Liquidation

What is Liquidation

Liquidation is the process of winding up a company's affairs by selling its assets, paying off creditors in order of priority, and distributing any remaining funds to shareholders before dissolving the company. In everyday business parlance, liquidation represents the formal termination of a company's existence, converting all its assets into cash to settle outstanding debts and obligations. This process marks the end of a company's operational life and ensures an orderly exit from the commercial ecosystem while protecting the interests of creditors and other stakeholders.

Official Definition of Liquidation

Liquidation as defined in legislations

Insolvency and Bankruptcy Code, 2016

The Insolvency and Bankruptcy Code, 2016 (IBC) does not explicitly define liquidation, however, the trigger for the process is laid out under Section 33 as the process that commences when the Adjudicating Authority (National Company Law Tribunal) passes an order for liquidation of the corporate debtor. The IBC provides a comprehensive framework for liquidation in Sections 33 to 54[1], establishing it as one of the two primary outcomes of corporate insolvency resolution process — the other being approval of a resolution plan.

Under Section 33(1) of the IBC, the Adjudicating Authority shall pass a liquidation order if: (a) it rejects the resolution plan for non-compliance with requirements; (b) no resolution plan is received within the stipulated period; or (c) it approves the decision by committee of creditors to liquidate; or (d) the corporate debtor contravenes the resolution plan [2][3]

Companies Act, 2013

Prior to the IBC's dominance in insolvency matters, the Companies Act, 2013,[4] governed the winding up of companies under Sections 270 to 365 (now largely superseded by the IBC for operational matters). Section 2(94A) defines "winding up" as "winding up under this Act or liquidation under the Insolvency and Bankruptcy Code, 2016."[5]

Reference: Companies Act, 2013, Section 2(94A) and Sections 270-365,

Key Terminology and Definitions Understanding liquidation requires familiarity with specific legal terminology defined under the IBC. A "claim," as per Section 3(6),[6] encompasses both rights to payment and remedies for legal breaches. The "corporate debtor," defined in Section 3(8),[6] refers to any corporate entity owing debt to another party. Creditors, defined under Section 3(10)[6], comprise several categories with distinct rights and priorities. Financial creditors, per Section 5(7)[7], hold purely financial debts, including assignees and transferees. Operational creditors, defined in Section 5(20)[7], possess claims related to goods, services, employment, or statutory dues. Secured creditors, per Section 3(30), benefit from security interests supporting their debt claims, while unsecured creditors lack such collateral protection. "Liquidation cost," defined under Section 5(16)[7], encompasses all expenses incurred during the liquidation process. The "liquidation commencement date," per Section 5(17), marks the initiation of liquidation proceedings under either Section 33 for compulsory liquidation or Section 59[8] for voluntary liquidation.

Liquidation Process Under Insolvency and Bankruptcy Code 2016

The Liquidation Order

The liquidation process formally commences with a tribunal-issued liquidation order, a concept detailed in Section 33[2] of the IBC. This order emerges during pending insolvency proceedings when the tribunal determines that corporate revival is no longer feasible. Several circumstances trigger liquidation orders, each reflecting failed resolution attempts or procedural violations.

The tribunal issues liquidation orders when resolution plans fail to materialize within prescribed timeframes, when the committee of creditors rejects proposed resolution plans, or when submitted plans fail to meet regulatory requirements. Additionally, liquidation may follow when approved resolution plans face rejection due to non-compliance issues, or when corporate debtors violate approved resolution plan terms through inconsistent actions or implementation failures.

Initiating the Process - The IBC provides two distinct pathways for initiating liquidation proceedings, each governed by specific statutory provisions and requirements. Compulsory liquidation under Section 33 follows failed CIRP attempts, while voluntary liquidation under Section 59 allows solvent companies to self-liquidate.[8]

Voluntary Liquidation (Section 59)

Companies without payment defaults may initiate voluntary liquidation under Section 59,[8] subject to the IBBI (Voluntary Liquidation Process) Regulations, 2017. The process requires a majority of directors to submit a declaration with an affidavit confirming either the absence of debt or ability to fully repay debts from liquidation proceeds, and attesting that liquidation does not aim to defraud creditors or other parties.

This declaration must include audited financial statements and reports covering the preceding two years or since incorporation for newer companies, along with any prepared valuation reports. Within four weeks of the declaration, the company must pass a special resolution in a general meeting to initiate liquidation and appoint a liquidator. For companies incorporated with specified durations or dissolution triggers in their articles, members must pass appropriate resolutions within the same timeframe.

When the company owes debts, creditors representing two-thirds of total debt value must approve the voluntary liquidation resolution. Both the Registrar of Companies and IBBI must receive notification of the resolution within seven days of passage or creditor approval. Once voluntary liquidation commences, the general liquidation procedures under Sections 35 to 53 apply with necessary modifications.

Compulsory Liquidation (Section 33)

Section 33[2] governs tribunal-ordered liquidation following failed CIRP attempts. The tribunal initiates liquidation when it fails to receive resolution plans within the maximum CIRP completion period of 180 days or extended deadlines. While tribunals may grant extensions with reasonable justification, continued failure to submit plans triggers mandatory liquidation orders.

The tribunal also orders liquidation when proposed resolution plans fail to comply with Section 31 requirements. These requirements, detailed in Section 30(2), include prioritizing liquidation costs, ensuring operational creditors receive minimum statutory amounts, protecting dissenting financial creditors' interests, providing for post-approval management, establishing implementation and supervision mechanisms, and maintaining legal compliance.

