Insolvency

What is 'Insolvency'

Insolvency refers to a state of financial distress and an inability to pay off debts. It is a financial state where an individual or organization is unable to pay its debts as they become due. It typically occurs when liabilities exceed assets, making it impossible to meet financial obligations. Insolvency can lead to legal proceedings such as bankruptcy or corporate restructuring, depending on the jurisdiction and severity.

It occurs when liabilities (debts) exceed assets, or when there is not enough cash flow to settle outstanding obligations. Insolvency can lead to severe consequences, including liquidation, bankruptcy, or restructuring, depending on the legal framework in the jurisdiction.

While insolvency typically refers to businesses, individuals can become insolvent too.

Official Definition of 'Insolvency'

Insolvency as defined in legislations

The Provincial Insolvency act, 1920[1], defines Acts of Insolvency

Acts of insolvency.— A debtor commits an act of insolvency in each of the following cases, namely: —

(a) if, in [India] or elsewhere, he makes a transfer of all or substantially all his property to a third person for the benefit of his creditors generally

(b) if, in [India] or elsewhere, he makes a transfer of his property or of any part thereof with intent to defeat or delay his creditors

(c) if, in [India] or elsewhere, he makes any transfer of his property, or of any part thereof, which would, under this or any other enactment for the time being in force, be void as fraudulent preference if he were adjudged as insolvent

(d) if, with intent to defeat or delay his creditors,-

(i) he departs or remains out of [the territories to which this Act extends],

(ii) he departs from his dwelling-house or usual place of business or otherwise absents himself,

(iii) he secludes himself so as to deprive his creditors of the means of communicating with him

(e) if any of his property has been sold in execution of the decree of any Court for the payment of money

(f) if he petitions to be adjudged an insolvent under the provisions of this Act

(g) if he gives notice to any of his creditors that he has suspended, or that he is about to suspend, payment of his debts or

(h) if he is imprisoned in execution of the decree of any Court for the payment of money.

The said act as been repealed with the coming of (IBC)

Legal provisions relating to Insolvency

Insolvency is not officially defined under the Insolvency and Bankruptcy Code (IBC), 2016 (and the rules and regulations framed thereunder), but it is commonly defined as the inability to pay debts[2]. The IBC however has different kinds of insolvency and its process defined in its code.

Classification of Insolvency Processes under India’s IBC Framework

Corporate Insolvency:

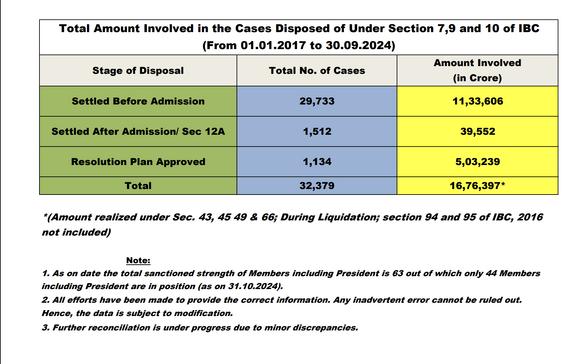

Corporate Insolvency Resolution Process (CIRP): Governed by Sections 4-77[3] of the IBC, CIRP is initiated against corporate debtors with the objective of resolving insolvency while keeping the corporate debtor as a going concern. This process can be triggered by financial creditors (Section 7)[4], operational creditors (Section 9)[5], or the corporate debtor itself (Section 10)[6].

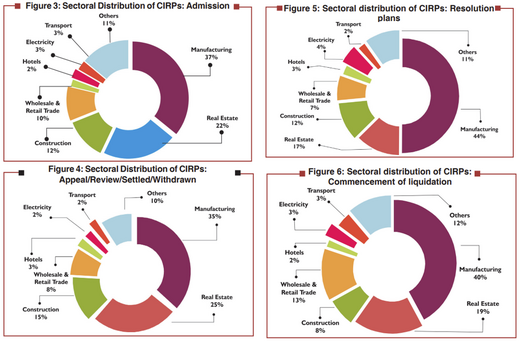

The IBBI reported that as of September 2025, 8659 CIRPs had been admitted since the Code's inception, with the manufacturing, real estate and construction sectors accounting for the highest number of cases[7]

Pre-Packaged Insolvency Resolution Process (PPIRP): Introduced through the Insolvency and Bankruptcy Code (Amendment) Act, 2021, for micro, small and medium enterprises (MSMEs). Section 54A to 54O provide for a resolution process where the terms of restructuring are negotiated prior to commencement of formal insolvency proceedings, reducing time and costs.[8]

Individual Insolvency:

Fresh Start Process: Sections 80-93[9] of the IBC provide for a fresh start process for individuals with income below a specified threshold and aggregate debts not exceeding Rs. 35,000 (as specified). This allows for discharge from qualifying debts after fulfilling certain conditions without undergoing full bankruptcy proceedings.

