dormant or inactive if it has not carried out any significant accounting transaction during the last two financial years or has not filed its financial statements and annual returns during that period.

Non-banking Financial Company

A Non Banking Financial Company (NBFC) is a company registered under the Companies Act, 2013 earlier (Companies Act, 1956) of India, engaged in the business of loans and advances, acquisition of shares, stock, bonds, hire-purchase insurance business or chit-fund business but does not include any institution whose principal business includes agriculture activity, industrial activity, purchase or sale of any goods (other than securities) or providing any services and sale/purchase/construction of immovable property. [7]

The term is defined under Section 45I(f) of the Reserve Bank of India Act, 1934, and includes:

- A financial institution which is a company;

- A non-banking institution that is a company, whose principal business is either:

- Receiving deposits under any scheme, arrangement, or method, or

- Lending in any manner;

- Any other class of non-banking institutions specified by the Reserve Bank of India, with the prior approval of the Central Government, by notification in the Official Gazette.

Listed Company

A listed company, as defined under Section 2(52) of the Companies Act, 2013, is one that has any of its securities listed on a recognised stock exchange in India. Such companies are subject to enhanced disclosure and compliance requirements under SEBI regulations, given their access to public trading.

However, Rule 2A of the Companies (Specification of Definitions Details) Rules, 2014 excludes certain companies from this definition. These include:

- Public companies that list only non-convertible debt securities or non-convertible redeemable preference shares on a private placement basis;

- Private companies that list non-convertible debt securities on a private placement basis;

- Public companies whose equity shares are listed exclusively on stock exchanges outside India as per Section 23(3) of the Act.

Small Company

A small company, as defined under Section 2(85) of the Companies Act, 2013, is a company other than a public company that satisfies both of the following conditions:

Its paid-up share capital does not exceed ₹50 lakh (or such higher amount as may be prescribed, up to ₹10 crore); and

Its turnover, as per the profit and loss account of the immediately preceding financial year, does not exceed ₹2 crore (or such higher amount as may be prescribed, up to ₹100 crore).

However, this definition does not apply to:

(A) a holding company or a subsidiary company;

(B) a company registered under section 8; or

(C) a company or body corporate governed by any special Act;

In furtherance of the objective of promoting Ease of Doing Business, the Ministry of Corporate Affairs, vide the Companies (Specification of Definition Details) Amendment Rules, 2022 dated 15th September 2022, revised the definition of a “small company” by increasing the threshold limits. The Companies (Specification of Definitions Details) Rules, 2014, Rule 2(1)(t), for the purposes of sub-clause (i) and sub-clause (ii) of clause (85) of section 2 of the Act, paid up capital and turnover of the small company shall not exceed rupees four crore and rupees forty crore respectively.[8]

Table: Classification of Companies under the Companies Act, 2013

| S. NO | BASIS OF CLASSIFICATION | TYPES OF COMPANIES |

| 1 | Based on Number of Members | - Private Company

- Public Company - One Person Company |

| 2 | Based on Incorporation | - Statutory Company

- Registered Company |

| 3 | Based on Liability | - Company Limited by Guarantee

- Company Limited by Shares - Unlimited Company |

| 4 | Based on Control | - Holding Company

- Subsidiary Company |

| 5 | Based on Ownership | - Foreign Company

- Government Company |

| 6 | Other Forms of Companies | - Section 8 Company

- Associate or Joint Venture Company - Investment Company - Producer Company - Nidhi Company - Dormant Company - Non-Banking Financial Company (NBFC) - Listed Company - Small Company |

Winding up

Winding up is a process of liquidating the assets of a corporation, firm or other legal entity in order to pay its creditors and make a distribution of assets to its partners or shareholders upon dissolution. According to Section 2(94A) of the Companies Act, 2013, "Winding up" means winding up under this Act or liquidation under the Insolvency and Bankruptcy Code, 2016, as applicable. Chapter XX Section 270-378 of the Companies Act, 2013 deals with winding up and other aspects of it.

A company comes into existence when it gets registered by the Registrar of companies (ROC) and obtains the certificate of incorporation by the ROC. It will come into existence even if an appointment is made in the form of a receiver or manager by the court or debenture holder, or the approval of a scheme of arrangement by the court.