Additionally, the Resolution Professional may inform the tribunal of the Committee of Creditors' decision to liquidate during CIRP, provided creditors holding at least 66% voting power approve. The tribunal also orders liquidation when corporate debtors contravene approved resolution plans, potentially imposing fines on non-compliant resolution applicants.[2]

Appointment and Role of Liquidator

Appointment Process - Liquidators, who are registered insolvency professionals, oversee and conduct the liquidation process following commencement under the IBC. Section 34[9] governs liquidator appointments. In proceedings initiated under Section 33[2], the CIRP-appointed insolvency professional typically becomes the liquidator upon providing written consent to the adjudicating authority.

The tribunal may replace the resolution professional as liquidator in three circumstances: when their submitted resolution plan fails due to non-compliance, when IBBI recommends replacement with reasons, or when the professional declines the liquidator appointment. Upon replacement, the tribunal directs IBBI to propose another insolvency professional within ten days, accompanied by written consent.

Liquidator Fees - According to Regulation 4 of the Insolvency and Bankruptcy Board of India (Liquidation Process) Regulation, 2016[10], the Committee of Creditors determines liquidator fees per Regulation 39D of the IBBI (Insolvency Resolution Process for Corporate Persons) Regulations, 2016. The fee structure covers compromise or arrangement periods under the Companies Act, asset sale periods, and remaining liquidation timeframes. When Regulation 39D doesn't apply, fees equal the resolution professional's entitlement during compromise periods, with remaining liquidation fees calculated as percentages of realized and distributed amounts.

Powers and Duties of Liquidator - Section 35[5] of the IBC comprehensively outlines liquidator powers and responsibilities. The liquidator verifies claims, assumes custody of corporate debtor assets and actionable claims, and prepares asset evaluation reports. They implement preservation measures for corporate assets and may continue business operations for beneficial liquidation purposes.

The liquidator sells moveable and immoveable properties through public auctions or private contracts as appropriate, and manages negotiable instruments on the corporate debtor's behalf. They may engage professional assistance to fulfill duties, invite and settle creditor claims, and institute or defend legal proceedings for the corporate debtor. The liquidator evaluates and avoids preferential or undervalued transactions, reports to the tribunal per IBBI directions, and distributes liquidation proceeds according to Section 53[11] priorities after stakeholder consultation.

Section 37[12] empowers liquidators to access information systems for claim verification and asset identification. These include IBBI-registered Information Utilities, credit information systems, government authorities, financial and non-financial liability systems, securities and asset information systems, IBBI databases, and other IBBI-specified sources. Creditors may request financial information about the corporate debtor, which liquidators must provide within seven days or explain their inability to do so.

Removal of Liquidator - While the IBC lacks specific liquidator removal provisions, tribunals exercise removal powers under Section 16[13] of the General Clauses Act, which permits appointing authorities to remove appointees unless otherwise specified. Tribunals have established that grounds for removing company liquidators under Section 276[14] of the Companies Act apply to IBC-appointed liquidators, with removal decisions resting with tribunals rather than Committees of Creditors.

However, IBBI's 2021 amendment to liquidation regulations empowers the newly constituted Stakeholder's Consultation Committee (SCC) to seek liquidator removal. With 66% majority approval, the SCC may petition the tribunal for removal with written justification, though specific grounds remain unspecified. This amendment's validity faces challenges as potentially ultra vires to IBC objectives, with arguments that tribunal discretion should remain paramount.

Claims Management

Consolidation of Claims - Section 38[15] mandates that liquidators receive and consolidate creditor claims within 30 days of liquidation commencement. This consolidation ensures all entitled creditors can claim their share of liquidated assets while enabling efficient debt valuation and priority-based distribution.

Financial creditors submit claims through Information Utility records or, absent such records, follow operational creditor procedures. Operational creditors submit claims with proof directly to liquidators within prescribed timeframes and formats. Creditors with mixed financial and operational claims submit each component through appropriate channels. The section permits claim withdrawal or variation within 14 days of submission.

Verification and Admission of Claims - Section 39[16] requires liquidators to verify submitted claims within prescribed periods, potentially requesting additional documentation or evidence. Following verification, Section 40 empowers liquidators to admit or reject claims wholly or partially, communicating decisions to creditors and corporate debtors within seven days with written explanations for rejections. Section 41[17] then requires liquidators to value admitted claims according to IBBI procedures.

Appeal Rights - Section 42[18] provides aggrieved creditors or members the right to appeal liquidator decisions to the tribunal, ensuring procedural fairness and oversight in claim determination.

Avoidance Transactions

The IBC empowers liquidators to identify and reverse certain transactions that unfairly prejudice creditor interests or diminish the corporate debtor's asset pool. Sections 43 to 51[19] address three categories of avoidance transactions: preferential, undervalued, and extortionate credit transactions.

Preferential Transactions - Section 43[20] defines preferential transactions as transfers benefiting specific creditors, guarantors, or sureties that improve their position relative to other creditors. Excluded transactions include those in ordinary business course, transfers creating security interests for new value with proper registration, and court-ordered transfers. The relevant period for avoidable preferential transactions extends two years for related parties and one year for unrelated parties before insolvency commencement.

Upon application under Section 43[20], Section 44[21] empowers tribunals to reverse preferential transactions by vesting transferred property with the corporate debtor, releasing created security interests, requiring beneficiaries to repay received benefits, reviving discharged guarantor obligations, and directing equivalent security provision. These orders protect good faith purchasers and unrelated parties lacking knowledge of insolvency proceedings.[3]

Undervalued Transactions - Section 45[22] addresses undervalued transactions, including gifts and transfers for significantly inadequate consideration. Liquidators or creditors may apply to void such transactions occurring within two years for related parties or one year for unrelated parties before insolvency.

Section 48[23] authorizes tribunals to vest transferred property with the corporate debtor, release security interests, require benefit repayment, and mandate appropriate consideration payment. Section 49[24] provides additional remedies for fraudulent undervalued transactions, including position restoration and victim protection, while preserving good faith interests.