Insolvency Resolution Process for Individuals: Sections 94-120[10] provide for a resolution process similar to corporate CIRP, where a repayment plan is developed to resolve the debtor's insolvency while allowing the debtor to continue economic activities.

Bankruptcy Process for Individuals: Sections 121-178[11] deal with bankruptcy orders where the debtor's assets are liquidated to repay creditors. This is the terminal stage of individual insolvency when resolution is not possible.

However, as noted by the Insolvency Law Committee (2020)[12], these provisions for individuals and partnership firms have not yet been fully operationalized due to infrastructural and procedural challenges.

Partnership Firm Insolvency

Insolvency Resolution and Bankruptcy for Partnership Firms: Sections 78-178[9] provide distinct processes for partnership firms, recognizing their unique legal character.

Financial Service Provider Insolvency

Section 227[13] empowers the Central Government to notify a resolution authority for insolvency or liquidation proceedings of financial service providers, recognizing that specialized treatment may be required for banks, insurance companies, and other financial institutions given their systemic importance.

The Financial Resolution and Deposit Insurance Bill (FRDI) were proposed in 2017 to create a comprehensive resolution mechanism for financial firms, but has not been enacted. Currently, financial service providers remain largely outside the IBC framework.

Cross-Border Insolvency

While the IBC does not comprehensively address cross-border insolvency, Sections 234[14] and 235[13] contain enabling provisions allowing the Central Government to enter into bilateral agreements with foreign countries for enforcing insolvency provisions. India has not yet adopted the UNCITRAL Model Law on Cross-Border Insolvency.

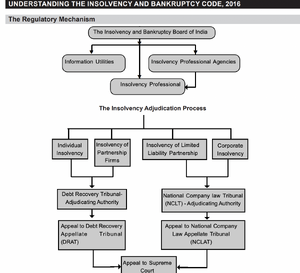

Insolvency Regulatory Mechanism

IBC’s regulatory mechanism is a four-pillar framework consisting of the IBBI (regulator), IPAs (self-regulators), IUs (information utilities), and IPs (frontline practitioners), supported by NCLT/DRT/NCLAT/SC as adjudicating authorities and CoC as the commercial decision-maker.[15]

Insolvency and Bankruptcy Board of India (IBBI)

The IBBI is the central statutory regulator for the insolvency ecosystem under the IBC. It is tasked with registering and regulating Insolvency Professionals (IPs), Insolvency Professional Agencies (IPAs), and Information Utilities (IUs), as well as laying down regulatory standards for them. The IBBI also frames regulations for various insolvency / bankruptcy processes (such as corporate insolvency resolution, liquidation, individual bankruptcy), collects and disseminates data on insolvency cases, conducts inspections and investigations, and enforces disciplinary actions. The Board oversees the effective implementation of the Code, which seeks to consolidate and amend laws relating to the insolvency resolution of corporate entities, partnership firms, and individuals within a defined timeframe [16]

Insolvency Professional Agencies (IPAs)

IPAs are professional bodies (typically Section 8 companies) that act as the first-level regulators for Insolvency Professionals. They are registered with the IBBI and must comply with model bye-laws. Their primary functions include regulating IPs - enrolling new IPs, setting professional and ethical standards, monitoring member performance, providing continuous education, and disciplining members when necessary. The IBBI retains oversight over IPAs and can inspect them, investigate, or even suspend their registration. [17] [18]

Insolvency Professionals (IPs)

Insolvency Professionals are licensed practitioners who conduct the core insolvency functions (e.g., acting as Interim Resolution Professional, Resolution Professional, Liquidator, or Bankruptcy Trustee) under the IBC. They must be a member of an IPA and must obtain an “Authorisation for Assignment” (AFA) from their IPA before taking up assignments. The IBBI regulates their eligibility, code of conduct, and professional competence, and can take disciplinary action if an IP violates the rules. [16][18]

Information Utilities (IUs)