The existence of a company is lost when the company completes two stages; the first being winding up and the second being Dissolution. There are only 2 major types or modes of winding up which are:

- Compulsory Winding Up by the Court

- Voluntary Winding Up

Compulsory Winding Up by the Court

Compulsory winding up takes place when a company becomes insolvent or bankrupt. The creditor if the said company asks the court for a wind up. If the company goes into liquidation, the court of law appoints a liquidator to complete the process of liquidation. Section 270 of the Companies Act, 2013 deals with winding up by the Tribunal. Section 271 of the same act deals with circumstances in which a company may be wound up by the Tribunal;

A company may, on a petition under section 272, be wound up by the Tribunal, If the company is unable to pay its debts, resolved by special resolution, acts against national interests or security, ordered to wind up by the Tribunal, conducted fraudulently, defaulted in filing financial statements, or deemed just and equitable by the Tribunal, it may be wound up under Chapter XIX of the Act.

Once the Tribunal is satisfied that the company has become insolvent or bankrupt then it orders the company to wind up and also orders the company to file a petition under Section 272 of the Companies Act, 2013. The following are the ones who can file a petition in the court for winding up of a company:

- the company,

- any contributor or contributories,

- all or any of the persons specified in clauses (a) and (b),

- the Registrar,

- any person authorized by the Central Government in that behalf, or

- in case falling under section 271(b), by the Central Government or State Government.

Voluntary Winding Up

A voluntary winding up takes place without the intervention of the court or tribunal. In a voluntary winding up the creditors and company agree mutually to wind up the company. This mode generally takes place

- When the company expires its prefixed duration or, due to the occurrence of certain events whereby the company has to be dissolved, and if the company adopts and passes an ordinary resolution for winding up.

- If the company passes a special resolution to wind up the company[9]

Merger of Companies

The law relating to mergers and amalgamations is governed by Chapter XV (Sections 230 to 240) of the Companies Act, 2013, along with the Companies (Compromises, Arrangements and Amalgamations) Rules, 2016, which came into effect on 15 December 2016. These provisions lay down the procedure for compromises, arrangements, amalgamations, and corporate restructurings.

A merger refers to the combination of two or more entities into one, not merely aggregating assets and liabilities but reorganizing them into a single, unified business.

Sections 230 to 234 provide the general framework for such transactions, requiring the preparation of a scheme of arrangement, which must be approved by shareholders, creditors, and the National Company Law Tribunal (NCLT).

- Section 233 provides a fast-track route for mergers involving small companies and wholly owned subsidiaries, dispensing with tribunal approval.

- Section 234 enables cross-border mergers between Indian and foreign companies, subject to prior approval from the Reserve Bank of India (RBI).

Under section 434(1)(c) of the Act, all proceedings under the Companies Act, 1956 including those relating to arbitration, compromise, arrangement, reconstruction, and winding up pending before any District Court or High Court stand transferred to the NCLT, which continues the proceedings from the stage at which they were transferred, thereby ensuring procedural continuity and uniform adjudication.

Inspection

Under Section 206(5) of the Companies Act, 2013, the Central Government may, if satisfied that circumstances so warrant, order the inspection of a company’s books and records by appointing an inspector for the purpose. Such inspections are typically directed after consideration of material indicating irregularities, including violations observed from documents filed with the Registrar of Companies, qualifications in auditors’ reports, complaints regarding manipulation of accounts, siphoning of funds, mismanagement, delays in transfers or payments, and references received from other regulatory authorities.

The primary objective of inspection is to verify whether companies are complying with the provisions of the Act and maintaining transparency in their financial and governance practices. It seeks to ensure that financial statements present a true and fair view of the company’s affairs and that they conform to the accounting standards notified under Section 133. Inspections also examine whether disclosures mandated under company law have been made, whether funds have been diverted or misappropriated, and whether managerial personnel have abused their fiduciary positions for personal gain. Additionally, inspections assess acts of mismanagement or oppression of minority shareholders, improper utilization of funds raised through public or private issues, and the diligence of statutory auditors in certifying accounts. Thus, inspections function as an essential regulatory tool to safeguard stakeholder interests and maintain accountability within corporate operations.

Investigation

The power to order an investigation into the affairs of a company is vested in the Central Government under Section 210 of the Companies Act, 2013. Such an investigation may be initiated if the Government forms the opinion that it is necessary to do so. The grounds for ordering an investigation include a report submitted by the Registrar of Companies (RoC) or an Inspector under Section 208, the passing of a special resolution by a company requesting an investigation into its own affairs, directions of a court or tribunal, or where such an inquiry is deemed necessary in the public interest. For the purpose of conducting the investigation, the Central Government may appoint one or more Inspectors.

