Pre-Packaged Insolvency Resolution Process

What is Pre-Packaged Insolvency Resolution Process?

The Pre-Packaged Insolvency Resolution Process (PPIRP) was introduced to provide an efficient and alternative insolvency mechanism for Micro, Small, and Medium Enterprises (MSMEs), which plays crucial role in India's economy. The COVID-19 pandemic severely affected MSMEs, exposing them to financial stress due to disrupted operations. Recognizing their unique business structures and simpler governance models, PPIRP was designed as a quicker, cost-effective, and value-maximizing process that minimizes disruption and helps preserve jobs.

PPIRP, officially announced through the Insolvency and Bankruptcy Code (Amendment) Ordinance, 2021, on 4th April 2021, enables resolution based on trust and cooperation between debtors and creditors, allowing the company to remain under the control of existing management during the process. It is available as an alternate option, should the stakeholders like to use it. It is available for resolving stress where default is at least 1 crore rupees for which CIRP is available, it is also available in respect of defaults where default is at least 10 lakhs, and for defaults occurring between March 25, 2020, and March 24, 2021.

Unlike the Corporate Insolvency Resolution Process (CIRP), PPIRP combines the advantages of both formal and informal mechanisms. It permits debtor-in-possession with creditor oversight, ensuring transparency and safeguarding stakeholder rights. Under Section 29A[1], the process involves submission of a Base Resolution Plan (BRP) by the debtor, which is evaluated for value maximization.[2] While both CIRP and PPIRP aim at resolution, PPIRP provides a more flexible, timely, and less disruptive option for MSMEs.[3]

Official definition of Pre-Packaged Insolvency Resolution Process

PPIRP as defined in legislation(s)

The Pre-Packaged Insolvency Resolution Process (PPIRP) is governed by a structured legal framework established under the Insolvency and Bankruptcy Code (IBC). The provisions for PPIRP outlined in:

- The Insolvency and Bankruptcy Code, 2016, as amended by the Insolvency and Bankruptcy Code (Amendment) Ordinance, 2021

- The Insolvency and Bankruptcy (Pre-Packaged Insolvency Resolution Process) Rules, 2021

- The Insolvency and Bankruptcy Board of India (Pre-Packaged Insolvency Resolution Process) Regulations, 2021

Together, these instruments provide the procedural and regulatory framework for initiating, conducting and resolving insolvency cases under the PPIRP mechanism. PPIRP is specifically defined in 3(b) of Insolvency and Bankruptcy Code, 2016 (Amendment, 2021)-

"Pre-packaged insolvency resolution process” means the insolvency resolution process for corporate persons under Chapter III-A of Part II of the Code"

Legal Provision(s) relating to PPIRP

The legal provisions for the Pre-Packaged Insolvency Resolution Process (PPIRP) in India are primarily contained within Chapter III-A of the Insolvency and Bankruptcy Code (IBC), 2016, specifically Sections 54A to 54P.[4]

Process Flow of PPIRP

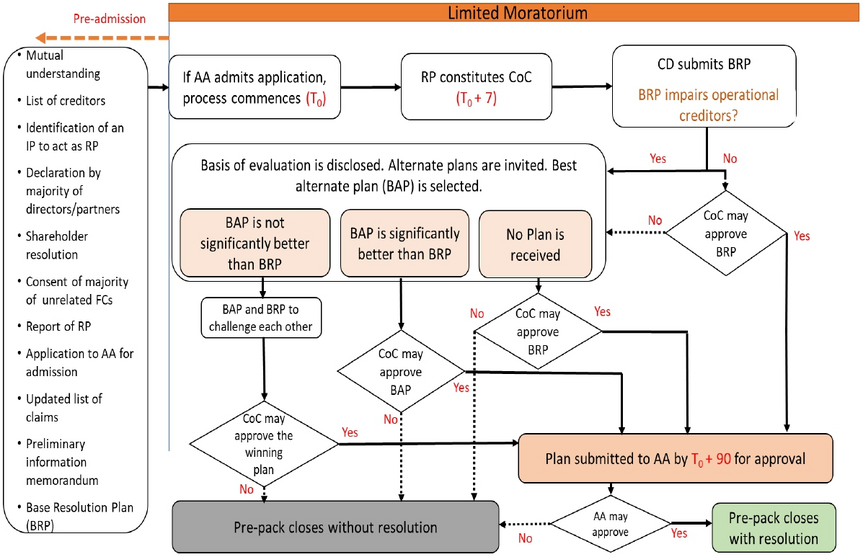

The flowchart summarises the typical process of a Pre-Packaged Insolvency Resolution Process (PPIRP), covering pre-admission requirements, commencements, constitution of the Committee of Creditors (CoC), submission of the Base Resolution Plan (BRP), invitation and evaluation of the Best Alternative Plan (BAP) and Approval or rejection by the CoC.[5]