Extortionate Credit Transactions - Section 50[25] addresses credit transactions requiring exorbitant payments within two years before insolvency. Regulation 5 of the IBBI Regulations defines these as transactions demanding excessive credit payments or violating contract law principles.

Section 51 [26]empowers tribunals to restore pre-transaction positions, set aside resulting debts, modify transaction terms, require repayment of received amounts, and relinquish created security interests.

Secured Creditors in Liquidation

Section 52[27] provides secured creditors with two options during liquidation. They may relinquish security interests and receive proceeds per Section 53[28] priorities, or realize security interests independently after liquidator verification. Independent realization requires informing the liquidator, proving security existence through Information Utility records or other means, and obtaining liquidator permission.

Upon realization, secured creditors apply proceeds to their debts, tender any surplus to the liquidator, and transfer applicable liquidation costs. Insufficient proceeds result in unpaid amounts being treated per Section 53[28] priorities.

Distribution of Assets

Section 53[28] establishes the mandatory priority order for distributing liquidation proceeds. Insolvency procedure costs receive first priority, followed by workmen's dues for 24 months and secured creditors who relinquished security ranking equally with employee dues for 12 months. Financial debts to unsecured creditors follow, then government dues and unpaid secured creditor amounts ranking equally. Remaining debts, preferential shareholders, and finally equity shareholders or partners complete the priority hierarchy. Liquidator fees are proportionately deducted before distribution, and any agreement disrupting this order is void.

Dissolution of Corporate Debtor

Section 54[29] governs the final liquidation step: corporate dissolution. Following complete asset liquidation, liquidators apply to tribunals for dissolution orders. Tribunals issue dissolution orders and notify the Registrar of Companies within seven days. For voluntary liquidations under Section 59[30], liquidators apply for dissolution after winding up affairs, with ROC notification required within 14 days.[3]

Liquidation process Under Companies Act, 2013

The Companies Act refers to liquidation as "winding up," governed by Chapter XX. Part I addresses tribunal-ordered winding up, while Part II's voluntary winding up provisions have been superseded by the IBC.[31]

Grounds for Winding Up

Section 271[32] specifies tribunal winding up grounds, including special resolutions for tribunal winding up, actions against India's sovereignty or security, fraudulent affairs or incorporation, consecutive five-year non-compliance with filing requirements, and "just and equitable" grounds.

The Supreme Court has interpreted "just and equitable" grounds to include substratum disappearance, management deadlock, illegal objects or fraud, persistent losses, public interest considerations, and failure to commence business post-incorporation.

Petition for Winding Up

Section 272[33] identifies eligible petitioners, including companies with special resolutions, contributories holding shares for six of the preceding 18 months, the Registrar of Companies with Central Government sanction for filing non-compliance, Central Government-authorized persons, and Central or State Governments for sovereignty or security violations. Petitions must be copied to the ROC, who submits views within 60 days.

Tribunal Orders

Section 273[34] empowers tribunals to dismiss petitions, pass interim orders or injunctions, appoint provisional liquidators with notice and hearing opportunities, issue winding up orders, or pass other necessary orders. Winding up orders or provisional liquidator appointments trigger Section 279[35] restrictions on legal proceedings without tribunal permission. Tribunals must dispose of petitions within 90 days.

Company Liquidator Under Companies Act

Appointment and Removal - Section 275[36] governs company liquidator appointments from IBC-registered insolvency professional panels. Tribunals determine appointment terms, conditions, and fees based on task complexity, experience, qualifications, and company size. Liquidators must file conflict of interest declarations within seven days.

Section 276[37] permits tribunal-ordered removal for misconduct, fraud, misfeasance, professional incompetence, conflict of interest, lack of independence, or inability to act. Removed liquidators receive hearing opportunities, and tribunals may appoint replacements while potentially recovering damages from negligent liquidators.

Powers and Duties - Section 290[38] details liquidator powers subject to tribunal directions. Liquidators continue necessary business operations, execute documents using company seals, sell properties through auctions or private contracts, sell entire undertakings as going concerns, raise money against assets, institute or defend suits with tribunal permission, call and settle claims, inspect company records, manage negotiable instruments, obtain professional assistance, and perform all winding up duties.

Reporting Requirements - Section 281[39] requires liquidators to submit comprehensive reports within 60 days of appointment. Reports must detail assets with registered valuer valuations, capital structure, liabilities and creditors, contributories and dues, intellectual property, subsisting contracts and ventures, holding and subsidiary companies, ongoing legal proceedings, incorporation circumstances and fraud opinions, business viability assessments, and tribunal-directed particulars.

Following report submission, Section 282[40] mandates tribunals to set completion timeframes and may order going concern sales. Fraud indications trigger investigations under Section 210[41], with potential criminal complaints and asset preservation orders.

Company Dissolution

Section 302[42] governs dissolution following complete winding up. Liquidators apply for dissolution, and tribunals issue orders upon satisfaction of just and reasonable grounds. Tribunals and liquidators must forward dissolution orders to the ROC within 30 days, with dissolution effective upon registration.

Key case laws involving liquidation

Several landmark cases have shaped India's liquidation jurisprudence and clarified statutory interpretations.

Pariman Enterprises Pvt. Ltd. v. Atlantis LifeSciences Pvt. Ltd

In Pariman Enterprises Pvt. Ltd. v. Atlantis LifeSciences Pvt. Ltd[43], the National Company Law Tribunal (NCLT) ordered the liquidation of the corporate debtor, Atlantis LifeSciences, because the Corporate Insolvency Resolution Process (CIRP) had lapsed after the maximum period (180 days) allowed under the Insolvency and Bankruptcy Code (IBC) had passed without a resolution plan being approved. This decision was influenced by the Committee of Creditors (CoC) determining that the company's revival was not possible, partly due to the insufficient assets and the failure to agree on a resolution plan, including a proposed one-time settlement.