In cases where the matter involves serious fraud or complex issues, the responsibility of conducting the investigation is entrusted to the Serious Fraud Investigation Office (SFIO). A case may be referred to the SFIO when the Government is satisfied that such intervention is required, either on the basis of a report from the RoC or an Inspector under Section 208, on the intimation of a company’s special resolution, in the larger public interest, or upon the request of any department of the Central or State Government. The SFIO, with its specialized expertise, thus plays a central role in handling intricate cases of corporate fraud and malfeasance.

Special Courts

As per Section 435 of the Companies Act, 2013, the Central Government may, for the purpose of providing speedy trial of offences under this Act, except under section 452, establish or designate as many Special Courts as may be necessary.

A Special Court shall consist of: a single judge holding office as Session Judge or Additional Session Judge, in case of offences punishable under this Act with imprisonment of two years or more; and a Metropolitan Magistrate or a Judicial Magistrate of the First Class, in the case of other offences, who shall be appointed by the Central Government with the concurrence of the Chief Justice of the High Court within whose jurisdiction the judge to be appointed is working.[10]

International Experience

The concept of a company as a separate legal entity embracing separate legal personality, limited liability, and perpetual succession is recognized globally, though statutory terms and structural details differ across jurisdictions. India’s Companies Act, 2013 provides a unified regulatory framework, whereas other countries operate under federal or state specific corporate regimes. Below are precise definitions from key jurisdictions, together with comparisons to India’s model:

United Kingdom

Under Section 1 of the Companies Act 2006 (UK), a “company” is defined as one formed and registered under the Act, including entities previously Registered under the Companies Act 1985 or the Companies (Northern Ireland) Order 1986, treated as if incorporated under the current law. Unlike India’s centralized Ministry of Corporate Affairs (MCA) and National Company Law Tribunal (NCLT) system, the UK relies on Companies House for centralized registration and public accessibility, while legacy companies retain continuity under older statutes and now seamlessly operate under the updated Act.

United States of America

The United States is one of the richest sources of legislation, case laws and debate about corporations. The United States is a federation of States with one Federal and other States Constitutions. Company law is essentially a state subject. A Business Corporation Act is the collection of laws in each state that governs corporations. A model corporation statute compiled by the American Bar Association has been adopted in whole or in part by, or has influenced the statutes of many states. The Model Business Corporation Act defined “Corporation,” “domestic corporation,” “business corporation” or “domestic business corporation” in section 1.40 as a corporation for profit, which is not a foreign corporation, incorporated under this Act. “Corporation” has been given special meanings in sections 5.01, 8.50 and 13.01. This contrasts India's national uniform framework. While India’s corporate governance and adjudication are uniform across states, the U.S. allows substantial variation from one state to another, although the MBCA promotes consistency.

Australia

The Corporations Act 2001 defines “company” under Section 9 as an entity registered under the Act. Australian corporate supervision is centralized via the Australian Securities and Investments Commission (ASIC). The system is similar to India's in centralization, though India's MCA and NCLT provide both regulatory and adjudicatory oversight, whereas Australia relies on ASIC and courts respectively.

Canada

Canada functions under both federal (CBCA) and provincial company laws. Under Section 2(1) of the Canada Business Corporations Act, a “corporation” is a body corporate incorporated or continued under this Act and not discontinued under it. This dual structure contrasts with India's single statute, meaning corporations may need to comply with both federal and provincial requirements, potentially complicating governance.

China

According to Articles 2 and 3 of the Company Law of the People’s Republic of China (revised 2018), a “company” refers to either a limited liability company or a company limited by shares incorporated in China, and is recognized as an enterprise legal person with independent legal property and full liability for debts. Shareholders’ liability is limited to their capital contribution or shareholding. Though conceptually in line with India’s approach, China’s regime includes greater state oversight and conditional licensing for foreign entities. India, under Chapter XXII, permits foreign companies to conduct business with reduced restrictions compared to China’s model.

Appearance of 'Company' in Official Database

Annual Reports

Summary Statistics of Indian Companies

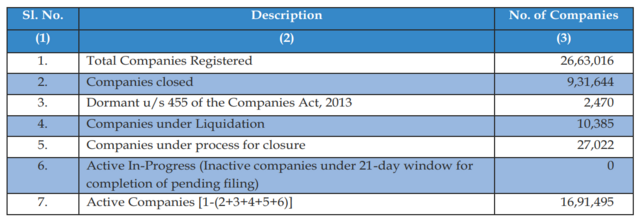

The table presents the overall status of companies registered in India as on 31st March 2024, indicating that out of 26,63,016 total registered companies, the rest were classified as active, closed, dormant, under liquidation, or in the process of closure.