Information Utilities are specialized data repositories, registered with and regulated by the IBBI, which collect, authenticate, store, and disseminate financial information (such as debt, defaults, security interests) of debtors. Their core services include accepting electronic submissions of financial data, verifying and authenticating the data, securely recording records, and providing access to authorized persons. The data maintained by IUs is used as admissible evidence in insolvency proceedings, helping to reduce disputes, simplify claim verification, and speed up the resolution process. Moreover, IBBI has recently strengthened the regulatory standards for IUs (e.g., identity verification, data integrity) to ensure higher trust in their records. [19][18]

Adjudicating Authorities (NCLT / NCLAT / DRT)

These bodies provide judicial oversight of insolvency cases. For corporate insolvency (CIRP), the National Company Law Tribunal (NCLT) is the primary adjudicating authority that admits/rejects applications, oversees the conduct of the resolution process, and approves resolution plans. The National Company Law Appellate Tribunal (NCLAT) serves as an appellate body for NCLT orders. For individual insolvency and bankruptcy, other authorities like the Debt Recovery Tribunal (DRT) may come into play (depending on the regime/part of the IBC).[18]

Committee of Creditors (CoC)

The CoC is a commercial decision-making body in the insolvency process. After the IRP is appointed and claims are verified, the CoC (comprising financial creditors) decides on key matters — approving or rejecting resolution plans, choosing the Resolution Professional, extending CIRP, or triggering liquidation. Their voting rights are typically based on the value of their claims, which gives them significant power in steering the insolvency resolution strategy.

Supporting ecosystem:

- Registered valuers, regulated by the IBBI Valuation rules, provide fair value and liquidation value for assets.

- Information system and registries like MCA, ROC records, CERSAI, Bank credit registries and other public databases facilitate due diligence and transparency.

Insolvency as defined in official documents

According to Blacks' law Dictionary[20], Insolvency means,

The condition of a person who is insolvent; inability to pay one's debts; lack of means to pay one's debts. Such a relative condition of a man's assets and liabilities that the former, if all made immediately available, would not be sufficient to discharge the latter. Or the condition of a person who is unable to pay his debts as they fall due, or in the usual course of trade and business.

Insolvency as defined in official government reports

Insolvency: the state of one who has not property sufficient for the full payments of his debts; the condition of being insolvent.[21]

History and evolution of insolvency

In 1828, insolvency courts were established in Presidency towns through statute 9 Geo.4, c.73 to assist insolvent debtors. These were independent courts with record-keeping authority. Appeals against their decisions could be made to the Supreme Court, which had the power to review and transfer cases as deemed fair and appropriate. The Supreme Court appointed court officials, including an "official assignee." When a creditor filed for intervention and an arbitration order was issued, the debtor's property was transferred to this official assignee. The courts also had provisions for making bankruptcy protection orders.[22]

Presidency-towns Insolvency Act, 1909

In advance of agenda in the twentieth century it was believed that the Indian Insolvency Act, 1848 had proven out to be antiquated and it was elected or we can say nominated to create separate law based on English Bankruptcy Acts. Same Act i.e. The Act of 1848 was to be believed as having no value or so called annulled and consequently a different separate Act was approved in 1909 being the Presidency-towns Insolvency Act taking into account of the Bankruptcy demonstration 1883 and the Bankruptcy Act 1890. As everything has a flaw, likewise the Indian Insolvency Act also had its own flaws, one of the main and solid defaults was that the Act was rather benefitting the borrowers to greater extent but not lenders.[23]

Principal legislation for Corporate Insolvency

The Indian Constitution placed "Insolvency" and "Bankruptcy" in the Concurrent List (Third List of Schedule 7)[24], while matters concerning incorporation, regulation, and liquidation of companies were included in the Union List. Using these constitutional provisions, the Companies Act, 1956 was enacted, transforming the corporate landscape. This Act comprehensively covered company operations and winding-up procedures, helping reduce fraudulent practices. However, despite being a positive step, the Act had significant limitations—it did not explicitly address insolvency or bankruptcy concepts and lacked provisions for debt resolution, even though it served as the primary law governing corporate bankruptcy. The Companies Act, 1956 did contain certain mechanisms allowing companies or their creditors to attempt restructuring, but these were general provisions rather than specific frameworks designed for insolvency or bankruptcy situations.[25]

The major legislation governing Corporate Insolvency was:

> Companies Act, 1956, relating to winding up of companies.[26]

> The Sick Industrial Companies (Special Provisions) Act, 1985.[27]

Eradi Committee – The Beginning (1999)

In the year 1999, the Government of India set up a High Level Committee headed by Justice V.B. Eradi, to examine and make recommendations with regard to the desirability of changes in existing law relating to winding up of companies so as to achieve more transparency and avoid delays in the final liquidation of the companies. The Committee recognized after considering international practices that the law of insolvency should not only provide for quick disposal of assets but in Indian economic scene, it should first look at the possibilities of rehabilitation and revival of companies (as mentioned in paragraph 3 of the Preface). The Committee also recommended that the jurisdiction, power and authority relating to winding up of companies should be vested in a National Company Law Tribunal instead of the High Court as at present. [28]

J J Irani Committee Recommendations (2005)

The Ministry of Corporate Affairs constituted an expert committee to advise the government on the new Company Law on December 2, 2004 which submitted its’ report in May 2005.