Swiss Ribbons Pvt. Ltd. v. Union of India

The landmark Swiss Ribbons Pvt. Ltd. v. Union of India[44] upheld the IBC's constitutionality, specifically validating Section 53's distribution priorities. The Supreme Court rejected challenges that the creditor classification violated Article 14[45] constitutional equality provisions, finding legitimate justification for distinguishing between operational and financial debts given their economic implications.

Kridhan Infrastructure Pvt. Ltd. v. Venkatesan Sankaranarayan & Ors

The Supreme Court case Kridhan Infrastructure Pvt. Ltd. v. Venkatesan Sankaranarayan & Ors[46] established that the Insolvency and Bankruptcy Code (IBC) requires strict adherence to the terms of a approved Resolution Plan. The company failed to comply with its obligations under the plan despite being granted opportunities to do so, leading the Court to uphold the liquidation order against the company. This ruling reinforced that liquidation is a last resort and is necessary when resolution applicants fail to meet their commitments, thereby upholding the IBC's goal of timely and effective insolvency resolution.

Sunil Kumar Jain and others v. Sundaresh Bhatt & Ors

In the case of Sunil Kumar Jain and others v. Sundaresh Bhatt & Ors (2022)[47] the Supreme court established that wages and salaries of workmen and employees who worked while the corporate debtor operated as a "going concern" during the CIRP are considered Insolvency Resolution Process Costs (CIRP costs). These costs have the highest priority under Section 53(1)(a) of the IBC. Additionally, all amounts due to workmen or employees from provident, pension, and gratuity funds are excluded from "liquidation estate assets" under Section 36(4) of the IBC. These funds are not subject to the distribution "waterfall mechanism" of Section 53, and employees are entitled to receive them in full..

Types of Liquidation

Voluntary Liquidation

Members' Voluntary Liquidation: Initiated by solvent companies whose members decide to wind up the company's affairs. Under Section 59[8] of the IBC, a corporate person may voluntarily liquidate itself and appoint a liquidator if it has not committed any default and is able to pay its debts. The declaration of solvency must be made by majority of directors as per the Insolvency and Bankruptcy Board of India (Voluntary Liquidation Process) Regulations, 2017.

Compulsory Liquidation

Compulsory liquidation occurs pursuant to Section 33[2] of the IBC when: (a) the corporate insolvency resolution process fails; (b) no resolution plan is submitted within the mandated timeline; (c) the resolution plan is rejected by the Committee of Creditors or the Adjudicating Authority; or (d) the contravention or default continues beyond the timeline specified in the resolution plan.

Fast Track Liquidation

The IBC provides for fast-track corporate insolvency resolution process for certain categories of companies under Section 55[48] read with Section 56[49], which can lead to expedited liquidation. The Insolvency and Bankruptcy Board of India (Fast Track Insolvency Resolution Process for Corporate Persons) Regulations, 2017provide the procedural framework.

Appearance in Official Databases

Insolvency and Bankruptcy Board of India (IBBI)

The IBBI maintains comprehensive data on liquidation proceedings through its official website. The Board publishes quarterly newsletters documenting the number of liquidation orders passed, ongoing liquidation processes, and closures.

As of September 2025, the IBBI reported that 2,896 corporate debtors had initiated liquidation since the IBC's inception, with 1,129 cases closed. The average time for liquidation closure was reported at 2.1 years. 987 CDs have been completely liquidated, 126 sold as going concern and 16 closed by compromise.

The admitted claims total to 2,65,485.61 crores, with liquidation value ascertained at 10,650 crores and realisation value at 9,671 crores, resulting in 90.8% realisation as against the liquidation value.[50]

The sectoral data is as below:

QUARTERLY NEWSLETTER FOR APRIL-JUNE, 2025[51]

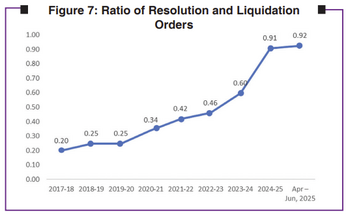

C.2 Ratio of Resolution and Liquidation orders: A number of initiatives are being taken to improve the outcomes of the Code. These include monitoring of cases pending for admission and ongoing CIRPs. Further, the IBBI revised its mechanisms for real-time sharing of information regarding applications for the initiation of CIRP with the IU. These initiatives have had a substantial impact on the IBC process, as evidenced by the increase in NCLTapproved resolutions and the admission of cases initiated by FCs. Figure 7 below highlights the improvement in ratio of number of cases ending with resolution vis-à-vis cases in which liquidation is ordered till the quarter April - June, 2025

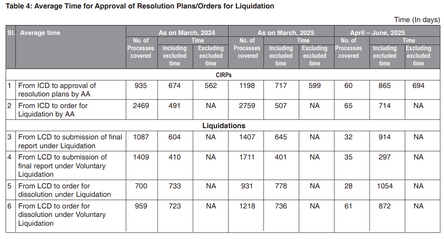

C.4 Timelines C.4.1 For Concluded Processes: The Code endeavours to close the various processes at the earliest. The 1258 CIRPs, which have yielded resolution plans by the end of June, 2025 took on average 602 days (after excluding the time excluded by the AA) for conclusion of process, while incurring an average cost of 1.11% of liquidation value and 0.63% of resolution value. Similarly, the 2824 CIRPs, which ended up in orders for liquidation, took on average 512 days for conclusion. Further, 1439 liquidation processes, which have closed by submission of final reports took on average 651 days for closure. Similarly, 1746 voluntary liquidation processes, which have closed by submission of final reports, took on average 400 days for closure. The average time taken for completion of various processes is presented in Table 4.