Timeline of PPIRP Process

The PPIRP is required to be completed within a period of 120 days from its commencement date. The RP shall either file the resolution plan for approval or an application for termination of PPIRP, with the AA within 90 days from the PPIRP commencement date. A model timeline along-with the activities to be undertaken during the process is as under:[6]

| Section of the Code /

Regulation No. |

Description of Activity | Norm | Timeline | ||

| Section 54C | Commencement of PPIRP and appointment of RP | ----- | T | ||

| Sections 54G and 54K | Submission of list of claims, preliminary information memo

randum and BRP |

Within 2 days from commencement of

PPIRP |

T+2 | ||

| Section 54E / Regulation 19 | Publication of public announcement | Within 2 days from commencement of PPIRP | T+2 | ||

| Regulation 38 | Appointment of registered valuers | Within 3 days from appointment of RP | T+3 | ||

| Section 54I | Constitution of CoC | Within 7 days from commencement of

PPIRP |

T+7 | ||

| Section 54I | First Meeting of the CoC | Within 7 days from constitution of CoC | T+14 | ||

| Regulation 43 | Submission of IM | Within 14 days from commencement of

PPIRP |

T+14 | ||

| Regulation 43 | Publication for invitation for resolution plan | Within 21 days from commencement of PPIRP | T+21 | ||

| Regulation 43 | Receipt of resolution plans | At least 15 days from publication for IFRP | T+36 | ||

| Regulation 47 & 48 | Evaluation and approval of resolution plan | Within 89 days from commencement of PPIRP | T+89 | ||

| Regulation 41 | RP to form opinion on avoidance transactions | Within 30 days from commencement of

PPIRP |

T+30 | ||

| RP to make determination on avoidance transactions | Within 45 days from commencement of

PPIRP |

T+45 | |||

| RP to file application to AA for appropriate relief | Within 60 days from commencement of PPIRP | T+60 | |||

| Section 54D / Regulation 48 | Submission of CoC approved resolution plan / application for termination of PPIRP | Within 90 days from commencement of PPIRP | T+90 | ||

| Section 54L | Approval of resolution plan / order for termination of PPIRP | Within 30 days of application under section 54D | T+120 | ||

Source: IBBI (Information Brochure: PPIRP)

Eligibility for PPIRP

Under Section 54A[7] of the Insolvency and Bankruptcy Code, 2016, a Corporate Debtor (CD) classified as a Micro, Small or Medium Enterprise (MSME) under Section 7(1) of the Micro Small and Medium Enterprises Development Act, 2006 is eligible to initiate a Pre-Packaged Insolvency Resolution Process (PPIRP) if it meets the following conditions[8]:

- The CD has committed a default of at least 10 lakhs

- The CD is eligible to submit a resolution plan under Section 29A of the Insolvency and Bankruptcy Code

- The CD has not undergone a PPIRP during the 3 years preceding the initiation date

- The CD has not completed a Corporate Insolvency Resolution Process (CIRP) during the 3 years preceding the initiation date

- The CD is not undergoing the CIRP

- The CD is not required to be liquidated under an order passed under Section 33 of the Insolvency and Bankruptcy Code

To establish MSME status, the application must include a valid and updated UDYAM REGISTRATION CERTIFICATE or proof of investment and turnover in accordance with Notification No. 2119(E) dated 26th June 2020, issued by the Ministry of MSMEs.

Duties of the Insolvency Professional Before PPIRP

Under Section 54B[9] of the Insolvency and Bankruptcy Code, 2016, the proposed Resolution Professional (RP) must undertake specific duties before the PPIRP begins:

- Eligibility Verification

- Prepare a report in such form as may be specified, confirming whether the corporate debtor meets the requirements of section 54A.

The RP's duties cease if the corporate debtor fails to file a PPIRP application within the declared timeline or if the application is admitted or rejected. The RP's fees for these duties are borne as specified and become part of the PPIRP costs if the application is admitted.

Application to Initiate PPIRP

Under Section 54C[10] of the Insolvency and Bankruptcy Code, 2016, to begin PPIRP, eligible corporate debtor (CD) must file an application with the Adjudicating Authority (AA). The application must include:

- A declaration, special resolution, and financial creditor approvals

- Consent and a compliance report from the proposed IP

- Declarations regarding potential avoidance transactions or fraudulent trading

- Financial records and other relevant documents

The AA has 14 days to admit or reject the application. If the application is incomplete, the debtor is given 7 days to rectify defects. Once admitted, the PPIRP officially begins.

Time Limit for Completion

Under Section 54D[11] of the Insolvency and Bankruptcy Code, 2016, PPIRP must be completed within 120 days of its commencement date. The RP is required to submit the resolution plan approved by the Committee of Creditors (CoC) to the AA within 90 days. If no resolution plan is approved the RP must file an application to terminate the PPIRP on the following day.