The Committee's key recommendations included: (i) Insolvency Tribunals should function in a general supervisory and non-intrusive capacity during rehabilitation and liquidation processes, with greater intervention reserved only for resolving disputes through a fast-track mechanism while applying a commercial approach to dispute resolution grounded in established legal principles of fairness; and (ii) these Tribunals must maintain high-quality standards meeting public expectations for fairness, impartiality, transparency, and accountability, with the President and Members selected to ensure a diverse mix of expertise necessary for effectively conducting the Tribunal's work.[29]

The Bankruptcy Law Reforms Committee Report In 2015

An essential struggle at far sighted bankruptcy amendment was cherished when the Ministry of Finance established by the by the Bankruptcy Law Reforms Committee (BLRC) under the Chairmanship of Dr. T. K Viswanathan. The order of the BLRC was to specify an Indian Bankruptcy Code that supposed to be relevant to entire non- financial associated corporations and people as an individual, and would supersede the present system. The aforementioned committee submitted its report and a deep seated proposal Insolvency and Bankruptcy Code (IBC) to the administration in November 2015. [30]

Types of Insolvency

The IBC separates processes based on whether the debtor is a company or an individual/partnership.

Personal/Individual insolvency

It refers to the insolvency of individuals and arises when a person is unable to meet personal debt obligations such as credit card dues, medical expenses, or loans. Individuals may apply for bankruptcy to discharge certain debts and obtain a fresh financial start. The process evaluates the person’s income and assets to determine the extent to which the debts can be repaid.[31]

Corporate insolvency

It refers to the insolvency of business entities such as companies and LLPs. Common causes include poor management, reduced sales, or adverse economic conditions. Generally, shareholders’ personal assets remain protected from creditors, except in specific circumstances.[31]

In a general financial context, insolvency can be categorized into two forms:

Cash flow insolvency

This happens even if the debtor has enough assets to eventually pay everything off. However, they lack the cash resources to pay their bills on time. For example, a company might own valuable equipment and inventory, but not have enough cash on hand to cover payroll or rent.[32]

Balance sheet insolvency

This occurs when a person or company's liabilities (debts) outweigh their assets (everything they own). In simpler terms, they are underwater financially; they wouldn't have enough money from selling everything they own to cover what they owe.[32]

Difference between Insolvency and Bankruptcy

The law defines insolvency as a situation where someone owes more money (liabilities) than they have assets to cover it. If left unaddressed, this insolvency can lead to different legal outcomes depending on the type of debtor. For individuals or non-corporations, it might end in bankruptcy. For companies (corporates), it could result in liquidation, which means selling all assets to pay off debts. However, insolvency isn't always a dead end. It's a financial state, and sometimes temporary fixes are possible without needing legal protection from creditors through bankruptcy. In short, insolvency is a starting point, and bankruptcy is a potential consequence. Not all cases of insolvency lead to bankruptcy, but all bankruptcies start with insolvency. There are usually two options for dealing with insolvency: working things out with creditors or, in the case of corporations, liquidation, and for individuals, bankruptcy[33].

Appearance in Official Databases

Insolvency and Bankruptcy Board of India (IBBI)

The IBBI maintains the most comprehensive database on insolvency proceedings in India through its official website at https://ibbi.gov.in[34]. The Board publishes:

Quarterly Newsletters: The IBBI publishes detailed quarterly newsletters analyzing trends, landmark cases, regulatory changes, and statistical data.

As of September 2025, the dashboard reported 8659 CIRPs admitted since inception, with 1,300 yielding approved resolution plans, 2,896 ending in liquidation, 1,223 withdrawn and 1,342 closed.[7]

Annual Reports: Comprehensive annual reports provide year-on-year analysis, policy developments, capacity building initiatives, and detailed statistical annexures. The 2023 Annual Report contains extensive data on CIRP outcomes, resolution values, and sectoral performance.[35]

Regional and Sectoral Variations:

The steel sector witnessed significant insolvency proceedings during 2017-2019, with major cases including Essar Steel, Bhushan Steel, and Electrosteel Steels. The power sector has seen increasing insolvency filings due to stress from power purchase agreement disputes and fuel supply issues. Per the latest quarterly newsletter published by IBBI in September 2025, the manufacturing, real estate and construction sectors reflect the concentration of cases across categories.