Ministry of Corporate Affairs (MCA)

The MCA maintains the MCA21 registry[52] which records the status of companies including those "under liquidation." When a company enters liquidation, its status is updated in the registry and accessible through company master data searches.

Indian Institute of Insolvency Professionals of ICAI (IIIPI)

The IIIPI and other Insolvency Professional Agencies maintain databases of liquidators and their ongoing assignments, primarily for regulatory oversight rather than full public access. They also curate extensive resources, including e-journals, publications, research reports, newsletters, case law summaries, IP success stories, articles, and interviews related to the IBC. In addition, these agencies host comprehensive repositories of applicable laws, policies, circulars, guidelines, and orders issued by the adjudicating authorities.[53]

Research that engages with Liquidation

The Insolvency and Bankruptcy Code: A Study of Liquidation Value

This paper titled 'The Insolvency and Bankruptcy Code: A Study of Liquidation Value' by Professors Kristin van Zwieten (Oxford) analyzed liquidation outcomes under the IBC, finding that average recovery rates for financial creditors in liquidation proceedings were approximately 4.3% compared to 42.5% in successful resolution plans. This research highlighted the significantly inferior outcomes for stakeholders when companies proceed to liquidation versus successful restructuring.[54]

IBC – Liquidation regime A review on the role of Liquidators and the Official Liquidator

The Insolvency and Bankruptcy Code, 2016 (IBC) marked a decisive transition from India’s earlier debtor-in-possession model to a creditor-in-possession framework, prioritizing resolution over liquidation. Historically, winding-up processes under the Companies Act were lengthy and inefficient, hindered by overlapping proceedings, overburdened courts, and the limited administrative capacity of the Official Liquidator (OL).

The IBC sought to remedy these inefficiencies by introducing a time-bound and professionalized insolvency regime. Since its enforcement in December 2016, data from the Insolvency and Bankruptcy Board of India (IBBI) shows that out of 2,542 admitted cases, 587 entered liquidation by September 2019. Of these, only 24 were fully dissolved, while the remainder remained ongoing—many surpassing one year in duration.

This report 'IBC – Liquidation regime A review on the role of Liquidators and the Official Liquidator' evaluates the challenges affecting the liquidation process under the IBC and discusses the policy alternatives that may be considered for making the process more robust. More specifically, it evaluates how the office of the OL may be integrated with the IBC system without compromising on the new law’s efficiency objectives[55]

The Economic Impact of the Insolvency and Bankruptcy Code (IBC) 2016 on Corporate Reconstruction in India

The Insolvency and Bankruptcy Code (IBC) of 2016 has been a game changer for India’s insolvency regime, significantly improving the resolution of non-performing assets (NPAs) and enhancing recovery rates (Abhirami & Rahul, 2022). Despite the progress, several challenges such as delays in proceedings, lack of cross-border insolvency regulations, and a shortage of tribunals persist (Karanth & Prabu, 2024). This study 'The Economic Impact of the Insolvency and Bankruptcy Code (IBC) 2016 on Corporate Reconstruction in India' aims to empirically analyze the economic effects of IBC and the performance of the judiciary in the reconstruction of sick companies. The research uses a new dataset comprising orders passed by the National Company Law Tribunal (NCLT) and National Company Law Appellate Tribunal (NCLAT) under the IBC. By examining cases from October 2016 to April 2024, this paper explores key trends in the corporate insolvency resolution process (CIRP), including the number of cases admitted, settled, closed, or withdrawn under Section 12A, as well as companies liquidated or revived through a resolution plan. The findings show that of the 7,813 companies admitted to CIRP, 1,005 were resolved, while 32.59% of closed CIRPs resulted in liquidation compared to 12.86% ending with a resolution plan. These findings highlight the economic impact of IBC and underscore the need for further reforms to enhance the resolution process.[56]

Corporate Insolvency Resolution and Liquidation: Measuring Effectiveness of the IBC Framework

The Insolvency and Bankruptcy Code, 2016 (IBC) has ushered in a major transformation of India’s corporate insolvency regime by introducing structured, time-bound processes for dealing with distressed companies. This paper 'Corporate Insolvency Resolution and Liquidation: Measuring Effectiveness of the IBC Framework' investigates the effectiveness of two core processes under IBC — the Corporate Insolvency Resolution Process (CIRP) and the liquidation process — by examining how well they safeguard stakeholder interests, improve asset value realisation, and deliver timely outcomes. Using a mix of methods (surveys, interviews, case-studies, and statistical/qualitative analysis) across industries, the study finds that while CIRP has improved creditor primacy, reduced resolution times, and improved India’s insolvency-resolution ranking, significant operational challenges persist. These include longer timelines in certain sectors (e.g., real-estate, MSMEs), inconsistent technology adoption, valuation difficulties, and uneven stakeholder awareness. The authors emphasise the need for targeted policy refinements, greater stakeholder education, and the integration of advanced technologies (e.g., AI, blockchain) to further enhance transparency, speed and effectiveness of the IBC framework.[57]

Corporate liquidation is a critical juncture in insolvency law which reshapes stakeholder rights and duties, including those of shareholders. This research 'The Role of Shareholders in Corporate Liquidation: a legal perspective' investigates the legal role of shareholders in both voluntary and compulsory liquidation frameworks under Indian law, primarily through the Insolvency and Bankruptcy Code, 2016 (IBC) and the Companies Act, 2013. As residual claimants, shareholders’ interests are typically subordinated to secured and unsecured creditors, yet they retain meaningful rights: e.g., initiating voluntary liquidation, participating or objecting to compulsory liquidation, and challenging decisions in legal proceedings. The study offers a comparative lens by examining shareholder protections in jurisdictions such as the United States and United Kingdom, showing marked divergence in scope and efficacy. It further examines directors’ fiduciary obligations to shareholders during liquidation, and potential liability of shareholders (especially majority/controlling) for wrongful or fraudulent trading. Particular emphasis is placed on minority shareholders’ remedies against oppression or mis-management during the liquidation process. The paper concludes by arguing for reforms to strengthen shareholder participation and protection—while preserving creditor primacy—to achieve an equitable liquidation framework that balances all stakeholder interests.[58]