Declaration of Moratorium and Public Announcement

Under Section 54E[12] of the Insolvency and Bankruptcy Code, 2016, upon commencement, the AA declares a moratorium, providing legal protection against actions such as debt recovery and asset seizure. The moratorium remains in effect until the PPIRP concludes. The RP is appointed to oversee the process and must make sure that the adjudicating authority makes a public announcement about the initiation of PPIRP.

Duties and Powers of the Resolution Professional

Under Section 54F[13] of the Insolvency and Bankruptcy Code, 2016, the RP's role inter alia includes:

- Claims Management

- Oversight of the pre packaged insolvency resolution process

- Documentation relating to company information

- Constituting the committee of creditors and convene and attend its meetings

- Access financial records and operational data to assess the corporate debtor's financial position

The RP's is supported by financial institutions, corporate personnel and stakeholders. Fees and expenses are determined by the CoC and included in the PPIRP costs.

Submission of Claims and Information

Under Section 54G[14] of the Insolvency and Bankruptcy Code, 2016, the corporate debtor (CD) must submit a list of claims and a preliminary information memorandum to the RP within 2 days of PPIRP commencement. Promoters, directors, or partners are liable for any omissions or misleading information in these submissions, unless they can prove lack of knowledge or consent. Affected parties may seek compensation through legal recourse.

Management of Corporate Debtor

Under Section 54H[15] of the Insolvency and Bankruptcy Code, 2016, during PPIRP, the management of CD remains with its Board of Directors or partners. They must preserve the debtor's value, operate the business as a going concern, and comply with all legal obligations under the PPIRP framework.

Formation of Committee of Creditors

Under Section 54-I of the Insolvency and Bankruptcy Code, 2016, the RP must constitute the CoC within 7 days of PPIRP commencement, based on confirmed claims. The CoC composition can be updated as claims are revised, but past decisions remain valid. The first CoC meeting must be held within 7 days of its formation.[16]

Transfer of Management to RP

Under Section 54J of the Insolvency and Bankruptcy Code, 2016, the CoC may resolve to transfer the debtor's management to the RP if there is evidence of fraud or gross mismanagement. The AA can approve this transfer, and certain insolvency provisions then apply to the RP's management.[17]

Consideration and Approval of Resolution Plan

Under Section 54K[18] of the Insolvency and Bankruptcy Code, 2016, the corporate debtor must submit a base resolution plan to the RP within 2 days of commencement. The CoC evaluates the plan and may allow revisions. If the plan is not approved or impairs claims, the RP invites competing plans from eligible applicants. The CoC must approve a plan with a 66% vote before submission of the Adjudicating Authority (AA).

Approval or Rejection of Resolution Plan

Under Section 54L[19] of the Insolvency and Bankruptcy Code, 2016, the AA must approve a resolution plan within 30 days if it meets all legal requirements and includes provisions for effective implementation. If the plan fails to comply, the AA may reject it and terminate the PPIRP.

Appeal Against Resolution Plan Approval

Under Section 54M[20] of the Insolvency and Bankruptcy Code, 2016, if the AA approves a resolution plan under Section 54L, any appeal against this decision can be made only on specific grounds as outlined in Section 61(3) of the IBC. These grounds include:

- Violation of legal provisions

- Material irregularities in the RP's exercise of powers

- Failure to provide for the debts owed to operational creditors as required under Section 30(2)

- Contraventions of any other provisions of the IBC

This ensures that appeals are limited to substantive issues, maintaining the efficiency of the PPIRP framework.

Termination of PPIRP

Under Section 54N[21] of the Insolvency and Bankruptcy Code, 2016, the PPIRP can be terminated under specific circumstances:

- If the RP files an application under Section 54D(3) (due to failure to approve a resolution plan within 90 days) or Section 54K(12) (if the CoC does not approve the plan)

- If the CoC resolves with a 66% majority to terminate the PPIRP before resolution plan approval.

The AA must pass an order terminating the PPIRP within 30 days of the RP's application or the CoC's resolution.

Transition to CIRP

Under Section 54-O[22] of the Insolvency and Bankruptcy Code, 2016, if the CoC resolves to initiate CIRP instead of continuing with PPIRP, the RP informs the AA. The AA terminates the PPIRP and initiates CIRP, appointing an interim RP. Ongoing proceedings under avoidance or fraudulent trading provisions continue during CIRP.

Application of Other IBC Provisions

Under Section 54P[23] of the Insolvency and Bankruptcy Code, 2016, relevant provisions from Chapters II, III, VI, and VII of the IBC apply to PPIRP with necessary modifications. For example, references to "insolvency commencement date" are replaced with "pre-packaged insolvency commencement date," and terms like "CIRP" are replaced with "PPIRP". These adjustments ensure procedural consistency while accommodating the unique features of PPIRP.