National Company Law Tribunal (NCLT)

The NCLT maintains case management systems for insolvency proceedings under the IBC. Each of the 15 NCLT benches publishes orders and case status information:

The NCLT website provides:

- Case status search functionality

- Daily cause lists

- Orders and judgments

- Filing procedures and forms

However, a fully integrated national case management system remains under development, with individual benches maintaining separate databases creating challenges for comprehensive data aggregation.

Ministry of Corporate Affairs (MCA)

The MCA maintains the MCA21 registry which records company status including "under CIRP" and "under liquidation." The registry provides Company Master Data search, Director information, Charges registered against companies and Annual filing compliance status. When insolvency proceedings are initiated, the company's status is updated in the registry, making this information publicly accessible.[36]

Insolvency Professional Agencies (IPAs)

IPAs registered with IBBI:[37]

- Indian Institute of Insolvency Professionals of ICAI [38]

- ICSI Institute of Insolvency Professionals [39]

- Insolvency Professional Agency of Institute of Cost Accountants of India [40]

International Experience

Usually, insolvency is defined similarly across jurisdictions; however, the legal treatment of the insolvent varies across jurisdictions.

Australia

Insolvency resolution is primarily governed by the Corporations Act (2001) in Australia. Insolvency deals with the financial distress of companies; whereas, bankruptcy deals with the financial distress of individuals.

Canada

The Companies' Creditors Arrangement Act (CCAA) deals with insolvency, and is primarily aimed at restructuring. The Winding-up and Restructuring Act is relied on to wind up banks, insurance companies and trust corporations, etc.

Green Insolvency

Green insolvency represents an emerging category of insolvency that arises specifically from climate-related risks and environmental factors affecting business viability. Unlike traditional insolvency driven by financial mismanagement or market downturns, green insolvency occurs when firms face financial distress due to physical climate damages (such as floods, droughts, or extreme weather events) or transitional risks stemming from climate mitigation policies, carbon regulations, and shifts toward sustainable economies.

In a seminal paper Green Insolvency: perspectives and policy recommendations by Namratha Nair and Medha Shankar it was noted

“However, the interaction of insolvency policies and sustainability studies has been restricted to the Canadian experience. “ [41]

This study advocates for a climate-sensitive insolvency regime, synthesizing literature on climate change and insolvency risks with particular focus on India. Cross-country evidence demonstrates that incentivizing sustainable practices through prudential frameworks alone is insufficient; climate disclosures must become integral to assessing firm viability, revival strategies, and asset valuation. India's Insolvency and Bankruptcy Code (IBC) and its ecosystem must incorporate climate-sensitive elements to manage losses from climate catastrophes and facilitate sustainable reorganization.

United Kingdom (UK)

Similar to India and Australia, bankruptcy is used to refer to the financial distress of natural persons; whereas, insolvency is used in the context of companies. The main legislation is the Insolvency Act 1986 (modified to a great degree by the Enterprise Act, 2002). It does not cover personal insolvency in Scotland.

United States of America

The insolvency law is primarily set forth in Title 11 of the U.S. Bankruptcy Code

Research that Engages with Insolvency

An overview of the research that has been conducted on the concept within the Indian Justice context, by non-government bodies like Academic Institutions, Research Organisations, CSOs, think tanks and other such bodies. This section seeks to explore:

Modern Corporate Insolvency Regime in India: A Review

The article titled 'Modern Corporate Insolvency Regime in India: A Review' argues that the Insolvency and Bankruptcy Code (IBC) has been a positive development for the Indian economy, but there is still more work to be done. The IBC is a law that allows for the orderly resolution of insolvency. However, the article also identifies a number of unfinished agenda items. This unfinished agenda for IBC includes creating a framework for individual bankruptcy, group insolvency, and cross-border insolvency, as well as improving procedures for fraud detection and data collection.[42]