Insolvency and Bankruptcy Framework: India Perspective

This paper 'Insolvency and Bankruptcy Framework: India Perspective' presents an overarching analysis of India’s insolvency and bankruptcy regime, tracing the historical evolution of insolvency laws (including corporate and individual frameworks) and culminating in the enactment of the Insolvency and Bankruptcy Code, 2016 (IBC). It outlines the key institutional and regulatory infrastructure under the Code — notably the Insolvency and Bankruptcy Board of India, the National Company Law Tribunal and its Appellate Tribunal — along with procedural frameworks for corporate insolvency, resolution and liquidation. The paper reviews early performance indicators (such as India’s improvement in the World Bank’s Ease of Doing Business resolving-insolvency metric) and identifies both achievements (e.g., consolidation of fragmented laws, clearer timelines, stronger creditor recovery mechanisms) and implementation concerns (including delays, tribunal capacity constraints, value erosion in liquidation). It further discusses the specific practice of liquidation under the IBC—including sale of assets, creditor distributions and exit of non-viable firms—and highlights how effective exit mechanisms support resource reallocation in the economy. The paper concludes with a forward-looking agenda of reforms, emphasising the need to strengthen infrastructure, enhance professional capacity, and ensure timely resolution or liquidation to safeguard asset value.[59]

Modern Corporate Insolvency Regime in India: A Review

This paper 'Modern Corporate Insolvency Regime in India: A Review' traces the evolution of India’s corporate insolvency framework, focusing on the introduction and operationalisation of the Insolvency and Bankruptcy Code, 2016 (IBC) and its impact on the resolution-liquidation pathways for corporate debtors. It examines key features of the modern regime — such as the time-bound Corporate Insolvency Resolution Process (CIRP), the Committee of Creditors (CoC) model, eligibility criteria, and the liquidation mechanism under the IBC — and reviews relevant jurisprudence in this space. The paper assesses how the new regime compares with prior frameworks in terms of creditor primacy, asset-value realisation, and process efficiency. It highlights achievements (e.g., consolidation of insolvency laws, enhanced clarity of roles, improved recovery culture) while also pointing out implementation challenges (such as delay in adjudicating authority cases, value erosion, bidder availability, and liquidation-practice shortfalls). The author concludes with suggested reforms to strengthen institutional capacity, enhance the liquidation process, and ensure that the regime fulfils its objective of maximising value for stakeholders.[60]

Taking Charge: Revisiting the Enforcement Of Inter-Creditor Agreements in IBC-Driven Liquidations

The article analyzes how inter-creditor agreements (i.e., contractual arrangements among different creditors about priority, repayment rights, and enforcement) are enforced under the Insolvency and Bankruptcy Code, 2016 (IBC) in India. The authors examine the complex legal and practical challenges that arise when such agreements intersect with statutory insolvency procedures under the IBC. It highlights how ambiguities in the Code and inconsistent judicial interpretations can affect the validity and enforceability of inter-creditor and subordination agreements once insolvency proceedings begin. The paper explores how Indian courts and adjudicating authorities treat these agreements—especially whether pre-insolvency priorities agreed by creditors are upheld during resolution and liquidation processes. By navigating recent case law, statutory provisions, and enforcement practice, the article assesses whether existing legal frameworks sufficiently protect contractual creditor rights and suggests areas where clarification or reform may be needed to reduce uncertainty and litigation risks for secured and inter-creditor arrangements.[61]

Reports by Professional Bodies

IBBI Annual Reports: The IBBI's annual reports provide comprehensive data analysis on liquidation proceedings, including sector-wise distribution, recovery rates, causes of liquidation, and implementation challenges. T

ICAI Studies: The Institute of Chartered Accountants of India (ICAI) published research on the role of liquidators and valuation methodologies in 2021, identifying gaps in professional training and standardization of asset valuation practices.

Reference: ICAI (2021). "Best Practices for Liquidators under IBC," available at https://www.icai.org

Reference: CII (2020). "Economic Impact of Liquidation under IBC," Confederation of Indian Industry

References

- ↑ The Insolvency and Bankruptcy Code, 2016, Part II, Chapter III, s. 33-54, available at: https://www.indiacode.nic.in/handle/123456789/2154

- ↑ 2.0 2.1 2.2 2.3 2.4 2.5 The Insolvency and Bankrupty Code, 2016, Part II, Chapter III, s. 33, available at: https://www.indiacode.nic.in/show-data?actid=AC_CEN_2_11_00055_201631_1517807328273&orderno=39

- ↑ 3.0 3.1 3.2 The Insolvency and Bankruptcy Code, 2016, available at: https://www.indiacode.nic.in/bitstream/123456789/15479/1/the_insolvency_and_bankruptcy_code%2C_2016.pdf (last visited on Nov. 26, 2025).