State/UT-wise Companies Registered in India

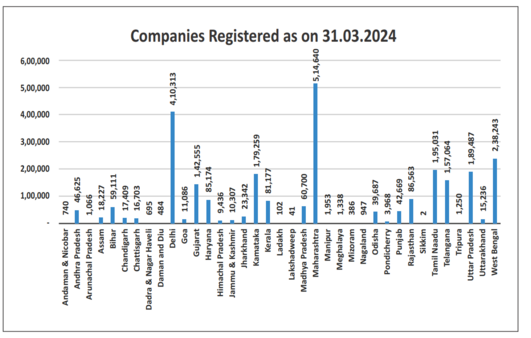

This chart highlights that Maharashtra (5,14,640), Delhi (4,10,313), and West Bengal (2,38,243) have the highest number of registered companies among Indian states as on 31st March 2024.

Monthly Report

Active OPC

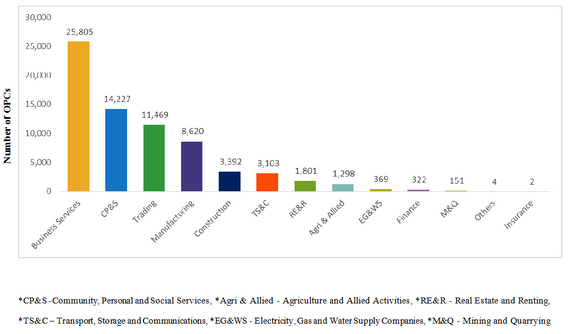

During July 2025, a total number of 1,146 One Person Companies were registered with a Paid-Up Capital of Rs. 9.23 Crore. Out of total Active number of One Person companies registered in July 2025, 29% were registered under the head Community, personal & Social Services.

Economic-Activity Wise Active LLPs

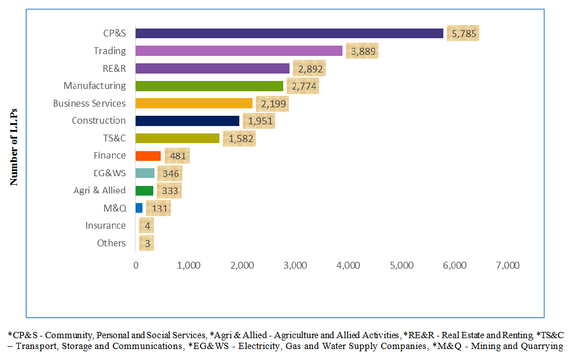

With an increase of new 22,370 Limited Liability Partnerships (LLPs) during the quarter May 2025 to July 2025, a total number of 4,15,620 LLPs were active in the country as of 31st July 2025.

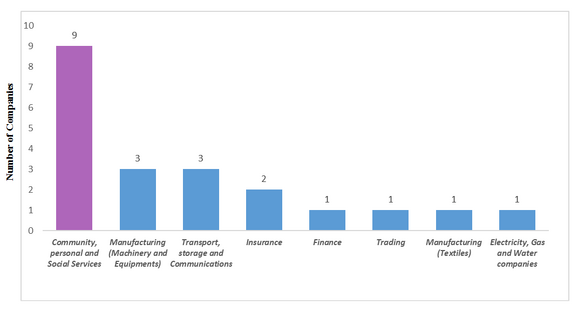

Economic-Activity Wise distribution of Registered Foreign Companies

As on 31st July 2025, there were a total of 5,262 foreign companies registered in India. Out of these, 62% (3,284) were Active. When looking at the economic activity classification, it was revealed that 43% of the companies can be classified as 'Community, personal and Social Services’.

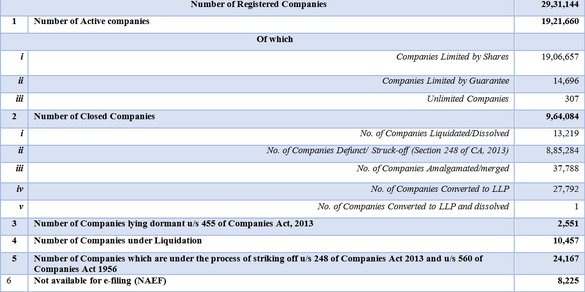

Summary Statement on Companies in India

A total number of 29,31,144 companies were registered in the country as on 31st July 2025, of which 66% (19,21,660) companies stand active. There is increase of 0.16% in the total proportion of active companies w.r.t registered companies when compared to June 2025.