Regulatory Framework under RBI Guidelines

Requires bankers to classify stressed accounts as special mention accounts (SMA)[24]. Delaying pre-pack initiation until SMA-2 classification may lead to CIRP, making pre-pack ineffective. Pre-pack should address stress before default, as early initiation reduces liquidation risk. However, using stress as a trigger can be misused and lead to litigation. Default is an objective insolvency test and easier to determine. The subcommittee recommends default as the basis for pre-pack initiation.

Forms Required under PPIRP

The Insolvency and Bankruptcy Board of India (IBBI) has prescribed a set of statutory forms to be used during different stages of the Pre-Packaged Insolvency Resolution Process (PPIRP). These forms, drawn from the PPIRP rules and Regulations, ensure standardization and compliance throughout the process.[25]

| FORM | SOURCE | DESCRIPTION |

| Form 1 | Rules | Application by Corporate Applicant to initiative PPIRP |

| Form P1 |

Regulations |

Written consent by IP to act as RP / IRP |

| Form P2 | List of creditors to be provided by the applicant | |

| Form P3 | Approval of terms of appointment of RP, by UFCs | |

| Form P4 | Approval for filing application to initiate PPIRP, by UFCs | |

| Form P5 | Written consent by IP to act as AR | |

| Form P6 | Declaration by majority of directors / partners | |

| Form P7 | Declaration regarding existence of avoidance transaction(s) | |

| Form P8 | Report by the IP proposed to be appointed as the RP | |

| Form P9 | Public announcement by the RP | |

| Form P10 | List of claims by the CD | |

| Form P11 | Brief particulars of the invitation for resolution plans | |

| Form P12 | Compliance certificate by the RP | |

| Form P13 | Application for termination of PPIRP |

Source: IBBI (Information Brochure: PPIRP)

'PPIRP' as defined in international instrument(s)

UNCITRAL, Legislative Guide on Insolvency Law

Expedited Reorganization Proceedings

The UNCITRAL Legislative Guide on Insolvency Law (2004)[26] does not define or use the term "PPIRP," which is an acronym specific to India's Pre-Packaged Insolvency Resolution Process under the Insolvency and Bankruptcy Code. Instead, it describes the underlying concept as 'expedited reorganization proceedings’, a hybrid mechanism where a debtor negotiates a restructuring plan with key creditors (typically banks and major stakeholders) through voluntary negotiations, then files for court-supervised confirmation to bind dissenting parties swiftly, minimizing delays, costs, and business disruption while preserving value. These proceedings commence upon application showing insolvency or likely inability to pay debts, prior plan acceptance by affected creditor classes, and supporting materials like a disclosure statement and vote certification, effects are limited to impacted parties, with court hearings held expeditiously under shortened timelines mirroring standard reorganization safeguards. Recommendations 160-168[26]outline this as a cost-effective tool to facilitate informal workouts turning formal, applicable where major creditors agree but trade or minor creditors do not, ensuring equitable treatment without full proceedings. India's PPIRP adapts this UNCITRAL model for MSMEs, emphasizing debtor-in-possession control and 120-day timelines.

International Experience

United Kingdom

In the United Kingdom, pre-packaged insolvency operates as "pre-pack administration" under the Insolvency Act 1986 (Schedule B1), where an insolvency practitioner (administrator) is appointed to sell all or part of a company's business/assets immediately upon entry into administration, based on pre-negotiated terms often with connected parties like directors[27]. Operationalisation emphasises speed without prior court approval, triggered by insolvency or creditor pressure, with independent valuations and creditor notifications within 7 days post-sale, data collection occurs via the Insolvency Service and Recognised Professional Bodies (RPBs), mandating reports under Statement of Insolvency Practice 16 (SIP16) with fields like company debts, sale rationale, creditor returns, and connected-party flags, filed annually for aggregation.[28] Unlike India's debtor-in-possession PPIRP with mandatory base plans and NCLT oversight from initiation, UK model shifts control to administrators post-appointment, lacks statutory pre-pack moratorium, and permits pure asset sales without full creditor votes unless post-2021 reforms for connected sales (>90% unrelated creditor approval).

United States

The United States defines pre-packaged insolvency within Chapter 11 of the Bankruptcy Code (11 U.S.C.), allowing debtors to negotiate and solicit creditor approvals for a reorganisation plan before filing, followed by expedited court confirmation post-petition to bind people with opposed views. Data tracking uses the federal Public Access to Court Electronic Records (PACER) system across 94 bankruptcy districts, capturing docket entries with variables like case number, filing date, plan confirmation timeline, debtor schedules (assets/liabilities), Statement of Financial Affairs (SOFA), creditor claims, and outcomes, aggregated stats from U.S. Courts and Epiq Systems report pre-pack metrics like median duration (45-60 days).[29]