- ↑ The Companies Act, 2013, available at: https://www.indiacode.nic.in/bitstream/123456789/2114/5/A2013-18.pdf

- ↑ 5.0 5.1 The Insolvency and Bankruptcy Code, 2016, Part II, Chapter III, s. 35, available at: https://www.indiacode.nic.in/show-data?actid=AC_CEN_2_11_00055_201631_1517807328273&orderno=41

- ↑ 6.0 6.1 6.2 The Insolvency and Bankruptcy Code, 2016,Part I, s.3 Available at: https://www.indiacode.nic.in/show-data?actid=AC_CEN_2_11_00055_201631_1517807328273§ionId=782§ionno=3&orderno=3

- ↑ 7.0 7.1 7.2 The Insolvency and Bankruptcy Code, 2016,Part I, s.5 https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273§ionId=784§ionno=5&orderno=5&orgactid=undefined

- ↑ 8.0 8.1 8.2 8.3 The Insolvency and Bankruptcy Code, 2016, Part II, Chapter V, s. 59, available at: https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273§ionId=838§ionno=59&orderno=81&orgactid=undefined

- ↑ The Insolvency and Bankrupty Code, 2016, Part II, Chapter III, s. 34, available at:https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273§ionId=813§ionno=34&orderno=40&orgactid=undefined

- ↑ IBBI Liquidation process Regulations, 2016, available at: https://ibbi.gov.in/uploads/legalframwork/b37ac2f0201e2e3c41cfa3d989f58f4d.pdf

- ↑ The Insolvency and Bankrupty Code, 2016, Part II, Chapter III, s. 53, available at: https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273§ionId=832§ionno=53&orderno=59&orgactid=undefined

- ↑ The Insolvency and Bankrupty Code, 2016, Part II, Chapter III, s. 37, available at:https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273§ionId=816§ionno=37&orderno=43&orgactid=undefined

- ↑ The General Clauses Act, 1897, s. 16, Available at :https://indiankanoon.org/doc/1970981/

- ↑ The Companies Act,2013, s. 276, Available at : https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_22_29_00008_201318_1517807327856§ionId=49202§ionno=276&orderno=280&orgactid=undefined

- ↑ The Insolvency and Bankrupty Code, 2016, Part II, Chapter III, s. 38, available at :https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273§ionId=817§ionno=38&orderno=44&orgactid=undefined

- ↑ The Insolvency and Bankrupty Code, 2016, Part II, Chapter III, s. 39, available at :https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273§ionId=818§ionno=39&orderno=45&orgactid=undefined

- ↑ The Insolvency and Bankrupty Code, 2016, Part II, Chapter III, s. 41, available at :https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273§ionId=820§ionno=41&orderno=47&orgactid=undefined

- ↑ The Insolvency and Bankrupty Code, 2016, Part II, Chapter III, s. 42, available at:https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273§ionId=821§ionno=42&orderno=48&orgactid=undefined

- ↑ Insolvency and Bankruptcy Code, 2016, Part II, Chapter III, ss. 43-51, available at: https://www.indiacode.nic.in/handle/123456789/2154

- ↑ 20.0 20.1 The Insolvency and Bankrupty Code, 2016, Part II, Chapter III, s. 43, available at:https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273§ionId=822§ionno=43&orderno=49&orgactid=undefined

- ↑ The Insolvency and Bankrupty Code, 2016, Part II, Chapter III, s. 44, available at:https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273§ionId=823§ionno=44&orderno=50&orgactid=undefined

- ↑ The Insolvency and Bankrupty Code, 2016, Part II, Chapter III, s. 45, available at :https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273§ionId=824§ionno=45&orderno=51&orgactid=undefined

- ↑ The Insolvency and Bankrupty Code, 2016, Part II, Chapter III, s. 48, available at: https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273§ionId=827§ionno=48&orderno=54&orgactid=undefined

- ↑ The Insolvency and Bankrupty Code, 2016, Part II, Chapter III, s. 49, available at :https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273§ionId=828§ionno=49&orderno=55&orgactid=undefined

- ↑ The Insolvency and Bankrupty Code, 2016, Part II, Chapter III, s. 50, available at : https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273§ionId=829§ionno=50&orderno=56&orgactid=undefined

- ↑ The Insolvency and Bankrupty Code, 2016, Part II, Chapter III, s. 51, available at : https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273§ionId=830§ionno=51&orderno=57&orgactid=undefined

- ↑ The Insolvency and Bankrupty Code, 2016, Part II, Chapter III, s. 52, available at :https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273§ionId=831§ionno=52&orderno=58&orgactid=undefined

- ↑ 28.0 28.1 28.2 The Insolvency and Bankrupty Code, 2016, Part II, Chapter III, s. 53, available at: https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273§ionId=832§ionno=53&orderno=59&orgactid=undefined

- ↑ The Insolvency and Bankrupty Code, 2016, Part II, Chapter III, s. 54, available at : https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273§ionId=833§ionno=54&orderno=60&orgactid=undefined

- ↑ The Insolvency and Bankrupty Code, 2016, Part II, Chapter V, s. 59, available at: https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273§ionId=838§ionno=59&orderno=81&orgactid=undefined

- ↑ The Companies Act, 2013, available at: https://www.indiacode.nic.in/bitstream/123456789/2114/5/A2013-18.pdf

- ↑ The Companies Act, 2013, Chapter XX, Part I, s. 271, Available at:https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_22_29_00008_201318_1517807327856§ionId=49197§ionno=271&orderno=275&orgactid=undefined

- ↑ The Companies Act, 2013, Chapter XX, Part I, s. 272, available at: https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_22_29_00008_201318_1517807327856§ionId=49198§ionno=272&orderno=276&orgactid=undefined

- ↑ The Companies Act, 2013, Chapter XX, Part I, s. 273, available at: https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_22_29_00008_201318_1517807327856§ionId=49199§ionno=273&orderno=277&orgactid=undefined

- ↑ The Companies Act, 2013, Chapter XX, Part I, s. 279, available at:https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_22_29_00008_201318_1517807327856§ionId=49205§ionno=279&orderno=283&orgactid=undefined

- ↑ The Companies Act, 2013, Chapter XX, Part I, s. 275, available at:https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_22_29_00008_201318_1517807327856§ionId=49201§ionno=275&orderno=279&orgactid=undefined