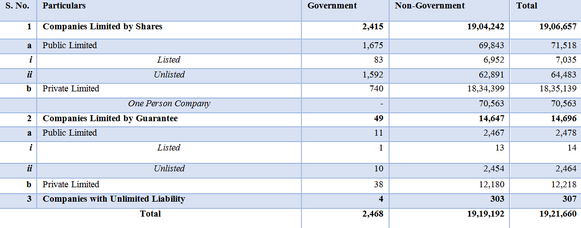

Active Companies

Private limited companies account for 96% of the total companies with 39% of the total Paid-up Capital. In comparison, Public Limited companies are smaller in number (4%) but comprise 61% of the total Paid-up Capital.

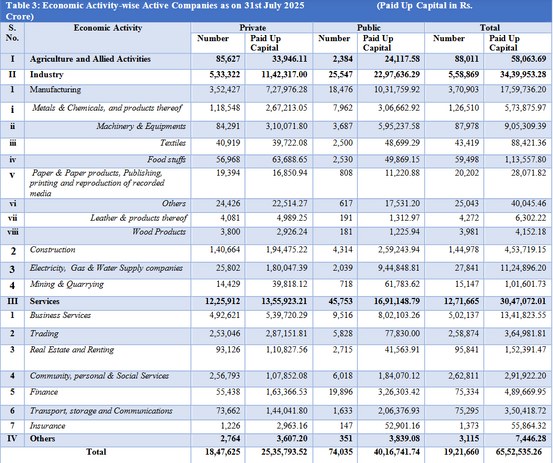

Economic Activity-wise Active Companies

Economic Sector-wise classification (NIC-2004) reveals that the Business Service has highest number of Active companies (26%) followed by Manufacturing (19%), Community, personal and Social Services (14%). It is also observed that Service Sector saw the maximum increase in the total number of Active Companies, followed by Industry Sector and Agriculture Sector. In the Service Sector, Community, personal & Social Services Sector showed the maximum rise in the number of Active Companies.

MCA Website

Company/LLP Incorporated Or Closed

Companies Under Alert

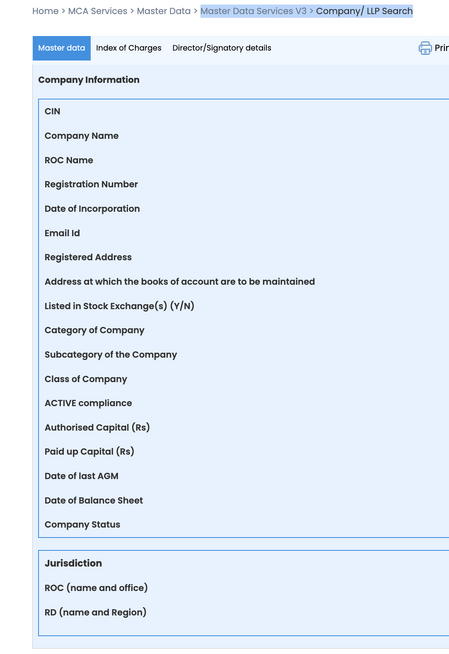

Master Data Services

Related terms

In the Indian legal and business context, the term ‘company’ is often used interchangeably with terms such as ‘corporation’, ‘body corporate’, ‘firm’, ‘business entity’, ‘enterprise’, ‘organisation’, ‘institution’, ‘entity’, ‘incorporated entity’, ‘legal person’, and ‘limited company’, depending on the specific usage and context.

References

- ↑ Taxmann, Meaning and Characteristics of Company, Taxmann (July 8, 2025, 11:30 AM), https://www.taxmann.com/post/blog/all-about-companies/.

- ↑ Trustees of Dartmouth College v. Woodward, 17 U.S. 518 (1819).

- ↑ (1897) A.C. 22

- ↑ (1886) ILR 13 Cal 43

- ↑ 2001 (5) SCC 22

- ↑ Ministry of Company Affairs, “Report of the Expert Committee on Company Law 2005,” p. 12 available at: https://ibbi.gov.in/ ( June 19 2025)

- ↑ Vrinda Aggarwal, Non Banking Financial Company, Taxguru (June 18, 11:30 PM) https://taxguru.in/finance/non-banking-financial-company.html.

- ↑ Taxmann, An Overview of Different Types of Companies in India, Taxmann (June 18, 2025, 11:30 PM), https://www.taxmann.com/post/blog/different-types-of-companies.

- ↑ B Bhanukesh, Winding up of companies under the Companies Act, 2013, 7 Int. J. Law 11,10-14 (2021), available at: https://www.lawjournals.org/assets/archives/2021/vol7issue2/7-1-52-574.pdf.

- ↑ Ministry of Corporate Affairs, “10th Annual Report on the Working and Administration of the Companies Act, 2013,” p. 50. Available at: https://www.mca.gov.in.