Assessment of Corporate Insolvency and Resolution Timeline

The research paper 'Assessment of Corporate Insolvency and Resolution Timeline' analyzes the delays in the Corporate Insolvency Resolution Process. The CIRP has to be completed within 270 days, but the paper finds delays which are common in the entire process, especially for complex sectors having many creditors. The biggest delay involved getting approval for the resolution plan from the Committee of Creditors (CoC) and the adjudicating authority. The paper suggests that this may be due to a focus on maximizing recovery rather than reviving the company. It also suggests that there may be a lack of qualified resolution applicants due to restrictions on Asset Reconstruction Companies (ARCs). In nutshell, the research suggests that changes are needed to make CIRP more efficient and effective from this particular perspective.[43]

On the Effectiveness of Insolvency and Bankruptcy Code, 2016: Empirical Evidence From India

This paper 'On the Effectiveness of Insolvency and Bankruptcy Code, 2016: Empirical Evidence From India' presents empirical evidence on how the Insolvency and Bankruptcy Code, 2016 (IBC) has functioned in India, focusing on metrics such as resolution time, liquidation outcomes, and non-performing assets. The study finds that although there has been improvement in creditor recovery and process formalisation, delays and structural bottlenecks persist.[44]

Promoter ownership and bankruptcy reforms: evidence from India

This paper on 'Promoter ownership and bankruptcy reforms: evidence from India' investigates how bankruptcy-law reform (specifically the IBC) affects firms’ borrowing, investment and financing decisions — especially when promoters hold high equity stakes. It uses a panel of listed Indian firms (2012-2019) to show that stronger creditor rights reduce borrowings (particularly in promoter‐heavy firms) and shift financing behaviour.[45]

A study on impact of IBC

The research 'A study on impact of IBC' offers an event-study approach to measure how strengthening creditor rights via the IBC influenced stock-market reactions in India. It addresses a gap in how investor confidence and firm valuations responded to the insolvency reforms.In the year 2016, the Indian government introduced a new Insolvency and Bankruptcy Code that would not only strengthen the creditor rights but also expedite the process in under 330 days. The new law is expected to increase the confidence of the investors. This study is important because it addresses the literature gap on how strengthening creditor rights impact the investor in the stock market.[46]

Green Insolvency: Perspective and policy prescription

India’s insolvency framework is now confronted with the emerging reality of climate-related financial distress. The world’s first climate change–induced bankruptcy of Pacific Gas and Electric (PG&E) stands as clear evidence that such insolvencies are no longer hypothetical future risks but a present challenge. Addressing the physical and transitional risks arising from climate change demands coherence between macroprudential and regulatory policies. Industries reliant on fossil fuels and those situated in climate-vulnerable regions face heightened insolvency risks as environmental pressures intensify. Moreover, growing compliance burdens under Environmental, Social, and Governance (ESG) standards and the mounting environmental liabilities of firms underscore the need for stronger alignment between insolvency and environmental laws. This paper 'Green Insolvency: Perspective and policy prescription' studies the scope of environmental claims in Indian perspective.[41]

Interplay between Mediation and Insolvency Procedure

The research paper 'Interplay between Mediation and Insolvency Procedure' examines various insolvency mediation frameworks adopted globally to identify the model most suitable for India. It further provides detailed recommendations for developing an effective insolvency mediation structure, building upon prior efforts in this area. The paper also discusses two major implementation challenges — the issues surrounding the mandatory and binding nature of mediation proposed under the Bill. Drawing on its comprehensive analysis, the authors strongly advocate for the introduction of insolvency mediation in India.[47]

Related Terms

- Bankruptcy - The situation where a person or organization is unable to pay back their debt. In response to this inability to pay debt, the concerned insolvent organization can initiate bankruptcy proceedings. The process of Bankruptcy involves evaluation of the assets and liabilities of the company followed by liquidation[48].

- Pauper - The term Pauper has been substituted with the term indigent person in CPC. As per the understanding provided by Order 33 CPC, Pauper is a man without means, being permitted to maintain or defend a suit in forma pauperis and that the privilege of maintaining a pauper suit is a personal privilege granted to people who have no means of carrying on or continuing litigation[49].