- ↑ The Companies Act, 2013, Chapter XX, Part I, s. 275, available at:https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_22_29_00008_201318_1517807327856§ionId=49202§ionno=276&orderno=280&orgactid=undefined

- ↑ The Companies Act, 2013, Chapter XX, Part I, s. 275, available at: https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_22_29_00008_201318_1517807327856§ionId=49216§ionno=290&orderno=294&orgactid=undefined

- ↑ The Companies Act, 2013, Chapter XX, Part I, s. 281, available at: https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_22_29_00008_201318_1517807327856§ionId=49207§ionno=281&orderno=285&orgactid=undefined

- ↑ The Companies Act, 2013, Chapter XX, Part I, s. 282, Available at: https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_22_29_00008_201318_1517807327856§ionId=49208§ionno=282&orderno=286&orgactid=undefined

- ↑ The Companies Act, 2013, Chapter XVI, s. 210, Available at: https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_22_29_00008_201318_1517807327856§ionId=49136§ionno=210&orderno=214&orgactid=AC_CEN_22_29_00008_201318_1517807327856

- ↑ The Companies Act, 2013, Chapter XX, Part I, s. 302, Available at:https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_22_29_00008_201318_1517807327856§ionId=49228§ionno=302&orderno=306&orgactid=undefined

- ↑ Pariman Enterprises Pvt. Ltd. v. Atlantis Life Sciences Pvt. Ltd. (2018), C.P.(IB)-65(MB)/2018

- ↑ Swiss Ribbons Pvt. Ltd. v. Union of India (2019), AIR (2019) 4 SCC 17

- ↑ Article 14 in Constitution of India https://indiankanoon.org/doc/367586/

- ↑ Kridhan Infrastructure Pvt. Ltd. v. Venkatesan Sankaranarayan & Ors (2020-2021), AIR 2021 SC 2578,

- ↑ Sunil Kumar Jain and others v. Sundaresh Bhatt & Ors,(2022) SCC OnLine SC 467 (C.A. No.-005910 / 2019)

- ↑ The Insolvency and Bankrupty Code, 2016, s. 55, available at:https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273§ionId=834§ionno=55&orderno=77&orgactid=undefined

- ↑ The Insolvency and Bankrupty Code, 2016, s. 56, available at:https://www.indiacode.nic.in/show-data?abv=CEN&statehandle=123456789/1362&actid=AC_CEN_2_11_00055_201631_1517807328273&orderno=78&orgactid=undefined

- ↑ IBBI, "Insolvency and Bankruptcy News", The quarterly newsletter of the IBBI, Jul-Sept 2025, Vol 36, searchable pg no 13, available at: https://ibbi.gov.in/uploads/publication/452d899ae03283f1eb40b1bf7ee5f187.pdf

- ↑ IBBI, "Insolvency and Bankruptcy News", The quarterly newsletter of the IBBI, Apr-Jun 2025, Vol 35, searchable pg no 7&8, available at:https://ibbi.gov.in/uploads/publication/3694d8874ee2ac5802de48d293ad5802.pdf

- ↑ MCA registry, available at: https://www.mca.gov.in/content/mca/global/en/mca/master-data/MDS.html

- ↑ IIIPI Repository, available at: https://www.iiipicai.in/research-reports/

- ↑ Kristin van Zwieten (Oxford Professor), "Insolvency and Bankruptcy Code 2016: Impact on Markets and the Economy", (202), available at: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3518778

- ↑ Manmayi Sharma and Rob Downey, "IBC – Liquidation regime A review on the role of Liquidators and the Official Liquidator" (2020), A collaboration of EY, Vidhi center for legal policy and Foreign and common wealth office (UK Govt), available at: https://vidhilegalpolicy.in/wp-content/uploads/2020/07/Liquidation-regime_Dec2019_Final-Draft_Research-paper-2.pdf

- ↑ Anupam Verma, Nidhi Maurya and Neelam Maurya, "The Economic Impact of the Insolvency and Bankruptcy Code (IBC) 2016 on Corporate Reconstruction in India", Journal of Scholastic Engineering Science and Management, A Peer Reviewed Refereed Multidisciplinary Research Journal, January 2025, Volume 4, Issue 1, pp: 8-12. DOI, available at:https://papers.ssrn.com/sol3/papers.cfm?abstract_id=5107333

- ↑ Chandan Choubey and Dr. Vandana Gupta, "Corporate Insolvency Resolution and Liquidation: Measuring Effectiveness of the IBC Framework", (2025), ShodhKosh: Journal of Visual and Performing Arts 6(2), DOI: 10.29121/shodhkosh.v6.i2.2025.6286, available at: https://www.researchgate.net/publication/395274988_CORPORATE_INSOLVENCY_RESOLUTION_AND_LIQUIDATION_MEASURING_EFFECTIVENESS_OF_THE_IBC_FRAMEWORK

- ↑ Arnav Sharma and Aashi Jain, "The Role of Shareholders in Corporate Liquidation: a legal perspective", (2025), available at: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=5326079

- ↑ S Sivakumar, "Insolvency and Bankruptcy Framework: India Perspective" (2019) 9(2), KLRI Journal of Law and Legislation 91, available at: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4025389

- ↑ Singh, Vijay Kumar, (2021), "Modern Corporate Insolvency Regime in India: A Review," National Law School Business Law Review: Vol. 7: Iss. 1, Article 4. available at: https://repository.nls.ac.in/cgi/viewcontent.cgi?article=1112&context=nlsblr

- ↑ Shrivastava, Priyanshu & Mankar, Hemang (2025), Taking Charge: Revisiting the Enforcement Of Inter-Creditor Agreements in IBC-Driven Liquidations, National Law School Business Law Review: Vol. 11: Iss. 2, Article 5, Available at: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=5954656