Technological transformation

Technological transformation in India's Pre-Packaged Insolvency Resolution Process (PPIRP) remains silent, with no PPIRP-specific digital mandates but with growing integration of e-governance tools mirroring broader Insolvency and Bankruptcy Code (IBC) reforms. The Insolvency and Bankruptcy Board of India (IBBI) emphasises digital platforms for electronic filing (e.g., Form 1 applications), claim verification, and stakeholder communication to cut timelines and costs for MSMEs, while proposing an integrated IBC ecosystem to minimise delays and boost transparency[30]. According to a report from the Insolvency and Bankruptcy Board of India (IBBI), “By leveraging AI tools, India can address challenges such as delayed resolutions, fraudulent activities, and the overwhelming volume of financial data that professionals must analyse.”[31] Blockchain for information utilities and e-auctions further supports value maximisation in PPIRP by enhancing data integrity and efficiency.[32]

Appearance of 'PPIRP' in Database

Official Database maintained by the government

IBBI Quarterly Newsletter, July - September 2025 - Vol. 36

As per the information available with IBBI, 16 applications[33] have been admitted as on September 30, 2025, out of which one has been withdrawn and resolution plans has been approved in ten cases i.e., Amrit India Limited, Sudal Industries Limited, Shree Rajasthan Syntex Limited, Enn Tee International Limited, GCCL Infrastructure and Projects Limited, Mudraa Lifespaces Private Limited, Garodia Chemicals Limited, Kvir Towers Private Limited, Rg Residency Private Limited and Kratos Energy & Infrastructure Limited.

The table illustrates ongoing cases:

| Name of the CD | Date of admission | Name of the NCLT Bench |

| Kethos Tiles Private Limited | 04-01-24 | Ahmedabad |

| Shreemati Fashions Private Limited | 05-01-24 | Kolkata |

| Vedik Ispat Private Limited | 05-02-25 | Bengaluru |

| Medhansh Snacks Private Limited | 08-08-25 | New Delhi |

| G Security (India) Private Limited | 10-12-24 | Mumbai |

Source: IBBI (Quarterly Newsletter, July - September 2025 - Vol. 36)

To know More: IBBI (Quarterly Newsletter, July - September 2025 - Vol. 36)

Database maintained by a non-government entity

IBC LAW Database

IBCLAW.in, is a non-government legal database, subscription based which invokes PPIRP via searchable judgment portals, categorising cases under "PPIRP-Cases After Approval of Plan" or "PPIRP-Claims." It appears as indexed case laws with filters, using abbreviations like PPIRP and units coded by judgment type or stage. Data is collated from tribunal filings, with fields for case numbers, dates, and sections.

Research that engages with 'PPIRP'

- Lessons from Pre-Packaged Insolvency Cases in India: A Long Road Ahead by M. P. Ram Mohan and Sriram Prasad

The paper analyses India’s experience with the Pre-Packaged Insolvency Resolution Process (PPIRP) since its launch in April 2021.[34] With such high expectations that pre-packs would transform insolvency outcomes for distressed companies, the paper finds that adoption has been extremely limited with only a single case resolved and eight total filings over two years. It also identifies significant delays relative to the 120-day statutory timeline, as well as persistent procedural and institutional bottlenecks hampering effective case disposal.

The paper explores why the policy intent of facilitating efficient organizational turnaround has not been realized. It highlights that the low uptake, especially in the wake of the pandemic, suggests deeper structural and design flaws. The research concludes that these challenges underscore the need for further reform and process improvements if PPIRP is to deliver on its promise for Indian insolvency law reform.

- Pre-Packaged - Integration of Debtor Centric Model with Creditor Protection by H. Thakkar (SSRN, 2022)

This research advocates extending PPIRP beyond MSMEs to all companies, emphasising a shift from creditor-in-control to debtor-in-possession.[35] It explores how PPIRP’s design reshapes insolvency dynamics and promotes quicker, consensual resolutions, highlighting benefits over the Corporate Insolvency Resolution Process (CIRP). The research builds upon official texts by proposing wider adaptability and fewer judicial interventions. A gap remains in analysing ground-level implementation challenges or stakeholder resistance.

- Pre-Packaged Insolvency Resolution in India - A Comprehensive Analysis by Yasir D. Pathan (IBC Laws, 2025)

Paper evaluates key process features such as the statutory 120-day resolution timeline, the Swiss challenge mechanism to introduce competitive bidding, and the debtor-in-possession (DIP) model that maintains promoter control during restructuring.[36] The analysis critically compares these aspects with pre-pack insolvency practices in the UK and US, especially highlighting valuation biases and challenges observed through empirical scrutiny of National Company Law Tribunal (NCLT) case data. Going beyond statutory provisions, the paper maps actual process workflows and suggests reforms including marketing enhancements aimed at improving transparency.