References

- ↑ The provincial insolvency act, 1920, s. 6, available at: https://www.indiacode.nic.in/bitstream/123456789/19723/1/a1920-05.pdf

- ↑ “Insolvency” defined in Merriam-Webster Dictionary, available at: https://www.merriam-webster.com/dictionary/insolvency(last visited on Nov 26, 2025)

- ↑ The Insolvency and Bankruptcy Code, 2016, Part II, s. 4 - s. 77, available at: https://www.ibbi.gov.in/uploads/law/IBC%20Part%20II.pdf

- ↑ The Insolvency and Bankruptcy Code, 2016, s. 7, available at: https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273§ionId=786§ionno=7&orderno=7&orgactid=AC_CEN_2_11_00055_201631_1517807328273

- ↑ The Insolvency and Bankruptcy Code, 2016, s. 9, available at: https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273§ionId=788§ionno=9&orderno=9&orgactid=AC_CEN_2_11_00055_201631_1517807328273

- ↑ The Insolvency and Bankruptcy Code, 2016, s. 10, available at:https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273§ionId=789§ionno=10&orderno=10&orgactid=AC_CEN_2_11_00055_201631_1517807328273

- ↑ 7.0 7.1 IBBI, "Insolvency and Bankruptcy News", The quarterly newsletter of the IBBI, Jul-Sept 2025, Vol 36, searchable pg no 8, available at: https://ibbi.gov.in/uploads/publication/452d899ae03283f1eb40b1bf7ee5f187.pdf

- ↑ The Insolvency and Bankruptcy Code (Amendment) Act, 2021, Chapter III-A, s. 54A - s. 54O, available at:https://ibbi.gov.in/uploads/publication/452d899ae03283f1eb40b1bf7ee5f187.pdf

- ↑ 9.0 9.1 The Insolvency and Bankruptcy Code, 2016, Part III, Chapters I-V, s. 78 - s. 178, available at: https://www.ibbi.gov.in/uploads/law/IBC%20Part%20III.pdf?

- ↑ The Insolvency and Bankruptcy Code, 2016, Part III, Chapter III, s. 94 - s. 120, available at: https://www.ibbi.gov.in/uploads/law/IBC%20Part%20III.pdf?

- ↑ The Insolvency and Bankruptcy Code, 2016, Part III, Chapters IV&V, s. 121 - s. 178, available at: https://www.ibbi.gov.in/uploads/law/IBC%20Part%20III.pdf?

- ↑ Ministry of Corporate Affairs, "Report of the Insolvency Law Committee" (Feb 2020), available at: https://ibclaw.in/report-of-the-insolvency-law-committee-feb-2020/

- ↑ 13.0 13.1 The Insolvency and Bankruptcy Code, 2016, s. 235, available at: https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273§ionId=1014§ionno=235&orderno=259&orgactid=AC_CEN_2_11_00055_201631_1517807328273

- ↑ The Insolvency and Bankruptcy Code, 2016, s. 234, available at: https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273§ionId=1013§ionno=234&orderno=258&orgactid=AC_CEN_2_11_00055_201631_1517807328273

- ↑ IBBI & IFC, "Understanding the IBC", pg 18, available at: https://ibbi.gov.in/uploads/whatsnew/e42fddce80e99d28b683a7e21c81110e.pdf

- ↑ 16.0 16.1 Powers and functions of IBBI, The Insolvency and Bankruptcy Code, 2016, s. 196, available at: https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273§ionId=975§ionno=196&orderno=220&orgactid=undefined

- ↑ Institute of Cost Accountants of India, "About Insolvency Professional Agency", available at: https://www.ipaicmai.in/IPANEW/aboutus.aspx?utm_

- ↑ 18.0 18.1 18.2 18.3 IBBI & UK Govt, "Handbook on Ethics for Insolvency Professionals", available at: https://ibbi.gov.in/uploads/publication/a30d234862670f06b5a128a1bf208083.pdf

- ↑ Renjith Mathew, "Concept, Utility and Working of Information Utilities under the Insolvency & Bankruptcy Code, 2016", SCC Times Online, Oct 11, 2020, available at: https://www.scconline.com/blog/post/2020/10/11/concept-utility-and-working-of-information-utilities-under-the-insolvency-bankruptcy-code-2016/?

- ↑ Blacks Laws Dictionary, "Insolvency", searchable pg no 1013, available at: https://www.latestlaws.com/wp-content/uploads/2015/04/Blacks-Law-Dictionery.pdf

- ↑ Legislative Department Glossary, "Insolvency", searchable pg no 29, available at: https://cdnbbsr.s3waas.gov.in/s380537a945c7aaa788ccfcdf1b99b5d8f/uploads/2025/08/202508251659864533.pdf

- ↑ Advocate Khoj Blog, "Historical Background", Report No. 26, available at: https://www.advocatekhoj.com/library/lawreports/insolvencylaws/b.php?Title=Insolvency%20Laws

- ↑ The Presidency-Towns Insolvency Act, 1909, available at: https://www.indiacode.nic.in/bitstream/123456789/19722/1/a1909-03.pdf