- Critical Analysis of Pre-Packaged Insolvency for MSMEs in India by Neeti Goyal (IJLRA, 2024)

This article from the International Journal for Legal Research and Analysis provides a comprehensive critique of PPIRP's framework under IBC amendments for MSMEs, positioning it as a hybrid of informal workouts and formal proceedings to address COVID-exposed vulnerabilities in India's GDP-contributing sector. It details key features like MSME eligibility (Udyam-registered, no prior CIRP/PPIRP in 3 years), debtor-driven base resolution plans (pre-negotiated with equal to or above66% unrelated financial creditors), 120-day timelines, and NCLT approval within 14 days, drawing from Insolvency Law Committee (2020) recommendations for debtor-in-possession models to prevent value erosion[37]. Beyond official notifications, Goyal analyzes advantages (speed, cost savings, business continuity) against challenges (MSME exclusivity excluding larger firms, promoter misuse risks, NCLT overload, creditor coordination hurdles), referencing precedents like Agarwal Structures Pvt Ltd (2022) on timeline adherence and hypothetical cases stressing creditor scrutiny. Global comparisons (US Chapter 11, Singapore schemes) highlight deviations like India's strict unrelated creditor thresholds and Swiss challenges, proposing reforms: scope expansion, independent plan evaluations, NCLT capacity building, awareness drives, and RBI-aligned safeguards. Gaps include sparse empirical recovery data and limited dispute resolution depth, overlaps with Vidhi (2020) on simplification but uniquely integrates committee insights (BLRC, Parliamentary Standing Committee).

- Evaluating the Role of Pre-Packaged Insolvency Process in India's Corporate Restructuring Landscape (IJLLR, 2025)

Published in the International Journal of Legal Developments and Allied Issues, this paper traces PPIRP's evolution as a streamlined IBC tool integrating pre-filing negotiations with formal safeguards, exclusively for MSMEs facing equal to more than ₹10 lakh defaults, to balance debtor control and creditor rights while curbing CIRP delays (average 600+ days).[38] It maps stakeholder roles- debtors submit base plans, insolvency professionals oversee as observers, CoC (equal to or more than 66% financial creditors) approves with 75% liquidation threshold, NCLT sanctions expeditiously- emphasising advantages like 120-day resolution, reduced costs (no full auctions initially), enterprise value preservation, and minimal disruption versus traditional liquidation. Extending beyond statutes, the study critiques limitations: transparency deficits in connected-party deals, promoter ineligibility under S.29A, operational creditor sidelining, and MSME-only access hindering broader restructuring; it proposes pilots for larger entities and enhanced disclosures. Gaps: absence of stakeholder surveys or quantitative outcomes (e.g., success rates), overlaps on timelines, but uniquely foregrounds PPIRP's ecosystem fit amid IBC's creditor-first shift, advocating judicial adaptability for efficacy.

Challenges

Limited Cases and Awareness: Since its introduction, PPIRP has seen low adoption with just a handful of cases filed. Many MSME promoters lack legal support or awareness about PPIRP, and creditors, especially public sector banks, show reluctance towards informal pre-negotiations behind closed doors compared to formal CIRP processes. This low awareness and trust constrain its effective utilisation.[39]

Transparency and Creditor based Concerns: PPIRP follows a "debtor-in-possession" model, which means the promoter remains in control during negotiations. This leads to transparency issues and concerns over preferential transactions or undervalued transaction. Financial creditors find this process opaque, while operational creditors are largely excluded from voting and decision-making, reducing the inclusiveness of the insolvency resolution.[40]

Procedural Delays and Judicial Involvement: Although PPIRP aims for a 120-day resolution timeline, actual admission and procedural delays often extend this significantly and also there are not much successful cases that can be taken as reference. Judicial involvement at various stages causes further delays contradicting the intended efficiency.[41]

Eligibility Threshold and Structural Issues: The minimum default threshold of INR 10 lakhs excludes many MSMEs facing liquidity problems below this limit, undermining early resolution objectives. Also, the process relies heavily on the promoter's base resolution plan with limited competition from third parties, skewing fairness and possibly resulting in suboptimal restructuring.

Conflict with the Insolvency Code's Basic Structure[42]: PPIRP takes promoter controlled framework which contrasts with creditor control and moratorium principles of the Insolvency and Bankruptcy Code, raising fundamental challenges related to enforceability and creditor protection mechanisms.[43]

Way Ahead

- Boosting Awareness and Adoption

Launch targeted awareness campaigns for MSME stakeholders on PPIRP benefits and procedures to overcome low uptake. Strengthen creditor protections through better transparency in negotiations and inclusion of operational creditors in decision-making.

Workshops that walk through actual case files (like Amrit India Limited or Sree Rajasthan Syntex Limited) can address many misconceptions.

- Procedural and Institutional Enhancements

Simplify processes with fast-track NCLT hearings, dedicated insolvency benches, and reduced interim applications to meet the 120-day timeline. Provide continuous training for NCLT members, insolvency professionals, and creditors on restructuring and commercial viability assessments. The valuation backbone needs to be strengthened through:

- Standard templates for MSME valuations

- Mandatory training in discounted cash flows, relative valuation and risk modelling

- Independent valuation panels for PPIRP cases

References

- ↑ The Insolvency and Bankruptcy Code, 2016, Part II, Chapter II, s. 29A, available at: https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273§ionId=49377§ionno=29A&orderno=34&orgactid=undefined

- ↑ Insolvency and Bankruptcy Board of India, Pre-Packaged Insolvency Resolution Process (PPIRP) FAQs (IBBI 2021), Available at, https://www.ibbi.gov.in/uploads/whatsnew/a650764a464bc60fe330bce464d5607d.pdf?

- ↑ Ministry of Corporate Affairs, Framework for Pre-Packaged Insolvency Resolution Process for MSMEs (Press Information Bureau, Government of India, 2021).

- ↑ The Insolvency and Bankruptcy Code, 2016, Part II, Chapter III-A, ss. 54A-54P. https://www.indiacode.nic.in/handle/123456789/2154

- ↑ IBBI (Pre-Packaged Insolvency Resolution Process), Information Brochure, Annexure A, Pg. No. 6, available at: https://www.ibbi.gov.in/uploads/whatsnew/a650764a464bc60fe330bce464d5607d.pdf

- ↑ IBBI (Pre-Packaged Insolvency Resolution Process), Information Brochure, Annexure C, Pg. No. 8, available at: https://www.ibbi.gov.in/uploads/whatsnew/a650764a464bc60fe330bce464d5607d.pdf

- ↑ The Insolvency and Bankruptcy Code, 2016, s54A, Available at: https://www.indiacode.nic.in/show-data?actid=AC_CEN_2_11_00055_201631_1517807328273§ionId=57216§ionno=54A&orderno=61

- ↑ The Insolvency and Bankruptcy Code, 2016, Part II, Chapter III-A, s. 54A. https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273§ionId=57216§ionno=54A&orderno=61&orgactid=undefined

- ↑ The Insolvency and Bankruptcy Code, 2016, Part II, Chapter III-A, s. 54B. https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273§ionId=57217§ionno=54B&orderno=62&orgactid=undefined

- ↑ The Insolvency and Bankruptcy Code, 2016, Part II, Chapter III-A, s. 54C. https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273&orderno=63&orgactid=undefined

- ↑ The Insolvency and Bankruptcy Code, 2016, Part II, Chapter III-A, s. 54D. https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273&orderno=64&orgactid=undefined

- ↑ The Insolvency and Bankruptcy Code, 2016, Part II, Chapter III-A, s. 54E. https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273&orderno=65&orgactid=undefined

- ↑ The Insolvency and Bankruptcy Code, 2016, Part II, Chapter III-A, s. 54F. https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273&orderno=66&orgactid=undefined

- ↑ The Insolvency and Bankruptcy Code, 2016, Part II, Chapter III-A, s. 54G. https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273&orderno=67&orgactid=undefined

- ↑ The Insolvency and Bankruptcy Code, 2016, Part II, Chapter III-A, s. 54H. https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273&orderno=68&orgactid=undefined

- ↑ The Insolvency and Bankruptcy Code, 2016, Part II, Chapter III-A, s. 54I. https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273&orderno=69&orgactid=undefined

- ↑ The Insolvency and Bankruptcy Code, 2016, Part II, Chapter III-A, s. 54J. https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273&orderno=70&orgactid=undefined

- ↑ The Insolvency and Bankruptcy Code, 2016, Part II, Chapter III-A, s. 54K. https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273&orderno=71&orgactid=undefined

- ↑ The Insolvency and Bankruptcy Code, 2016, Part II, Chapter III-A, s. 54L. https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273&orderno=72&orgactid=undefined

- ↑ The Insolvency and Bankruptcy Code, 2016, Part II, Chapter III-A, s. 54M. https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273&orderno=73&orgactid=undefined

- ↑ The Insolvency and Bankruptcy Code, 2016, Part II, Chapter III-A, s. 54N. https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273&orderno=74&orgactid=undefined

- ↑ The Insolvency and Bankruptcy Code, 2016, Part II, Chapter III-A, s. 54-O. https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273&orderno=75&orgactid=undefined

- ↑ The Insolvency and Bankruptcy Code, 2016, Part II, s. 54P. https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273&orderno=76&orgactid=undefined

- ↑ Reserve Bank of India,“Resolution of Stressed Assets – Revised Framework”. https://ibclaw.in/wp-content/uploads/2018/02/RBI-Circular-on-Stressed-Assets.pdf

- ↑ IBBI (Pre-Packaged Insolvency Resolution Process), Information Brochure, Annexure D, Pg. No. 9, available at: https://www.ibbi.gov.in/uploads/whatsnew/a650764a464bc60fe330bce464d5607d.pdf

- ↑ 26.0 26.1 UNCITRAL, Legislative Guide on Insolvency Law, Parts One and Two (2004), Available at: https://uncitral.un.org/sites/uncitral.un.org/files/media-documents/uncitral/en/05-80722_ebook.pdf