- ↑ The Constitution of India, Seventh Schedule, art. 246, available at: https://www.mea.gov.in/images/pdf1/S7.pdf

- ↑ IBBI, "Frequently Asked Questions (FAQs) on Corporate Insolvency Resolution Process (‘CIRP’)", available at: https://www.ibbi.gov.in/uploads/faqs/CIRPFAQs%20Final2408.pdf

- ↑ Companies Act, 1956 (Act No. 1 of 1956), available at: https://ca2013.com/wp-content/uploads/2015/10/Companies_Act_1956_13jun2011.pdf

- ↑ The Sick Industrial Companies (Special Provisions) Act, 1985, available at: https://www.indiacode.nic.in/repealedfileopen?rfilename=A1986-1.pdf

- ↑ Report of High Level Committee (Eradi Committee), "Law relating to insolvency and winding up of companies" (2000), available at: https://ibbi.gov.in/uploads/resources/July%202000,%20Eradi%20Committee%20Report%20on%20Law%20relating%20to%20Insolvency%20and%20winding%20up%20of%20Companies.pdf

- ↑ Report of the expert committee (JJ Irani report), "Company Law" (2005), available at: https://ibbi.gov.in/uploads/resources/May%202005,%20J.%20J.%20Irani%20Report%20of%20the%20Expert%20Committee%20on%20Company%20Law.pdf

- ↑ The report of the Bankruptcy Law Reforms Committee, "Volume I: Rationale and Design" (Nov 2015), available at: https://www.ibbi.gov.in/uploads/resources/BLRCReportVol1_04112015.pdf

- ↑ 31.0 31.1 ICAS, "Types of insolvency", available at: https://www.icas.com/regulation-technical-resources/technical-resources/insolvency/types-of-insolvency (last visited on Nov 26, 2025)

- ↑ 32.0 32.1 Equirus Wealth blog, "Insolvency", available at: https://www.equiruswealth.com/glossary/insolvency (last visited on Nov 26, 2025)

- ↑ MNP Ltd Blog, "Difference Between Insolvency and Bankruptcy", available at: https://bankruptcy.mnpdebt.ca/faqs/difference-between-insolvency-and-bankruptcy (last visited on Nov 26, 2025)

- ↑ https://ibbi.gov.in//en

- ↑ IBBI Annual reports, available at: https://ibbi.gov.in//en/publication/reports

- ↑ https://www.mca.gov.in/

- ↑ IBBI, "Insolvency Professionals Agencies List", available at: https://ibbi.gov.in//en/service-provider/professional-agencies

- ↑ IPA - ICAI, available at: https://www.iiipicai.in/

- ↑ IPA - ICSI, available at: https://icsiiip.in/

- ↑ IPA - ICMAI, available at: https://www.ipaicmai.in/IPANEW/Default.aspx

- ↑ 41.0 41.1 Namrata Nair and Medha Shekar, "Green Insolvency: Perspective and Policy Prescription" (2022), available at: https://www.ibbi.gov.in/uploads/publication/599cf8fb50be73f518fca467311304db.pdf

- ↑ Vijay Kumar Singh, "Modern Corporate Insolvency Regime in India: A Review" (January 14, 2021), available at: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3766210

- ↑ Neeti Shikha and Urvashi Shahi, "Assessment of Corporate Insolvency and Resolution Timeline", (February 2021), available at: https://ibbi.gov.in/uploads/publication/2021-02-12-154823-p3xwo-8b78d9548a60a756e4c71d49368def03.pdf

- ↑ Abhirami A, "On the Effectiveness of Insolvency and Bankruptcy Code, 2016: Empirical Evidence From India", (January 2022), available at: https://reference-global.com/article/10.2478/law-2022-0003

- ↑ Vishnu K. Ramesh, Reshma K. Ramesh & Jithesh T, "Promoter Ownership and Bankruptcy Reforms: Evidence from India", (August 2022), available at: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4171178

- ↑ Vamsi Krishna Gunturu & Qambar Abidi, "A study on impact of IBC", (2023), available at: https://mpra.ub.uni-muenchen.de/116850/

- ↑ Interplay between Mediation and Insolvency Procedure - by Vinitha Singh and Jeeri Sanjana Reddy https://www.ibbi.gov.in/uploads/publication/599cf8fb50be73f518fca467311304db.pdf

- ↑ What is Bankruptcy, The Economics Times, available at: https://economictimes.indiatimes.com/definition/bankruptcy

- ↑ Santokh Singh And Anr. vs Radheshyam, AIR 1975 BOM 5