- ↑ Insolvency Service,”Pre-Packaged Insolvency- Review”(2014) Available at- https://www.gov.uk/government/news/pre-packaged-administrations-a-review

- ↑ Richard Tett, Adam Jones, Yoonji Lee,"UK regulations on pre-pack administrations come into force” (2021) Available at: https://transactions.freshfields.com/post/102gwuk/uk-regulations-on-pre-pack-administrations-come-into-force

- ↑ Chapter 11- Bankruptcy Basics, Available at: https://www.uscourts.gov/court-programs/bankruptcy/bankruptcy-basics/chapter-11-bankruptcy-basics

- ↑ Ravi Mittal,” Digitalisation of IBC”, Available at:https://ibbi.gov.in/uploads/resources/ffa2fc846853f7a25eaaa754dc305de9.pdf

- ↑ Manu Kaushik,” IBBI moots mandatory use of AI in insolvency resolution” Financial Express, Available at:https://www.financialexpress.com/business/industry/ibbi-moots-mandatory-use-of-ai-in-insolvency-resolution/3996649/

- ↑ Ankeeta Gupta, "Information Utilities and Blockchain: An Unlikely but Holy Partnership”, Available at:https://ibbi.gov.in/uploads/publication/6b683482bf24ca7023aa99c8ef198bd8.pdf

- ↑ Quarterly Newsletter of IBBI, July - September 2025, Vol 34, Pg. No. 16, available at: https://ibbi.gov.in/uploads/publication/452d899ae03283f1eb40b1bf7ee5f187.pdf

- ↑ MP Ram Mohan and Sriram Prasad“ Lessons from Pre-Packaged Insolvency Cases in India: A Long Road Ahead” (2023) IBBI Annual Publication 2023 Available at: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4590500

- ↑ Hiteshkumar Thakkar & Agarwal, K. “Pre-Packaged - Integration of Debtor Centric Model with Creditor in Control Model: Indian Insolvency Regime”, (2022) Bank Quest -Indian Institute of Banking and Finance (IIBF), Volume 93, Issue 1, Available at: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4752965

- ↑ Yasir D. Pathan,” Pre-Packaged Insolvency Resolution in India: A Comprehensive Analysis of PPIRP under the IBC” (2025), available at: https://ibclaw.in/pre-packaged-insolvency-resolution-in-india-a-comprehensive-analysis-of-ppirp-under-the-ibc-by-yasir-d-pathan/#:~:text=Pathan,-March%2011%2C%202025&text=Pre%2Dpackaged%20insolvency%20resolution%20is,framework%20for%20managing%20financial%20stress.

- ↑ NEETI GOYAL,"CRITICAL ANALYSIS OF PRE-PACKAGED INSOLVENCY FOR MSMES IN INDIA” (Nov, 2024) International Journal For legal research and analysis, Volume II Issue 7, Available at: https://www.ijlra.com/details/critical-analysis-of-pre-packaged-insolvency-for-msmes-in-india-by-neeti-goyal

- ↑ Aswathy Ashok, "Evaluating The Role Of Pre-Packaged Insolvency Process In India’s Corporate Restructuring Landscape” (May, 2025)IJLLR Journal, Available at: https://www.ijllr.com/post/evaluating-the-role-of-pre-packaged-insolvency-process-in-india-s-corporate-restructuring-landscape

- ↑ Chinna Aswathy Abraham, Pooja Shree,” PPIRP PROBED: EXAMINING PROGRESS AND CHALLENGES IN MSME INSOLVENCY” (February, 2024), Available at: https://suranaandsurana.com/ppirp-probed-examining-progress-and-challenges-in-msme-insolvency/

- ↑ Chinna Aswathy Abraham, Pooja Shree,” PPIRP PROBED: EXAMINING PROGRESS AND CHALLENGES IN MSME INSOLVENCY” (February, 2024), Available at: https://suranaandsurana.com/ppirp-probed-examining-progress-and-challenges-in-msme-insolvency/

- ↑ Amritanshu Rathi,” Insolvency Without Assets? Rethinking India’s Pre-Pack Framework for MSMEs” Available at: https://www.irccl.in/post/insolvency-without-assets-rethinking-india-s-pre-pack-framework-for-msmes

- ↑ Anwesh Patnaik,” A Critique of the Pre-Packaged Insolvency: A Flawed Framework” (Aug, 2021) Arbitration and Corporate Law Review, Available at: https://www.arbitrationcorporatelawreview.com/post/a-critique-of-the-pre-packaged-insolvency-a-flawed-framework

- ↑ Kanishka Agrawal, Sourav Singh,” Critical Analysis of Pre-Packaged Insolvency Resolution Process Under IBC” (April, 2024) IBCLAW, Available At: https://ibclaw.in/critical-analysis-of-pre-packaged-insolvency-resolution-process-under-ibc-by-kanishka-agrawal-and-saurav-singh/